Summary

- Shares of Gilead Sciences remains under pressure coming off the heels of their earnings disappointment.

- The market continues to value Gilead with a single digit multiple as revenues decline..

- Gilead begins to resemble Apple as both companies are loved yet revenue growth is declining..

- The article below will discuss my views on Gilead sciences along with a robust discussion on upcoming potential catalysts.

An underwhelming earnings report often leads to a prolonged period of share price underperformance irrespective of share price valuation. The market will equate a progressively higher multiple to businesses are that can continuously expand their top and bottom line. The Street craves predictability, companies who's results are often lumpy or cyclical often trade at a single digit multiple. The article below will discuss the case for Gilead Sciences (NASDAQ:GILD) along with a review of a similar well followed mega cap that exhibits similar characteristics in Apple (NASDAQ:AAPL)

The Sharp Drop

GILD surprised and disappointed many with the latest earnings release. As shown above, the much touted Hepatitis C franchise printed NEGATIVE year over year growth. Many including myself, did not see this coming as the addressable patient population continues to swell. Granted, GILD did share that the VA, a large customer was absent from the marketplace until mid-February further skewing numbers. The market did not care for explanations; the result is sell and run as illustrated by the steep drop in the chart shown above.

Technical Set-up

Shares of GILD remain deeply oversold since disclosure of their quarterly earnings report. The stock price stayed in a steady uptrend heading into earnings when disaster struck. The RSI (relative strength index) closed above 70 level indicating the shares were overbought, and a pullback is likely as the stock will consolidate the recent advance. GILD disappointing earnings report served as the catalyst for a steep stock pullback. The RSI hit 30 which typically signifies oversold and has flatlined there for close to a month. Is all hope lost for the GILD bulls? From a technical perspective, the shares are attempting to put in a bottom close to the lows seen in February. The MACD (moving average convergence divergence) indicator is poised to cross over; a sign traders use to enter into short-term positions. GILD remains in dire need of a catalyst to jump start the share price.

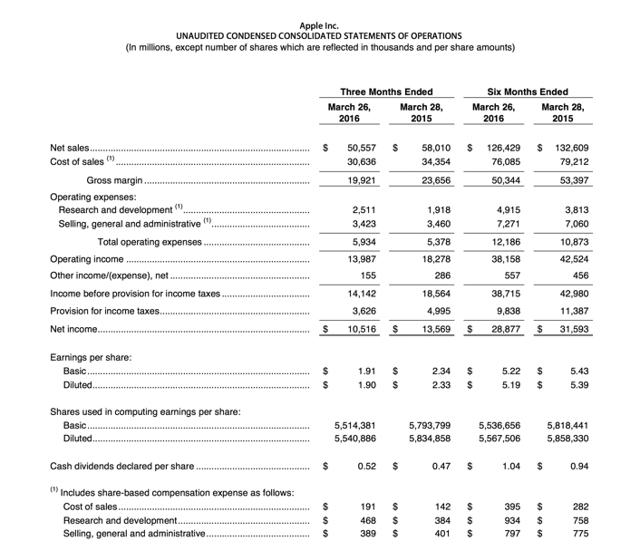

Apple

While AAPL and GILD operate in drastically different industries, a valid comparison is inferred from their respective share price performance. Both companies generate a tremendous amount of free cash flow while the market equates a single digit earnings multiple. The primary reason for AAPL absurdly low multiple remains the inherent cyclicality of their product cycle. AAPL derives over 60% of its revenue from sales of its iconic iPhone franchise. Thus far, AAPL has issued new versions on a two-year cycle with a likely fall in revenue in year 2 of the cycle as customers wait for the new model before making a purchase. AAPL reported a decline in revenues for the first quarter of 2016 which generated a less than enthusiastic response from the Street.

Notice how the GILD/AAPL charts are eerily similar with a big gap down coupled with a prolonged period of oversold based on the RSI. The bears on AAPL such as Doug Kass were quite vocal in the media, tweeting and pounding the table to sell and run away. Things did indeed look bleak when out of the blue Berkshire Hathaway (NYSE:BRK.A) and the venerable Warren Buffett rode to the rescue. The disclosure of Berkshire's stake (NYSE:BRK.B) served as the positive catalyst as those who wish to emulate Buffett rushed in to buy additional shares.

