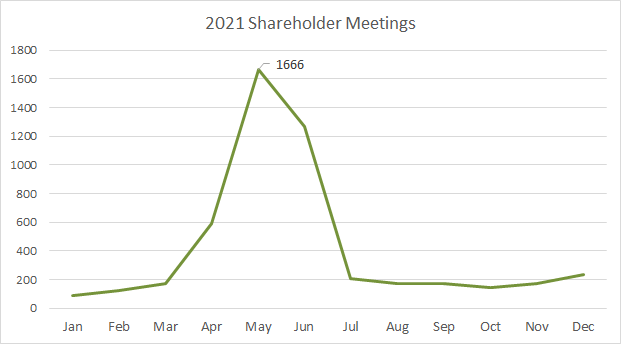

- May is the peak in shareholder meetings, a key corporate event type that can bring about management team shake-ups and unexpected business insights

- Investors want to hear more about the resilience of the consumer and how commodity prices are impacting the economy

- Twitter shareholders meet on May 25. Traders should be on guard for elevated volatility.

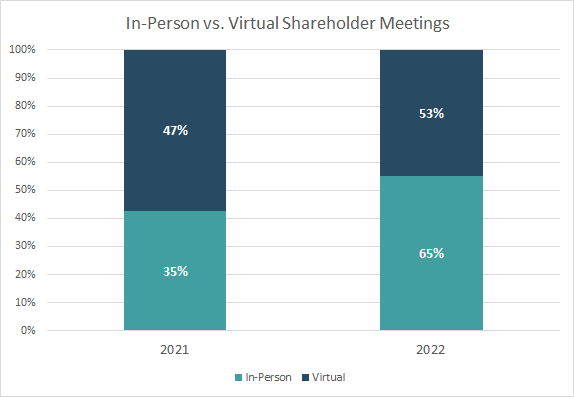

- In 2022, 65% of shareholder meetings will be held in-person versus 35% in 2021.

Springtime brings about a cadence in corporate events: conferences in March then Q1 earnings season then shareholder meetings. While we are in the heart of the first-quarter reporting period, the shareholder meeting count climbs in late April through May for S&P 500 companies. In 2021, there was a clear peak for the year in May, so now is the time to know when your stocks might be affected.

Source: Wall Street Horizon

Why Should Traders Care About Shareholder Meetings?

Shareholder meetings are typically held at least annually to elect members to a firm’s board of directors. Executives also weigh in with the latest updates on business conditions and even some interim financial figures. Perhaps the most exciting aspect of this corporate event type is a glimpse into the future – new policy initiatives from management teams can grab headlines after the meeting. Traders and risk managers should always know when shareholder meetings happen on stocks they own.

In-Person Events Back on the Rise

While run-of-the-mill shareholder meetings do not have the fanfare of, say, Berkshire Hathaway’s spectacle held in Omaha each year, the impact on stock prices can still be material. Following a brutal two years of Covid, Wall Street Horizon (WSH) finds that a gradual return to normal is the theme – there are many more in-person events this season. Of course, a virtual option is made available by most companies, too.

For 2022, WSH data show there are more shareholder meetings slated with a greater percentage of in-person events this year.

Source: Wall Street Horizon

What to Watch For

Let’s dig into some of the key shareholder meetings that are in the queue in the coming month. Major themes investors and the financial media will certainly pay attention to are what’s happening with the consumer, how capital markets are faring, and if energy companies are planning any big moves amid very high oil and natural gas prices around the world. Clearly the Consumer Discretionary, Consumer Staples, Financials, and Energy & Utilities sectors are in the spotlight. And we cannot forget about what’s happening with Twitter! More on that to come.

Problems at Home?

Beginning April 27, a few household names in the Consumer Staples and Healthcare sectors host shareholder meetings. Kimberly-Clark Corporation (KMB) meets virtually on Wednesday, April 27, Johnson & Johnson (JNJ) gathers on April 28, and Kellogg Company’s event (K) is April 29. Together, these three meetings could reveal more information about how food prices and the cost of other household products have increased. Many soft commodities have surged in price this year, putting a financial squeeze on low- and middle-income families.

What Will Warren Say?

Berkshire Hathaway’s annual meeting (more like a festival) happens on Saturday, April 30, according to Wall Street Horizon data. The Oracle of Omaha, Warren Buffett, and his partner in portfolio management Charlie Munger will be sipping Cokes and sharing their latest insights and wisdom. The investor community always pays close attention to this event.

Sectors in Play

In May, many big-name companies host shareholder meetings. It will be a pivotal period as many of these firms will have reported quarterly results, so this is a chance for stakeholders to learn more about specific areas of business.

Spending Insights

But what should you be watching? Consumer spending data could be on the docket from American Express (AXP) on May 3. JPMorgan Chase & Company (JPM) as well might have insights into card spending during their meeting on May 17, followed by Discover Financial Services (DFS) on May 19.

Folks on the Move

Travel companies could also give a boost of optimism. Consider that consumer confidence is the worst in about a decade according to some metrics while investor sentiment is downright dreadful. We all need something fun to get our minds off money matters! MGM Resorts International’s (MGM) shareholder meeting is on May 4. After that is Marriott International Inc (MAR) on May 6 and then Las Vegas Sands (LVS) on the 12th. Host Hotels & Resorts (HST) stockholders meet on May 19. This set of Consumer Discretionary firms might be in play over the ensuing weeks.

Welcome Aboard Again

Sticking with the travel theme, the major airlines offered strong guidance for the balance of 2022 during their April conference calls. More good news could be a tailwind for these Industrials stocks in May. Southwest Airlines (LUV) hosts an event on May 18 followed by United Airlines (UAL) on May 25, right before the Memorial Day weekend’s unofficial summer kick-off.

Welcome Home? Not So Much for New Buyers.

The landscape of the housing market is a not-so-rosy picture, however. PulteGroup (PHM) shareholders meet on May 4 followed by real estate name Simon Property Group (SPG) on the 11th. Surging mortgage rates, above 5% on the typical 30-year fixed, and extremely low inventory make for a tough scenario for some firms while others, like REITs, can effectively increase rents and lease prices as they see their holdings climb in value. There could be insights gleaned from the Real Estate sector next month.

Commodities Crunch

Finally, home A/C bills this summer could be much higher than we are all used to. And let’s not even talk about what next winter’s heating costs might be! Energy and Utilities stocks (and anything related to commodities, including the Materials sector) have been some of 2022’s biggest winners, so expect a positive tone and upbeat corporate body language from companies in this space.

What are the stocks to watch? Archer Daniels Midland (ADM), a key food-related firm, meets on May 5 along with one of the biggest Utilities stocks, Duke Energy (D). In the energy patch, Occidental Petroleum (OXY) gathers on the 6th followed by Conoco Phillips on the 10th. Toward the end of the month on the 25th, the big guns host shareholder meetings: Exxon Mobil (XOM) and Chevron (CVX).

Musk’s Move?

Bonus round: The coup de grâce. Twitter (TWTR) meets on May 25. Could there be fireworks at this event? Might Tesla’s Elon Musk make an appearance? You’ll have to tune in to find out. Volatility could be elevated in Twitter shares and options as the big day approaches.

Conclusion

May is shareholder meeting month for key global companies. Traders and portfolio managers must know when key events will drive enhanced volatility. Wall Street Horizon’s corporate event data coverage spanning 10,000 firms worldwide keeps traders and investors ahead of major stock-specific events.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)