Key Takeaways

- For the most part earnings results continue to impress and lift markets. S&P 500 growth currently stands at 36.6%, but Q4 growth falls to 21.6%

- Companies that miss earnings expectations are experiencing outsized price impacts

- Retail looks strong heading into the holiday shopping season, despite warnings from Amazon and disappointing Q3 GDP results

- Possible surprises this week? Booking.com - a bellwether for the OTAs

- Peak earnings season continues this week with 2,586 companies reporting (from our universe of 9,300), the busiest week of the season

Earnings Season Scorecard - Q3 Continues to Impress, but Q4 Expectations Tick Down

After the first peak week of Q3 earnings season revealed the continuation of stellar results from S&P 500 companies, the blended growth rate increased to 36.6%, the third highest growth rate since 2010. Revenues on the other hand have grown 15.8% YoY. More important at this juncture might be expectations for Q4, and it looks like cautionary language from companies on everything from supply chain disruptions and inflationary pressures have finally weighed on analysts. Profit growth for Q4 has been revised downward to 21.6%, from last week’s 22.4%, an atypical and somewhat concerning development. (Growth rates from FactSet)

The number of S&P 500 companies beating earnings expectations (84%) is above the historical average, as is the margin by which they are beating (13.4%). However, this surprise percentage is below the 1-year average of 18%, suggesting that while results are very good on a historical basis, the last four quarters (particularly the first half of this year) were still better.

Another thing to keep an eye on as we head into the last quarter of the year, and in response to many companies’ cautionary cues regarding when the impacts from supply chain disruptions and inflation will really hit, is profit margins (ie: profit/sales). Thus far earnings have increased faster than revenues. This growth has been driven by continued strong demand that has increased sales, and costs that have gone up but not so much that they can’t be passed on to customers. There is a threshold though, at some point price increases will not be passed on as easily to consumers, and companies will have to absorb them while also dealing with slower demand, both which would hit the bottom-line. Companies are trying to manage that delicate balance now.

Companies that Miss Estimates Punished Even More During First Peak Week

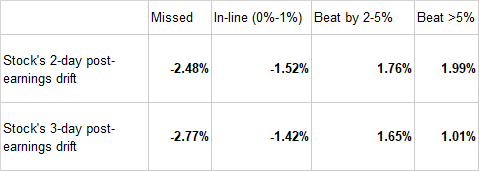

Now with 280 S&P 500 companies reporting, the gap between investor reaction to beats and misses has widened. Companies that miss analyst estimates see their stock price trend downward by an average of -2.48% in the 2-day post-earnings period (from 2-days pre-earnings) and down -2.77% in the 3-day post-earnings period (from 3-days pre-earnings). Companies that report exactly in-line also have seen their stocks fall 2 and 3 days later, by -0.41% and -0.36%, respectively. However, those companies that beat expectations show an increase of 1.52% in the 2-day post-earnings period and 0.80% in the 3-day post-earnings period.

We broke that down a bit more in the tables below. As you can see in the 2-day post-earnings drift, companies that miss estimates see their stocks fall by -2.48%, followed very closely by companies that report “in-line” (0-1% from estimate). Those reporting 2-5% above estimates see a 1.76% bump, and beating by greater than 5% averages a 2% stock increase in the following 2 days.

However, losses for those that miss widens by day 3. Those that miss are still trending down by 2.77%, the in-line names have recovered slightly to -1.42%, the 2-5% group has simmered to a 1.65% uptick in stock price, while those reporting results over 5% from estimates see an average increase in stock price of 1%.

Consumer Discretionary Still Looking Good Heading into the Holiday Shopping Season

We got mixed signals on the health of the US consumer last week. Thursday’s GDP report showed US growth slowing to a rate of 2%, lower than the 2.8% estimate, partially due to a deceleration in consumer spending. On a more upbeat note, the National Retail Federation (NRF) shared their expectations for a record holiday shopping season this year.

Despite supply chain strains, most retailers are in a good position heading into the holiday season, having invested heavily to be sure they have the right products to meet consumer demand. Consumers are also in a good position, as wages continue to rise, prompting those polled by the NRF to say they would spend an average of $997.73 on gifts this season, on par with prior years.

