Key Takeaways:

-

Amid geopolitical uncertainty and a waning pandemic, analysts and investors seek guidance from the world’s top executives on how 2022 will evolve

-

Supply chain issues persist. BMW & NVIDIA should shed light on the latest trends in the automotive chip market.

-

Deutsche Bank and Citigroup could offer clues on future financial conditions as credit markets tighten and Russia risks spike

Fourth-quarter earnings season is in the books. Investors now focus attention on important analyst conferences and investor days hosted by the world’s most prominent companies. March is among the busiest months for these corporate events. Now more than ever, stockholders must stay tuned to the latest happenings and announcements at investor events. News breaks, product and market trend updates are shared, and pivotal outlooks are given by executives.

Corporate Events Drive Volatility

Analyst meetings are often annual gatherings where Wall Street sell-side analysts confer with company management to get new clues on a firm’s operating outlook. CEOs and CFOs also provide a bit of a health checkup to the public. Investor conferences, on the other hand, are intended for shareowners, but analysts often attend as well. These corporate events can move stock and options prices.

Citigroup & 3M Recent Updates

It was just last week when shares of Citigroup (C) fell sharply following its investor day. The major U.S. bank set a return forecast that missed analyst estimates.¹ Often, investor events can be just as market-shaking as a corporate earnings release. At the very least, traders should mark the event on their calendars for potential volatility spikes.

On the bright side, as we enter springtime in the states, Minnesota-based 3M Company (MMM) emphasized a “back to normal” theme during its 2021 analyst day.² It feels like firms have been hopeful for a true shift to the post-pandemic world for months on end, but it appears we are finally getting our wish. 3M’s analyst day back on February 14 painted a somewhat rosy picture but shares still slid. Management affirmed consensus 2022 earnings estimates in the $10.15-$10.65 range. Unfortunately, the major Industrials firm underscored continued challenging logistical issues and potential elevated costs.

Key Dates to Watch in March

According to Wall Street Horizon, here are some of the key analyst, investor, and capital markets days on the docket.

March 10 – Deutsche Bank AG (DB) Investor Deep Dive 2022

The ongoing Russia-Ukraine conflict and resulting financial market turmoil has rattled shares of Germany’s largest bank. Deutsche Bank has kept ties with Russia over the decades, even boasting a 140-year relationship with the troubled country.³ With strict sanctions on Russia, global firms with significant operational exposure to the nation have suffered. Indeed, Deutsche Bank’s American Depository Receipt fell from near $17 per share to under $12 in less than a month. Traders should expect volatility at the March 10 Analyst Day as the market gets a fresh update on how much of a toll the bank’s significant Russian exposure will have on earnings this year.

Chart 1: Deutsche Bank AG Stock Price History (1-Year)⁴

March 11 – AT&T Corp (T) Analyst & Investor Day 2022

Shares of AT&T have been under pressure for several years. Yield-hungry stockholders have grown frustrated with a lack of growth in the major US telecom company. Ahead of its third-quarter results to be released on April 21, investors will look for answers on March 11’s investor day webcast. During the event, the company says it will provide updates on its business strategy and capital allocation plans. After announcing a spinoff of WarnerMedia—a mega transaction valued at $43 billion—analysts seek clarity on when the deal will close. Color on DirecTV earnings and T’s wireless and wireline business outlooks are also key potential highlights.

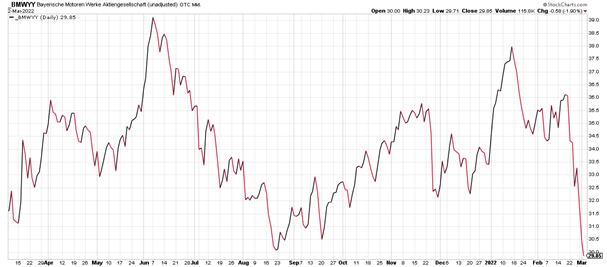

March 16 & 17 - Bayerische Motoren Werke AG (BMW) Annual Conference 2022

Supply chain woes are seen perhaps most starkly in the auto industry. New and used car prices are through the roof as semiconductor chip shortages persist. The German automaker may shed light on when the global car market will return to some normalcy, but geopolitics risks make the future picture less clear. Moreover, surging oil and gasoline prices make the case for accelerated electric vehicle development. BMW noted a strong 32% xEV penetration rate back in November, according to BofA Securities. Amid the tough business environment, BMW shares fell to 52-week lows earlier this month.

Chart 2: BMW Stock Price History (1-Year)⁵

March 22 – NVIDIA Corp. (NVDA) Investor Day 2022

Speaking of chips, NVIDIA will move markets later this month. The largest and fast-growing semiconductor innovator in the US might give new glimpses into its software subscription business and its new line of silicon chips—3nm products—used in gaming and data centers. Details on its omniverse operations and automotive supply chain business will be of particular interest to market-watchers. Traders should mark this event on their calendars for its potentially wide-reaching volatility impacts.

March 23 – Petco Investor (WOOF) Day 2022

A major Covid trend was a jump in demand for pets. Bank of America credit and debit card data show that retail spending on pets was up a whopping 35% in early February versus the same time two years ago—right before the pandemic began. We will find out just how strong the consumer is with respect to pet spending on March 8 when Petco Health & Wellness Co reports its fourth-quarter 2021 earnings. The stock has struggled since its January 2021 IPO despite strong same-store sales growth. You and Fido can log in to the investor event on the morning of March 23.

Chart 3: Petco Stock Price History (1-Year)⁶

Conclusion

It is primetime for investor and analyst days on Wall Street now that we are between earnings seasons. Amid a volatile stock market so far in 2022 and new geopolitical risks, stakeholders clamor to hear the latest business outlooks from executives of multinational firms. Investors need to keep tabs on key corporate event data to help manage risk and volatility.

²https://investors.3m.com/events-and-presentations/default.aspx

³https://country.db.com/russia/

⁴https://stockcharts.com/h-sc/ui?s=_DB&p=D&yr=1&mn=0&dy=0&id=p23535587580

⁵https://stockcharts.com/h-sc/ui?s=_BMWYY&p=D&st=2021-03-09&id=p78235844634

⁶https://stockcharts.com/h-sc/ui?WOOF&p=D&yr=1&mn=0&dy=0&id=p18810418814

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)