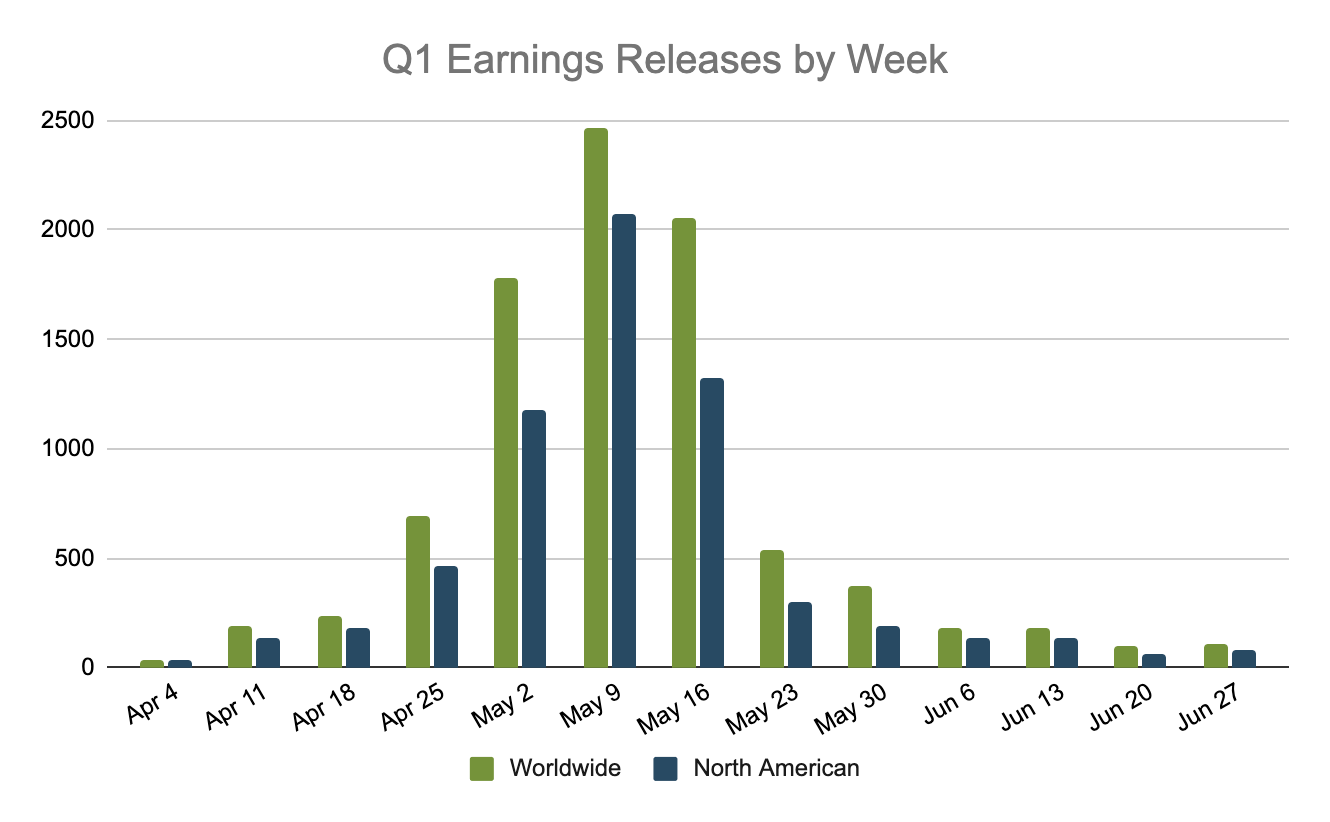

As we ready ourselves for the official kick-off to the Q1 2021 earnings season with JPMorgan, Goldman Sachs and Wells Fargo all reporting on Wednesday, early indicators are painting a very rosy picture of what’s to come.

In addition to higher corporate guidance and a record-high increase in analyst estimates, we’re tracking “corporate body language” through event announcements, confirmations and changes.These may be intentional or unintentional, but regardless they are sending a bullish signal to the marketplace.

