Above all, the accuracy and speed of event data are the most valuable traits for market makers. Market makers use Wall Street Horizon's streaming feeds for real-time news about events so they can move earlier to take advantage of or avoid the event-driven volatility. These alerts can in turn enable faster spread and price adjustments.

Earnings Calendar

For firms that only need earnings announcement information, the earnings calendar features upcoming earnings calendar dates - confirmed or forecasted, with the expected timing of announcements. This includes preliminary earnings announcements.

Interim Calendar

With the new Interim Calendar, institutional investors and traders can access critical dates and information when public companies report key sales, production and financial information between their quarterly or semi-annual earnings announcements.

Institutional investors increasingly rely upon earnings date revisions to help formulate trading and risk strategies. Recent academic research has shown that tracking changes to earnings announcement dates can help investors generate additional alpha or mitigate risk in their portfolios.

By keeping clients apprised of critical market-moving event revisions, DateBreaks data empowers financial professionals to take advantage of - or avoid - short-term volatility in a given equity or its underlying option. For more details, click here.

Earnings Date Monitor

We offer a streaming feed of announced earning dates and timing to accommodate the latency need of market makers.

Dividend Monitor

To meet the fast delivery requirements of HFT/algo traders and market makers, we offer we offer a streaming feed of announced dividend dates and amounts.

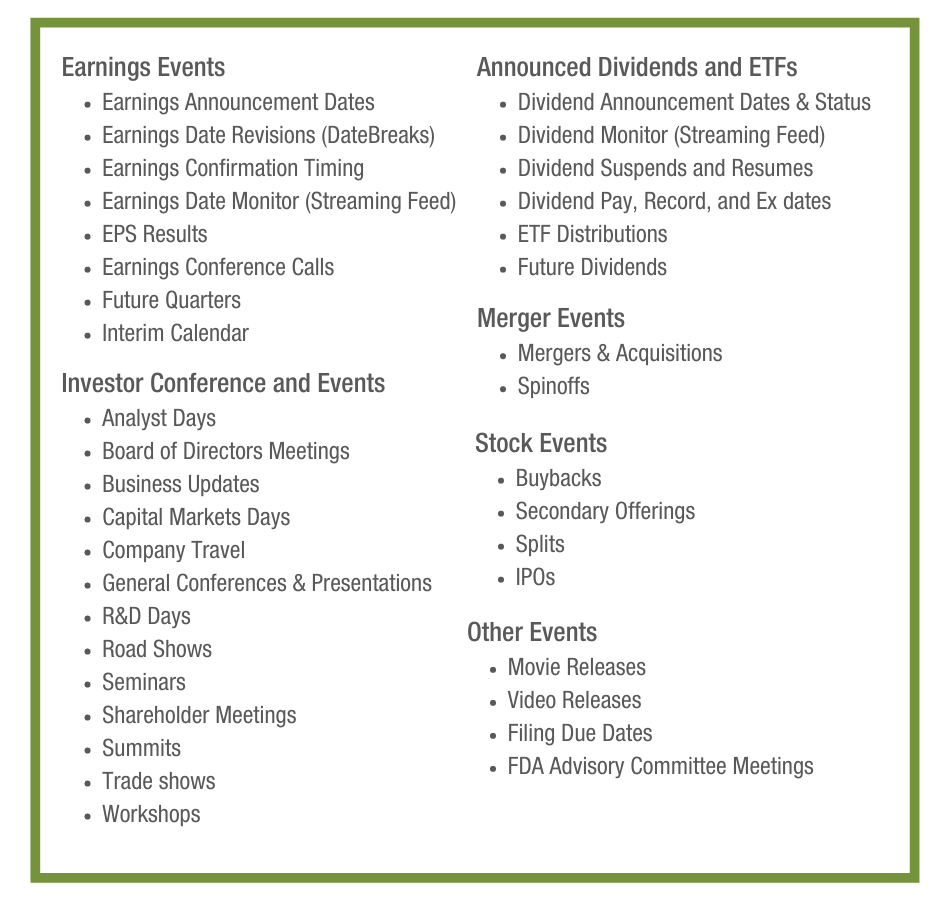

Additional event offerings include:

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)