Potential Gilead Catalysts

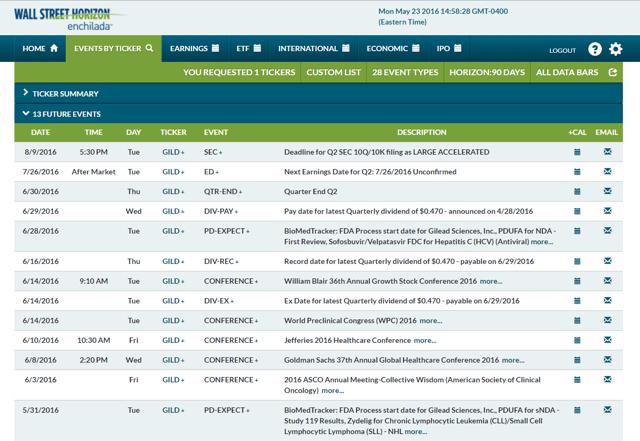

Chart courtesy of Wall Street Horizon, a fantastic app for tracking future corporate events or on Twitter @WallStreetHorizon

I find the Wall Street Horizon app an invaluable tool to track upcoming corporate events. I have often found market moving events are often disclosed during conferences or in annual professional meetings such as the next ASCO event scheduled for June 3rd.

The primary catalyst for GILD is the approval of their nex gen HCV pan-genomic treatment scheduled for June 28 th. Velpatasvir/Sofosbuvir generated a 99% response rate during clinical trials. The trial measured the virologic response of 624 patients affected with various strains of HCV.The new compound will eliminate the need for genotype testing thus ensuring more widespread use. PBM's such as Express Scripts (NASDAQ:ESRX) will now be forced to cover the new compound as the competing products Abbvie's (NYSE:ABBV) Viekira Pak garnered approved for Genotype 1a &b and Merck's (NYSE:MRK) Zepatier is approved to treat genotypes 1 and 4. I find it highly unlike ESRX will require Hep C genotypic testing as part of their approval process. The test is relatively expensive and unnecessary if the patient is treated with GILD new product. The ultimate adoption of the new product and subsequent formulary coverage should finally dispel the fear of GILD losing sales in the HCV marketplace by an over the top PBM such as the fear that caused a swift drop in the share price in December of 2014 as detailed here. A very profitable short term trend emerged which I happily took advantage of.

A second potential catalyst is the upcoming ASCO conference. Typically, companies will disclose updated results of their clinical pipeline at this event. For GILD, the need to develop and commercialize an alternative revenue stream outside of its core competency in infectious disease is magnified in light of the recent quarterly miss. The share price will remain range bound until further visibility concerning the strength of the pipeline.

The upside for GILD is the strength of their balance sheet, with over $21 billion in cash waiting for a valid purpose outside of share repurchases and dividends. Thus far, management has shown a proclivity to make purchases of early stage assets concentrated in the quest to commercialize a viable treatment for NASH. I have no qualms with the strategy, in my view, GILD correctly considers the burgeoning field of NASH as a "must get," as NASH serves as a logical extension of its HCV franchise.

Forgotten in the non-stop coverage of GILD HCV franchise is their burgeoning oncology platform spearheaded by Zydelig. I have written about Zydelig in the past notably after the discontinuation of additional clinical trials. GILD is currently conducting clinical trials on its proprietary compound Momelotinib for the treatment of myelofibrosis. The following excerpt in my view bodes well from a safety standpoint.

In oncology we have two compound in Phase 3, the first one is momelotinib for myelofibrosis, this should come to fruition later this year, it's two studies, one of them simplified, one compares directly momelotinib to the competitor ruxolitinib and the other one compares momelotinib to best available therapy. As you may know there were two recent setbacks with JAK1 inhibitors, one of them was a discontinuation of a Phase 3 program because of CNS toxicity and the other one was withdrawal of an NDA because of cardiovascular adverse events. We were contacted by FDA, they asked us to do an analysis -- safety analysis of our ongoing study which we did and the DSMC, it was actually done by the Data Safety Monitoring Committee, we are blinded to the data and they recommended continuation of the Phase 3 program without modifications. We should have data on these two studies later this year and if the data is positive, we will file the NDA in the first half of 2017.

Speaker is Norbert Bischofberger from a recent conference. The quote is courtesy of the Sentieo research platform.

The upcoming ASCO conference may serve as a catalyst for GILD to acquire additional novel compounds in the field of oncology. In my opinion, GILD needs to become more acquisitive especially with the biotech index (NASDAQ:IBB) trading at depressed levels as shown in the charts below. The IPO window has effectively closed for smaller companies as they become more constrained for cash. For example, Relypsa (NASDAQ:RLYP) recent debt offering terms are hardly generous.

Relypsa(NASDAQ: RLYP) slumps 13% after hours on increased volume in response to its announcement that it has closed a $150M offering of senior secured term loans bearing an interest rate of 11.5% per annum. The loans mature on April 27, 2022, and include a 30-month interest-only provision that can be extended to 48 months under certain conditions.