Three bullish indicators around corporate actions and events

Earnings date confirmations

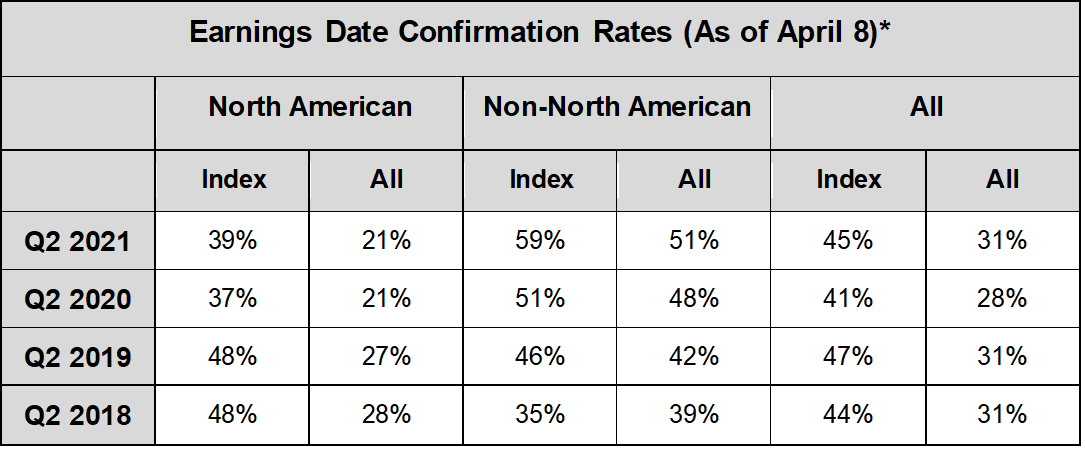

Companies are confirming their earnings dates and conference calls slightly earlier than the 4-year average, and much earlier than this time last year. Right now, 45% of indexed companies in our global universe have confirmed their earnings dates for the Q1 reporting season, vs. the 4-year average of 44%, and compared to Q2 2020 when only 41% confirmed at this time. We take this as a sign that companies have good things to share on their upcoming calls. Note that a large share of non-North American companies, currently 59%, are confirming Q1 reports the earliest that they have in the 4-year period. Definitions for chart at end of article.

Shareholder meetings

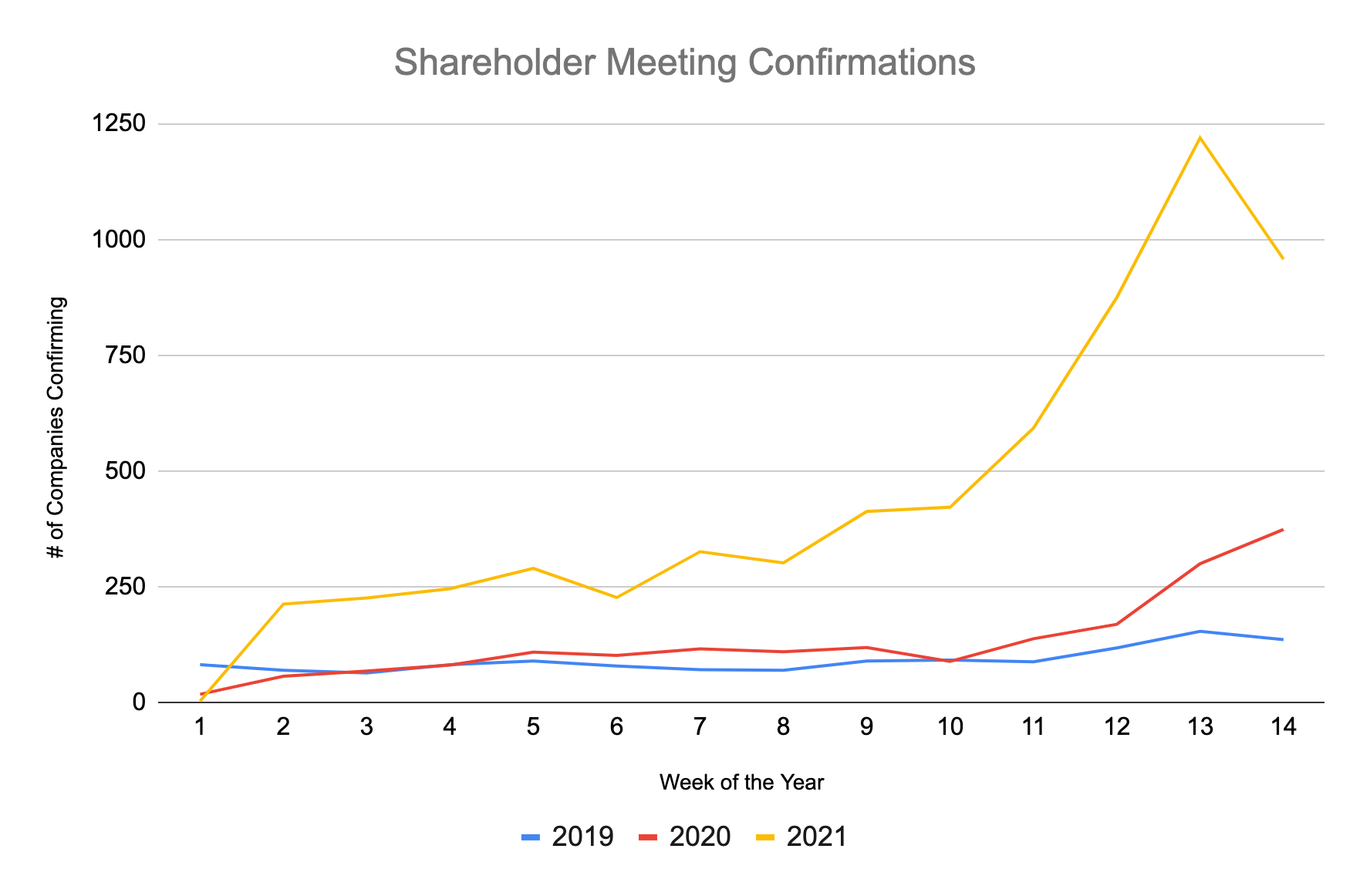

Companies are also confirming Shareholder Meeting dates months earlier than they have in the last 3 years, another signal that positive news is on the horizon. Shareholder meeting confirmations ramped up unusually early in 2021, by the second week of January. In 2020, volume did not increase until February. In 2019, we did not see increased volume until at least March.