Possible Surprise this Week: A Look at the OTAs

Booking.com (BKNG)

Company Confirmed Report Date: Wednesday, November 3 AMC

Projected Report Date (based on historical data): Thursday, November 4, AMC

Z-Score: -2.3

Booking.com has reported from November 5 - 7 for the last 5 years, typically on Thursday. This will be their first Wednesday report. Historically speaking, moving an earnings date earlier is a cue that that positive news will be shared in the earnings report and on the call.

BKNG is expected to have benefitted from increased vaccination rates, loosening travel restrictions around the world and an increase in travel bookings as indicated from Q3 airline results as well as data on hotel and other accommodation reservations.

Earnings Wave

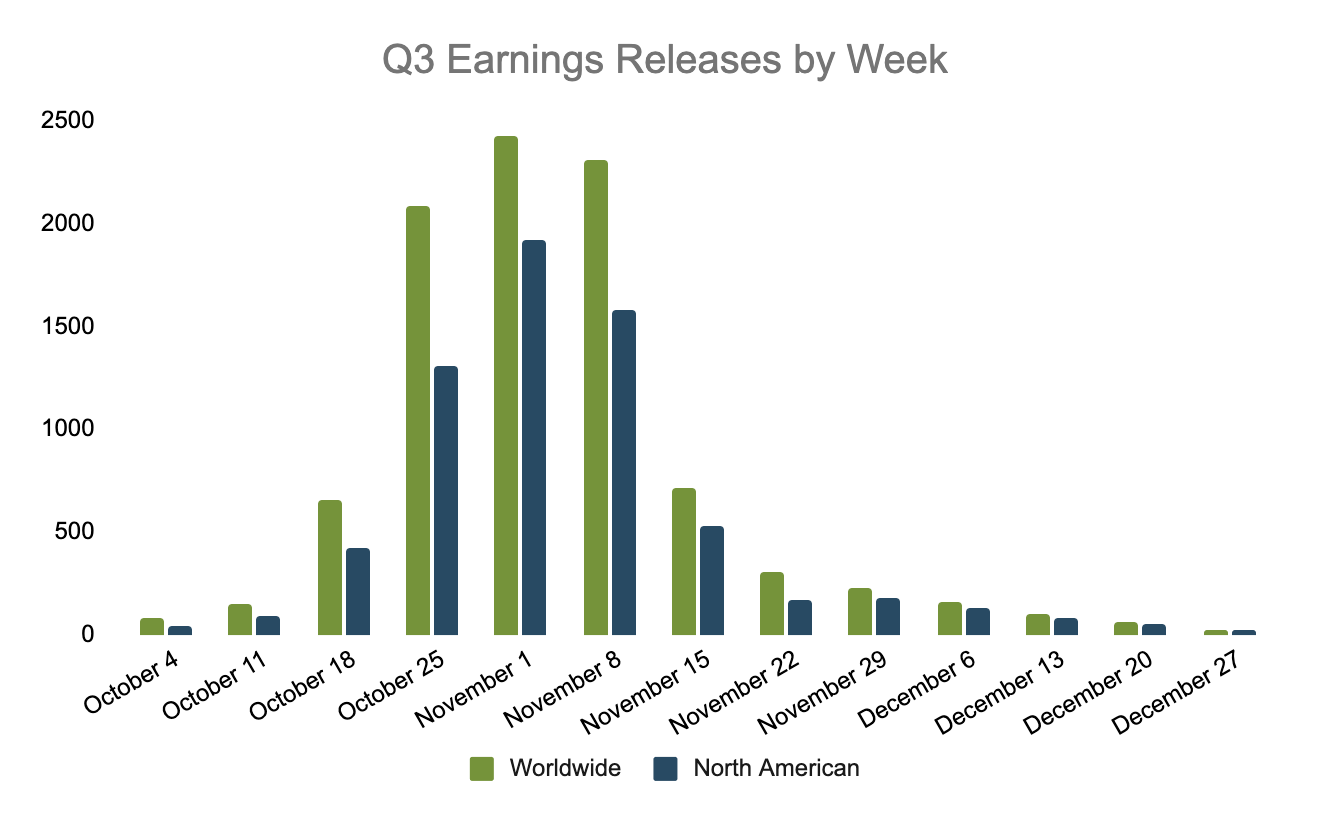

This week marks the heaviest for Q3 reports, with 2,586 companies (from our universe of 9,300) expected to release results. November 4 will be the busiest day of the season, with 1,045 companies scheduled to report.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)