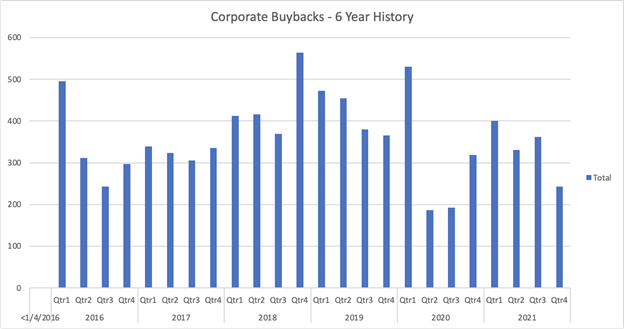

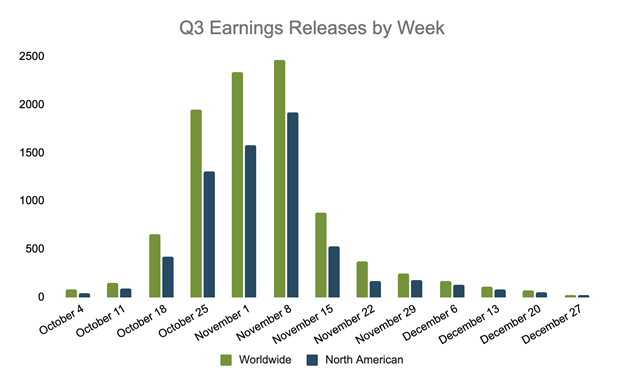

Key Takeaways Retailers reporting better than expected results, say they're stocked and ready for the holidays. Lowest Consumer Sentiment in a decade paired with the highest Retail Sales reading in 7 months has investors scratching their heads. The retail earnings parade gives way to Thanksgiving this week. Big names to watch: URBN, DKS, BBY, DLTR, AEO, ANF, BURL, JWN, GPS Buyback activity is back… possibly on track to hit a record in Q3. This week, Q3 earnings season continues to fade, with only 379 companies from our universe of 9,500 expected to report. Last week kicked off the retail earnings parade for Q3, the period at the end of every earnings season when a flurry of retail companies report quarterly results. Third quarter retail reports are usually closely watched for details and guidance on the upcoming holiday shopping season. That might be even truer this year as supply chain disruptions and inflationary pressures have many worried that consumers will not show up. So far, retail earnings, holiday guidance and the October Retail Sales report is quelling any fears investors may have had. This week several blue chip retailers such as WalMart, Target, Macy’s, Kohl’s and others reported better than expected Q3 results, raised guidance (either for Q4, CY 2021, or both) based on positive predictions for the holiday shopping season, and confirmed they were in a good standing as it relates to inventory levels. Watch What They Do, Not What They Say - Consumer Sentiment and Retail Sales at Odds There is a huge disconnect these days between how consumers say they feel and what they actually do. Two economic indicators released last Tuesday drove this point home. October Retail Sales increased 1.7% MoM, the fastest clip since the third round of stimulus checks were sent out in March. That very same day the University of Michigan consumer sentiment index for November dropped to its lowest reading in a decade, 66.8. Consumers may not feel good about the cost of inflated goods, but that isn’t stopping them from buying. Increased prices are helping to boost sales figures for now, but if they continue to rise this will likely result in consumer’s pulling back as many will have to grapple with the first real increase in cost of goods after a decade of low inflation. More Big Retail Earnings on Deck this Holiday Week This is a shortened week due to the Thanksgiving holiday on Thursday, but still plenty of retailers and other names reporting earnings. Corporate Buybacks Returning to Pre-Pandemic Levels If you need another sign that things are returning back to normal post-COVID, look no further than corporate buyback activity. A once common practice, especially in the last decade as companies have had record amounts of cash on their balance sheets, slowed down significantly during peak COVID quarters (Q2 2020, Q3 2020) as companies hoarded cash and prepared for an uncertain future. That trend started to ease by the fourth quarter of 2020, and in 2021 we will end the year back at pre-pandemic levels when it comes to the number of companies repurchasing stocks … likely not at 2018 and 2019 record levels, but ahead of where we were in 2016 and 2017. At a dollar level, however, Q3 is on track to hit a record for stock buybacks by S&P 500 companies. As of November 2, S&P 500 companies disclosed $145B in buybacks for the quarter, well on the way to surpassing the $224B all-time high (according to S&P Dow Jones Indices). *Based on our universe of 9,500 companies Q3 Earnings Season Comes to an End This marks the last week of retail earnings for Q3, after which reports slow way down until the January season begins. This week will see 379 companies from our universe of 9,500 report, mostly within the consumer discretionary sector.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)