Peak earnings season is upon us, with the next few weeks sure to confirm whether the early reports which have been better-than-expected are the rule rather than the exception. The blended growth rate has only improved as more companies have reported, with FactSet now expecting YoY EPS growth for the S&P 500 to reach 33.8%, the best in over 10 years (since Q3 2010). This includes results from the 100 names that have reported, and estimates for the remaining 400 companies.

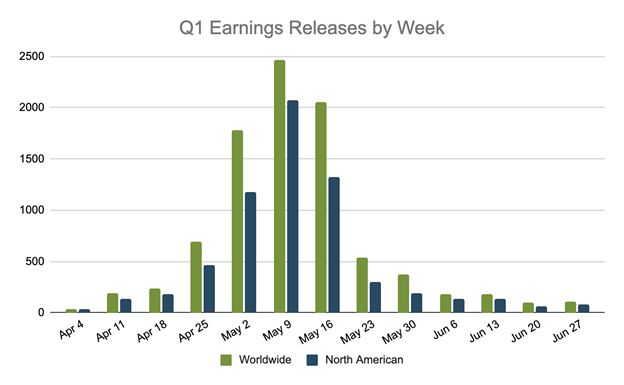

Next week officially marks the beginning of the busiest weeks of earnings season, however this week kicks off the peak season for companies in the S&P 500, with 181 reporting results. Worldwide, 688 companies will report this week.

Tech in focus this week

Big tech and other names with cult-followings will have investors’ full attention this week, starting with Tesla (TSLA) which reports earnings tonight. If it seems like they are reporting earlier than usual, you aren’t imagining it. Tesla is bucking a long-term trend this quarter of reporting on Wednesday, after over 5 years (21 months) of releasing quarterly results on that day. Could they have some good news to share?

Tesla (TSLA)

April 26 (confirmed) - Earnings release (AMC), conference call 5:30PM ET

Alphabet (GOOGL)

April 27 - (confirmed) - Earnings release (AMC), conference call 5:00PM ET

June 2 - Shareholder Meeting, 12PM ET

May 19 - Wells Fargo Financial Services Investor Conf 2021

June 1 - Projected quarterly dividend amount $1.25

Microsoft (MSFT)

April 27 - (confirmed) - Earnings release (AMC), conference call 5:30PM ET

June 10 - Pay date for quarterly dividend $0.56

Apple (AAPL) - On 4/20 Apple held their special event

April 28 (confirmed) - Earnings release (AMC), conference call 5:00PM ET

May 10 - Estimated future dividend, $0.205

June 7 - 10 - Worldwide Developers Conference (WWDC) 2021

Facebook (FB)

April 28 (confirmed) - Earnings release (AMC), conference call 5:00PM ET

May 26 - Shareholder Meeting, 1PM ET

Amazon (AMZN)

April 29 (confirmed) - Earnings release (AMC), conference call 5:30PM ET

April 30 - Video release: Tom Clancy s Without Remorse

May 7 - Video release: The Boy from Medellín

May 21 - Video release: P!nk: All I Know So Far

May 26 - Shareholder Meeting, 12PM ET

Twitter (TWTR)

April 29 (confirmed) - Earnings release (AMC), conference call 6:00PM ET

May 27 - Shareholder Meeting, 1PM ET

Unusual movements to pay attention to this week

Discovery, Inc. (DISC)

Company Confirmed Report Date: Wednesday, April 28, BMO

Previously Inferred Report Date (based on historical data): May 5, BMO

Z-Score: -3.15

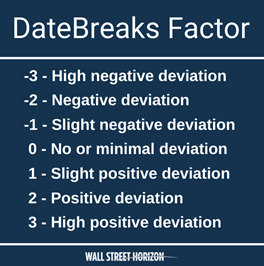

DateBreaks Factor: 3

Discovery, Inc. (DISCA, DISCB, DISCK) has a history of reporting Q1 results between May 2 - 9, with no day of the week trend. As such, we set a report date of May 5. On April 22 Discovery issued a press release stating that Q1 2021 results would be released on 4/28 BMO. This change resulted in a high Z-score of -3.15. A high negative Z-score (we consider anything higher than 3 or lower than -3 to be significant) reflects an earlier than usual confirmed earnings date, which in this case could signal that DISCA is getting ready to surprise to the upside. Z-score is also incorporated into our DateBreaks Factor*, for which DISCA has a factor of 3, meaning there is a high positive deviation from the historical trend for the same quarter.