Net proceeds will fund the repayment of outstanding borrowings (~$17M) under its loan and security agreement with Oxford Finance LLC and Silicon Valley Bank, the ongoing commercialization of Veltassa in the U.S., working capital and general corporate purposes.

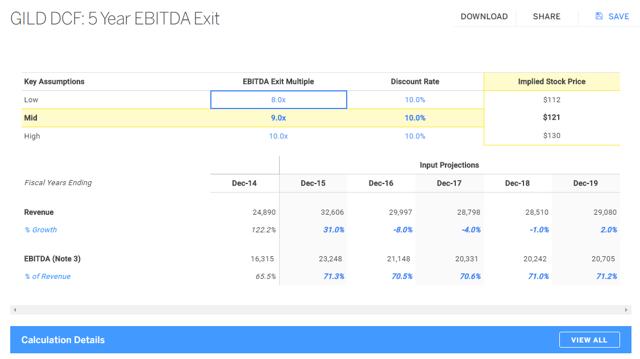

GILD was fortunate the Galapagos deal (NASDAQ:GLPG) for Filgotinib fell into their laps. Filgotinib remains a promising compound to treat Crohn's Disease and Rheumatoid Arthritis as detailed here. Thus far the clinical data presented in the article remain favorable, and the compound should receive ultimate approval once an NDA is filed. Filgotinib will aid in shoring up the expected revenue shortfall through the continued maturation of the HCV platform. Similar deals are of vital importance for GILD as opposed to expensive takeout of an already established product line such as the recent action surrounding Medivation (NASDAQ:MDVN). Getting into a bidding war with a well established deep-pocketed rival such as Sanofi (NYSE:SNY) is a less than ideal situation. While the continued growth of MDVN lead compound would greatly aid in GILD discounted cash flow models such as the one shown below, I have a hard time justifying the use of over half of GILD war chest when the question of the outcome of the proposed treatments for NASH remains unresolved. I would prefer smaller tuck-in deals such as Astra Zeneca's (NYSE:AZN) purchase of Acerta where AZN will paid $2.5 billion upfront plus an additional $1.5 billion upon approval of Acalabrutinib. The structure of the ideal is optimal; the risk is spread out based on how the lead product proceeds through various trials. GILD would be wise to emulate this deal and add additional properties to its oncology franchise.

Finbox. io Fair Value

Link to full work courtesy of Finbox.io. The Finbox.io platform is an invaluable tool that has aided in my entry and exists in various equities. A must for the value investor.

My fair value remains mired at $121 yet continues to trend down based on disappointing results. While guidance remains unchanged, uncertainty has increased which necessitated a drop in the exit multiple and an increase in the discount rate. As per custom, I use the bottom of management's revenue guidance when attempting to configure GILD fair value. GILD fair value will rise if the company can generate additional sales in the 2018 and 2019 time frame. This is the period where the current pipeline should bear additional fruit or a strategic acquisition. If GILD where to take out MDVN or Vertex (NASDAQ:VRTX) as the rumor by a prominent analyst last year and discussed in depth here, GILD fair value would rise into the $140 range and the company would show the timeless pattern of continued revenue and earnings growth which equates into a higher multiple. Until this time, either through internal development or external additions as long as revenue trends down GILD will stay mired at a single digit multiple.

My Take

Multiple variables are affecting GILD which makes forecasting quite difficult. Typically during sideways trading periods, I would sell covered calls against my position to generate additional income. The strategy is suboptimal as GILD seems poised to ink a deal or two which would change sentiment once announced. GILD management team seems quite capable, John Milligan the new CEO is keenly aware of the need to diversify the revenue stream. A transformational deal, especially with biotech valuations quite favorable, becomes more likely yet not a certainty. I will not be at all surprised if we receive word of such a deal before the upcoming election. The dividend remains attractive, a proverbial being paid to wait. The dividend will continue to be reinvested to gain additional shares. The share repurchase plan helps place a floor under the shares yet WILL NOT act as a catalyst for a higher stock price. In pharma, an aggressive share repurchase program is read as we are out of ideas. I remain long my core position that was entered into in 2014 with scant reason to sell. I will not be adding additional exposure. Instead, I prefer to play the recent drawdown in price by selling deep out of the money puts, similar to the strategy employed with APPL as detailed to subscribers of the Undervalued Gems service. The set-up here for GILD remains favorable, yet there is scant need to go overboard with the position. I would like to thank you for reading, and I look forward to your comments.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Disclosure: I am/we are long GILD, AZN, ABBV.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)