A recent article from CNBC shows that asset managers and hedge funds are becoming increasingly reluctant to pay for analyst research reports that they once relied on so heavily. In fact, data shows a 25% decrease from client spend on reports compared to a year earlier. While the importance and need for in-depth research and insight is by no means diminishing, the means in which traders are consuming and obtaining analyst intelligence is changing in a somewhat surprising way.

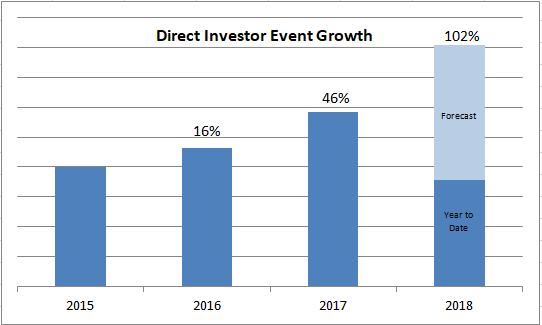

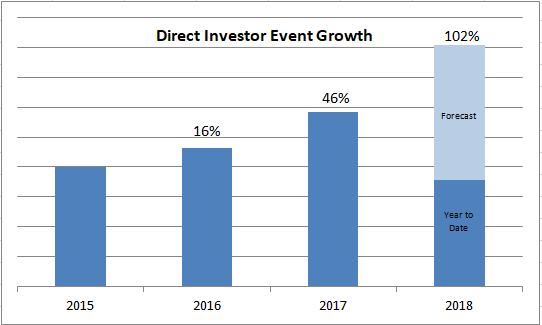

So where is Wall Street getting their information? Wall Street Horizon’s latest data shows there has been a sharp uptick in face-to-face interaction, meaning that financial services professionals are more willing to attend - and pay for - investor conferences that allow them to obtain analysts’ insight in person rather than through detailed research reports. In addition, due to demand and a number of other factors detailed below, investor relations professionals are also placing increased emphasis on investor conferences with numbers showing a substantial uptick in meetings. The data and below chart shows that the number of direct investor events has doubled in growth since 2015.

*Investor related event types tracked: Analyst days, Business updates, Company travel, R&D Days

In today’s digital era, business is increasingly conducted online as technology has revolutionized global communications and workflow. However, new regulations that unbundle trade execution and research (such as MiFID II) have skyrocketed the price for research reports which has ultimately contributed to the uptick towards preferential in-person analyst conferences.

For investor relations officers (IROs), the increased emphasis on investor conferences has also shown the trend is widespread. A number of factors that contribute to the growth of roadshows include:

As the number of investor conferences continues to increase, traders need to be able to capitalize and stay on top of the meetings that matter most. Wall Street Horizon has detailed information on over 2,600 investor conference presentations scheduled, confirmed, & available - more than any other provider, allowing clients to keep their finger on the pulse on upcoming events.

This type of information, detailed insight into when these conferences will take place, will only continue to grow in importance as traders and institutional investors increasingly search for information that provide them an edge over their peers.

So where is Wall Street getting their information? Wall Street Horizon’s latest data shows there has been a sharp uptick in face-to-face interaction, meaning that financial services professionals are more willing to attend - and pay for - investor conferences that allow them to obtain analysts’ insight in person rather than through detailed research reports. In addition, due to demand and a number of other factors detailed below, investor relations professionals are also placing increased emphasis on investor conferences with numbers showing a substantial uptick in meetings. The data and below chart shows that the number of direct investor events has doubled in growth since 2015.

*Investor related event types tracked: Analyst days, Business updates, Company travel, R&D Days

In today’s digital era, business is increasingly conducted online as technology has revolutionized global communications and workflow. However, new regulations that unbundle trade execution and research (such as MiFID II) have skyrocketed the price for research reports which has ultimately contributed to the uptick towards preferential in-person analyst conferences.

For investor relations officers (IROs), the increased emphasis on investor conferences has also shown the trend is widespread. A number of factors that contribute to the growth of roadshows include:

- Wall Street’s increasing attendance and need for face-to-face interaction due to the rising cost of analyst reports

- The pressure on the sell-side to reduce analyst costs

- IROs desire to control the message by communicating to investors directly

- Technology and the ability to reach and educate investment banks on timely events and marketing moving data they can obtain and incorporate into trading strategies

As the number of investor conferences continues to increase, traders need to be able to capitalize and stay on top of the meetings that matter most. Wall Street Horizon has detailed information on over 2,600 investor conference presentations scheduled, confirmed, & available - more than any other provider, allowing clients to keep their finger on the pulse on upcoming events.

This type of information, detailed insight into when these conferences will take place, will only continue to grow in importance as traders and institutional investors increasingly search for information that provide them an edge over their peers.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)