Dividends Increasing

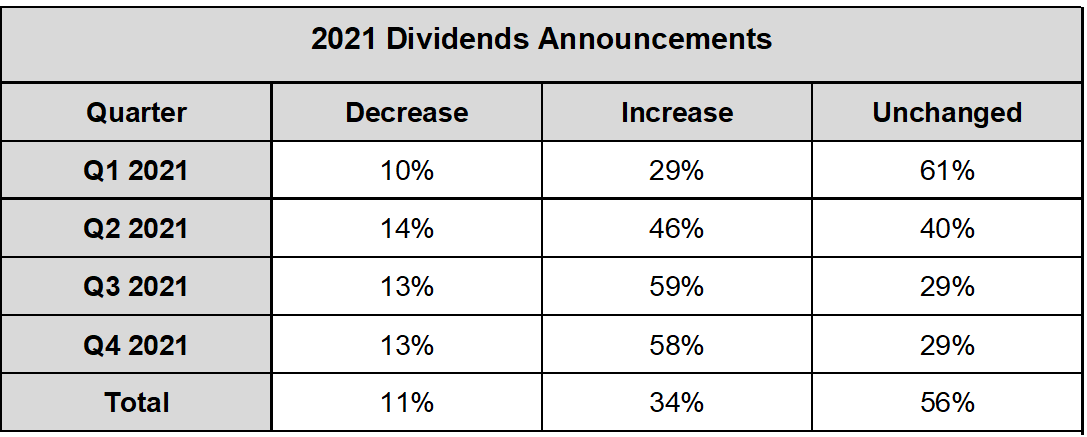

Currently, 34% of companies in our universe that have made announcements pertaining to dividend payments in 2021 have announced they are increasing them, vs. the 3-year average of 31% (keep in mind there is a very small sample size for Q3 and Q4 at this point). Just looking at Q2, 46% of companies have announced they are increasing dividends with payouts occurring in Q2 2021, vs. the prior three Q2s (2018 - 2020) which only average 36% of dividend increase announcements.

Banks on deck

In addition to the big banks, we’re tracking 92 North America companies that report this week, and 134 worldwide.

JPMorgan Chase (JPM)

April 14 (confirmed) - Earnings release (BMO), conference call 8:30AM ET

April 30 - Pay date for quarterly dividend of $0.90 (no change)

May 18 - Shareholder Meeting

May 19 - Wells Fargo Financial Services Investor Conf 2021

Goldman Sachs (GS)

April 14 - (confirmed) - Earnings release (BMO), conference call 9:30AM ET

April 29 - Shareholder Meeting

May 19 - Wells Fargo Financial Services Investor Conf 2021

June 1 - Projected quarterly dividend amount $1.25

Wells Fargo (WFC)

April 14 - (confirmed) - Earnings release (BMO), conference call 10:00AM ET

April 27 - Shareholder meeting

April 28 - Projected quarterly dividend amount $0.10

May 4 - PegaWorld INspire 2021

May 19 - Wells Fargo Financial Services Investor Conf 2021

Citigroup (C)

April 14 - Capital Link Decarbonization in Shipping Forum 2021

April 15 (confirmed) - Earnings release (BMO), conference call 10:00AM ET

April 27 - Shareholder Meeting

April 30 - Ex date for quarterly dividend amount $0.51

May 3 - Record date for quarterly dividend of $0.51

Bank of America (BAC)

April 15 (confirmed) - Earnings release (BMO), conference call 9:00AM ET

April 20 - Shareholder Meeting

May 19 - Wells Fargo Financial Services Investor Conf 2021

June 4 - Projected quarterly dividend amount $0.18

Morgan Stanley (MS)

April 16 - (confirmed) - Earnings release (BMO), conference call 8:30AM ET

April 29 - Projected quarterly dividend amount $0.35

May 20 - Shareholder Meeting

Next week we will see 285 companies report worldwide, with 220 in North America.

- *Note these figures represent the percentage of companies in our universe that have confirmed earnings dates as of April 8 in their respective year.

- North American Index - 878 North American indexed companies (slightly lower for prior years). That is in the DOW30, NASD100, S&P500, and F1000.

- North American All - Based on ~6460 North American companies currently in our universe (slightly lower for prior years).

- Non-North American Index - Based on 486 Non-North American indexed companies which reside in the Nikkei, FTSE, NIFTY50, HANGSENG, CAC, and DAX.

- Non-North American All - Based on ~2725 Non-North American companies currently in our universe (slightly lower for prior years).

- All Index - Combination of previously mentioned companies in the DOW30, NASD100, S&P500, F1000, Nikkei, FTSE, NIFTY50, HANGSENG, CAC, and DAX.

- All All - Our entire universe covering ~9185 names

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)