-

Banks kicked off Q1 earnings season with mixed results, proving that sizeable economic headwinds still persist

-

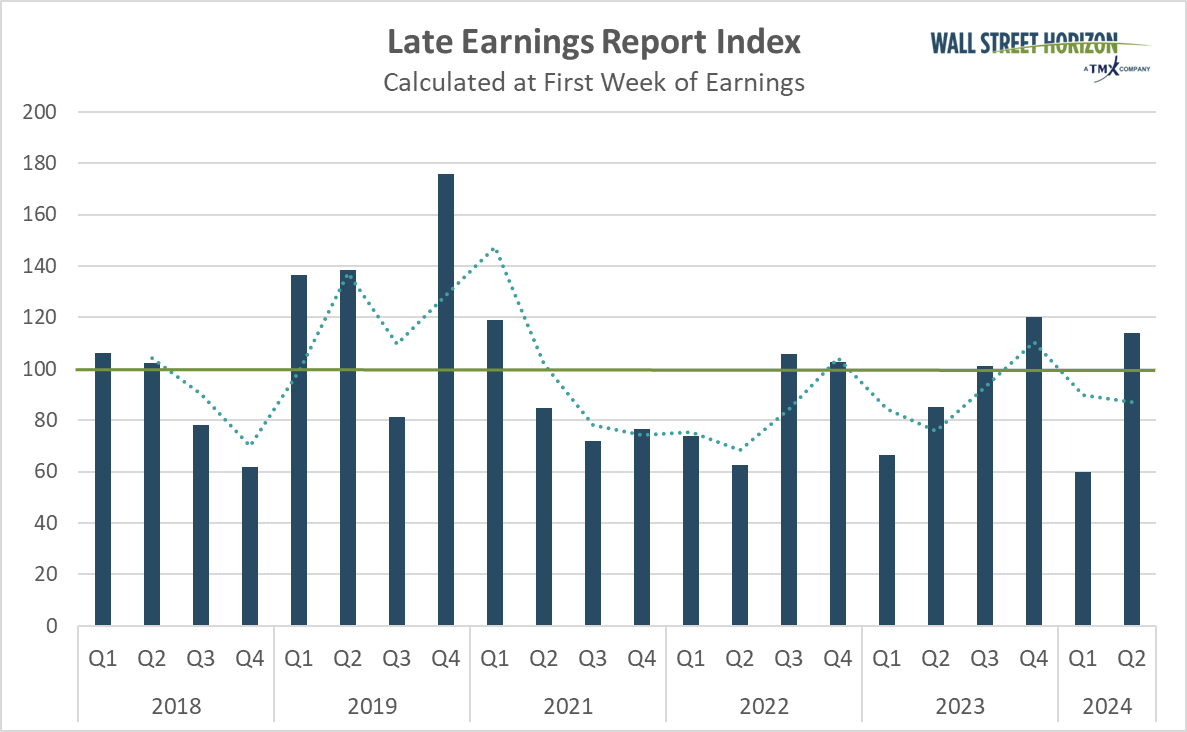

The LERI shows corporate uncertainty ticking back up after falling in Q4