Discovery’s HGTV, Food Network, TLC, ID and Discovery networks all reported record viewership upticks during last year’s COVID-19 lockdowns, holding top spots in non-news networks in total day cable and primetime viewing. While viewership increased, ad sales suffered in the early months of the pandemic. After being down 8% and 14%, respectively, in Q2 and Q3 2020, US ad revenues started to make a comeback in the fourth quarter, up 1%. With the home improvement trend still strong, viewership high and ad revs returning, plus early signs that investments in video streaming are paying off, Discovery’s earlier than anticipated earnings release could signal continuing momentum.

Del Taco (TACO)

Company Confirmed Report Date: Thursday, April 29, AMC

Previously Inferred Report Date (based on historical data): May 3, AMC

Z-Score: -3.99

DateBreaks Factor: 3

Since its IPO in 2013, Del Taco (TACO) has a history of reporting Q1 results between May 3 - 11, with no day of the week trend. As such, we set a report date of May 3. On April 15 Del Taco issued a press release stating that Q1 2021 results would be released on 4/29 AMC. This change resulted in a high Z-score of -3.99. A high negative Z-score (we consider anything higher than 3 or lower than -3 to be significant) reflects an earlier than usual confirmed earnings date, which in this case could signal that TACO is getting ready to surprise to the upside. Z-score is also incorporated into our DateBreaks Factor*, for which TACO has a factor of 3, meaning there is a high positive deviation from the historical trend for the same quarter.

From fast-food to upscale dining, diners across the country are coming back in a big way. Del Taco’s EPS and revenues slumped significantly in Q1 and Q2 of 2020, but profits specifically showed signs of life in the second half of the year while revenues remained flat. As the country continues re-opening and more Americans get vaccinated, restaurants are poised to benefit. However, labor remains a concern, particularly whether there will be enough workers to handle increasing demand within the restaurant industry.

Noodles & Company (NDLS)

Company Confirmed Report Date: Thursday, April 29, AMC

Previously Inferred Report Date (based on historical data): May 5, AMC

Z-Score: -3.44

DateBreaks Factor: 3

Since 2016, Noodles & Company has a history of reporting Q1 results between May 3 - 10, with no day of the week trend. As such, we set a report date of May 5. On April 14, NDLS issued a press release stating that Q1 2021 results would be released on 4/29 AMC . This change resulted in a high Z-score of -3.44. A high negative Z-score (we consider anything higher than 3 or lower than -3 to be significant) reflects an earlier than usual confirmed earnings date, which in this case could signal that NDLS is getting ready to surprise to the upside. Z-score is also incorporated into our DateBreaks Factor*, for which NDLS has a factor of 3, meaning there is a high positive deviation from the historical trend for the same quarter.

Unlike Del Taco which relies more on take out and drive up window service, Noodles & Company is in the fast-casual space and sees a larger percentage of dine-in customers. The pandemic took its toll on the company’s top and bottom line, both of which showed YoY declines for the entirety of 2020. Wall Street analysts are expecting the first YoY increase for both metrics since Q4 2019.

Next week we will see 1,922 companies report worldwide, with 1,273 in North America.

The DateBreaks Factor is a Wall Street Horizon proprietary measure, using a modified Z-score protocol which looks at standard deviations from the norm and that captures the extent to which a confirmed earnings date deviates or breaks from historical trend (last 5 years) for the same quarter.

Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

_thumb.gif)

_thumb.png)

(1)_thumb.png)