Executive Summary

The Q1 and Q2 2021 earnings seasons were perhaps the best in history relative to expectations. FactSet notes that for Q2, 86% of S&P 500 companies beat on the bottom line, and maybe more impressively, 76% of firms reported a positive revenue surprise.¹

This week, we feature insights on what companies are doing with their cash flow in light of the much better than expected operating conditions. We also investigate one small U.S. firm as an Earnings Outlier that traders should keep on their radar.

Wall Street Horizon reports dividend data such as announcements, payable dates, record dates, and ex dates. In addition to tracking each company’s dividend-related events, we spotted an interesting theme indicative of this year’s improving market environment.

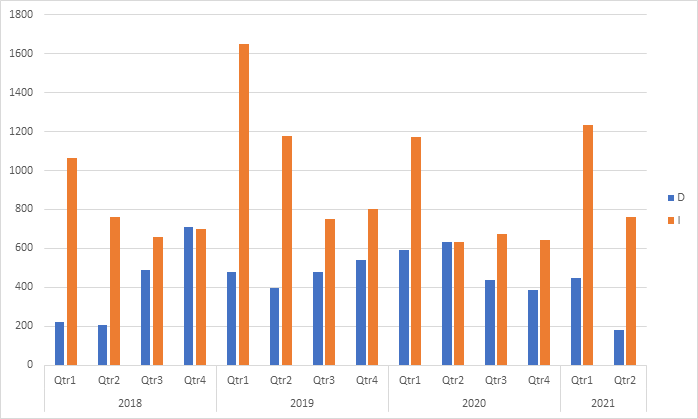

Firms around the world are increasing their dividends at a very fast clip, particularly compared to firms slashing dividends. Among the 9,000 companies Wall Street Horizon covers across the globe, 2021-to-date has seen 2,000 firms raise dividends while just 628 have decreased dividends.

Last week, we analyzed how companies were using cash, and this week’s latest data shows that indeed firms are putting cash to work for the benefit of shareholders. In contrast, the first two quarters of 2020 netted just 577 firms increasing dividends—so far this year that figure is a whopping 1,369.

What’s more, many European nations and particularly emerging economies are still finding their footing as restrictions are slowly lifted in areas still grappling with the virus. Investors should expect many international stocks to continue shareholder accretive activities while the pace of dividend hikes might slow in North America. Portfolio Managers must be in the know concerning market-moving corporate events such as dividend hikes.

Figure 1: Firms Increasing and Decreasing Dividends

The latest list of firms resuming or suspending dividends is green across the board. Five U.S. companies recently announced a resumption to their respective dividends:

- Golden Ocean Group Ltd (GOGL)

- Cracker Barrel Old Country Stores Inc (CBRL)

- L Brands, Inc. (LB)

- The Cato Corporation (CATO)

- Ralph Lauren Corp (RL)

From an economic perspective, it is encouraging to see that four of these names are Consumer Discretionary stocks and GOGL is an economically cyclical Industrial dry bulk shipping firm. While companies voice struggles with inflation and tight global supply chains, data shows there is ample cash flow to increase and resume dividends in today’s economy.

Earnings Date Outlier

Shifting gears to earnings, we feature one software microcap as an earnings outlier this week.

American Software Inc. (AMSWA) is an Atlanta-based supply chain management and enterprise software solutions firm in the Information Technology sector. Shares of AMSWA have been under pressure over the last three months as investors shift away from growth stocks toward value. Many names within the IT sector have underperformed year-to-date while cyclical sectors such as Energy and Industrials have gained ground versus the S&P 500. Just last week, AMSWA presented at the William Blair 41st Annual Growth Stock Conference.² Wall Street Horizon tracks many important corporate events, among them are conferences. Next week, we will report on the key investor conference slated for Q3.

Supply Chain Woes

Amid bearish macro and sector tones, there is an opportunity for American Software. Investors around the world have been bombarded with pessimistic headlines regarding disruptions in supply chains as economies bounce back faster than goods can be produced and delivered. American Software’s focus on AI-powered capabilities for supply chain management might be just the right niche for today’s complicated economy experiencing surging consumer demand. Investors should pay attention to the tone of management at upcoming conferences and on Tuesday’s Q4 and Fiscal Year 2021 preliminary financial results webcast.

Outlier Analysis

- Since 2017, AMSWA announced their Q4 results between June 18 and 22 After Market.

- May 17 - AMSWA preannounced an earnings date of June 8 After Market for their Q4 and FY 21 report and webcast.

- The earlier than usual date resulted in a very high Z-score of -5.68. Traders should pay close attention to Tuesday’s results and the tone of management in light of the outlier earnings date

Figure 2: AMSWA Stock Price History (YTD)

Wall Street Horizon Z-score: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company's 5-year trend for the same quarter. This metric is included in our DateBreaks product, learn more.

Conclusion

The first two quarters of 2021 witnessed tremendous earnings growth, but concerns regarding inflation and a historic raw materials backlog make today’s operating environment challenging in a way not seen in decades. The semiconductor shortage and surging commodity prices are situations pressuring nearly all sectors, perhaps aside from Financials and Utilities. Certainty is never a feature of global equity markets. Traders and portfolio managers must have the most accurate and comprehensive forward-looking event data to stay on top of impending market volatility.

1: https://www.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_052121.pdf

2: https://www.amsoftware.com/wp-content/uploads/2021/06/2021-05-20-ASI-William-Blair-Growth-Stock-Conference-press-release_VK2.pdf

3: https://stockcharts.com/h-sc/ui?=_AMSWA&p=D&yr=1&mn=0&dy=0&id=p05803987542

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)