-

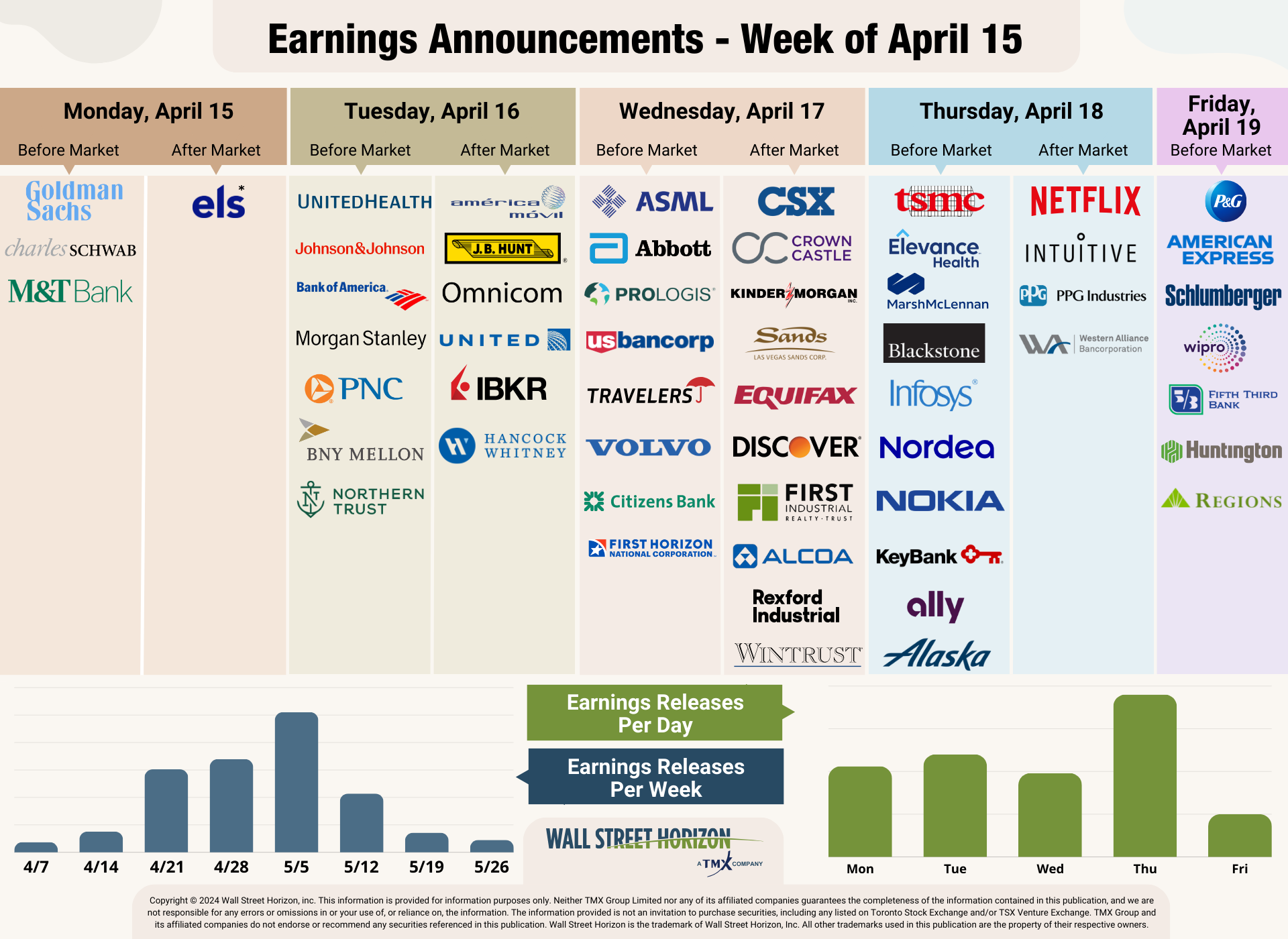

All eyes turn to Tech and Communication Services when Netflix (NFLX) and Taiwan Semiconductor Manufacturing (TSM) report Thursday

-

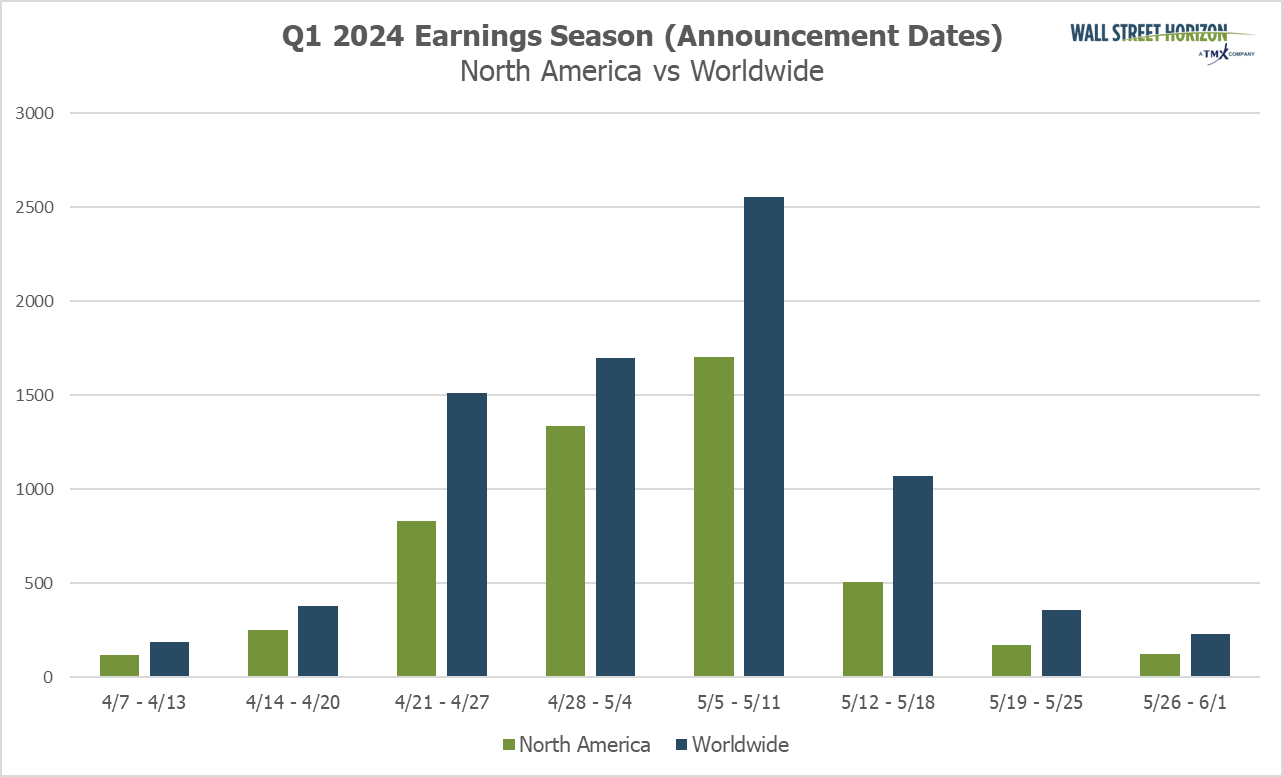

Peak weeks for Q4 season run from April 22 - May 10

Bank Results Come in Mixed, Economic Headwinds Persist

Banks started the Q1 2024 reporting season with decent results, but with forward-looking warnings that left investor’s a bit squeamish last week. JPMorgan Chase (JPM)1, Citigroup (C)2 and Wells Fargo (WFC)3 all reported better-than-expected results on the top and bottom-line when they kicked things off on Friday. Despite surpassing analyst estimates, all commented on the negative impact of inflationary pressures, which will result in muted core lending income for 2024. Those comments lead to investors taking prices down for the three banks in Friday’s trading.

This week started off on a slightly more positive note from the big investment banks. Goldman Sachs (GS) handily beat top and bottom-line expectations on Monday in part due to strong investment banking and trading revenues.4 Morgan Stanley (MS) reported the same when they released results on Tuesday, also beating profit and revenue estimates as a result of robust wealth management, trading and investment banking results.5 Both of those stocks were rewarded by investors after their reports.

At present, Q1 2024 S&P 500 ® EPS growth is expected to come in at 0.9% according to FactSet.6 This is down from the 3.2% expected the week prior. This would be the third straight quarter of growth after three down quarters.

Inflation, Geopolitical Tensions and the Fed

Inflationary pressures was one headwind that came up in every bank call. Unfortunately for doves, there was more bad news on the inflation front last week when the Consumer Price Index (CPI) for March came in higher-than-expected, showing sticky inflation is still in play and adding to the reasons that the US Federal Reserve (along with robust jobs numbers) may hold off on interest rate cuts again in Q2.7 One slightly positive note was the Producer Price Index (PPI) out on Friday which showed wholesale prices rose 0.2% in March, less than expected.8 The Personal Consumption Expenditures Price Index (PCEPI), the Fed’s main guide on inflation, will release results for March on April 26, and has generally trended below CPI.

Geopolitical tensions have also been top of mind after Iran’s mostly thwarted air missile attack on Israel over the weekend. Investor’s are waiting for a response from Israel, to see if the war in the Middle East will escalate. This of course could have huge implications for oil prices as Iran is the third largest producer in the Organization of the Petroleum Exporting Countries (OPEC).9 Energy prices have been a major contributor to persistently high inflation readings as of late.

Yet, in the face of inflation pressures, the US consumer remains resilient. March Retail Sales out on Monday jumped 0.7% from February, well above what was expected. This is despite data that shows credit card delinquencies continue to rise, and that overall consumer sentiment is waning.

All of these factors have pushed back expectations for Fed rate cuts this year. While investors started the year pricing in 5 - 6 rate cuts according to the CME Group’s FedWatch Tool, we are now down to an expectation of only 2 - 3 cuts10 down to two. Economists at Goldman Sachs, Bank of America and UBS now expect the first cut to come in July, moving back their previous estimate for a June cut. Earlier today, Federal Chairman Jerome Powell doubled down during remarks at a Washington DC policy forum where he commented on the lack of progress in reducing inflation this year, and as a result rates would need to stay higher for longer.

CEO Uncertainty Ticks Back Up After Easing in Q1

After falling to its lowest level in its nine years of existence last quarter, the Late Earnings Report Index, our proprietary measure of CEO uncertainty, is back up for the Q1 earnings season.

The LERI tracks outlier earnings date changes among publicly traded companies with market capitalizations of $250M and higher. The LERI has a baseline reading of 100, anything above that indicates companies are feeling uncertain about their current and short-term prospects. A LERI reading under 100 suggests companies feel they have a pretty good crystal ball for the near-term.

The official pre-peak season LERI reading for Q1 (data collected in Q2) stands at 114, back above the baseline reading, suggesting companies are feeling less certain about economic conditions than they were at the beginning of the year. As of April 12, there were 43 late outliers and 34 early outliers.

Source: Wall Street Horizon

On Deck this Week

With the banks out of the way, the markets will turn their attention to results from companies hailing from other sectors. Names to watch later this week include the always popular, Netflix (NFLX) which continues to show impressive subscriber growth and Taiwan Semiconductor Manufacturing (TSM) which will give a read on the state of semiconductors, both out on Thursday.

Source: Wall Street Horizon

Q1 Earnings Wave

This season peak weeks will fall between April 22 - May 10, with each week expected to see over 1,500 reports. Currently May 9 is predicted to be the most active day with 1,249 companies anticipated to report. Thus far only 42% of companies have confirmed their earnings date (out of our universe of 10,000+ global names), so this is subject to change. The remaining dates are estimated based on historical reporting data.

Source: Wall Street Horizon

1 First Quarter 2024 Results, JPMorgan Chase & Co., April 12, 2024, https://www.jpmorganchase.com

2 Firhttps://www.citigroup.com

3 Wells Fargo Reports First Quarter 2024 Net Income of $4.6 billion, or $1.20 per Diluted Share, April 12, 2024, https://www08.wellsfargomedia.com

4 First Quarter 2024 Earnings Results, Goldman Sachs, April 15, 2024, https://www.goldmansachs.com

5 Morgan Stanley First Quarter 2024 Earnings Results, April 16, 2024, https://www.morganstanley.com

6 FactSet Earnings Inhttps://advantage.factset.com

7 Consumer Price Index Summary, U.S. Bureau of Labor Statistics, April 10, 2024, https://www.bls.gov

8 Producer Price Index Summary, U.S. Bureau of Labor Statistics, April 12, 2024, https://www.bls.gov

9 Iran's oil exports and tensions with the West, Reuters, April 16, 2024, https://www.reuters.com.

10 CME FedWatch Tool, CME Group, April 1, https://www.cmegroup.com

Copyright © 2024 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon's prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are the trademarks of TSX Inc. and are used under license. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)