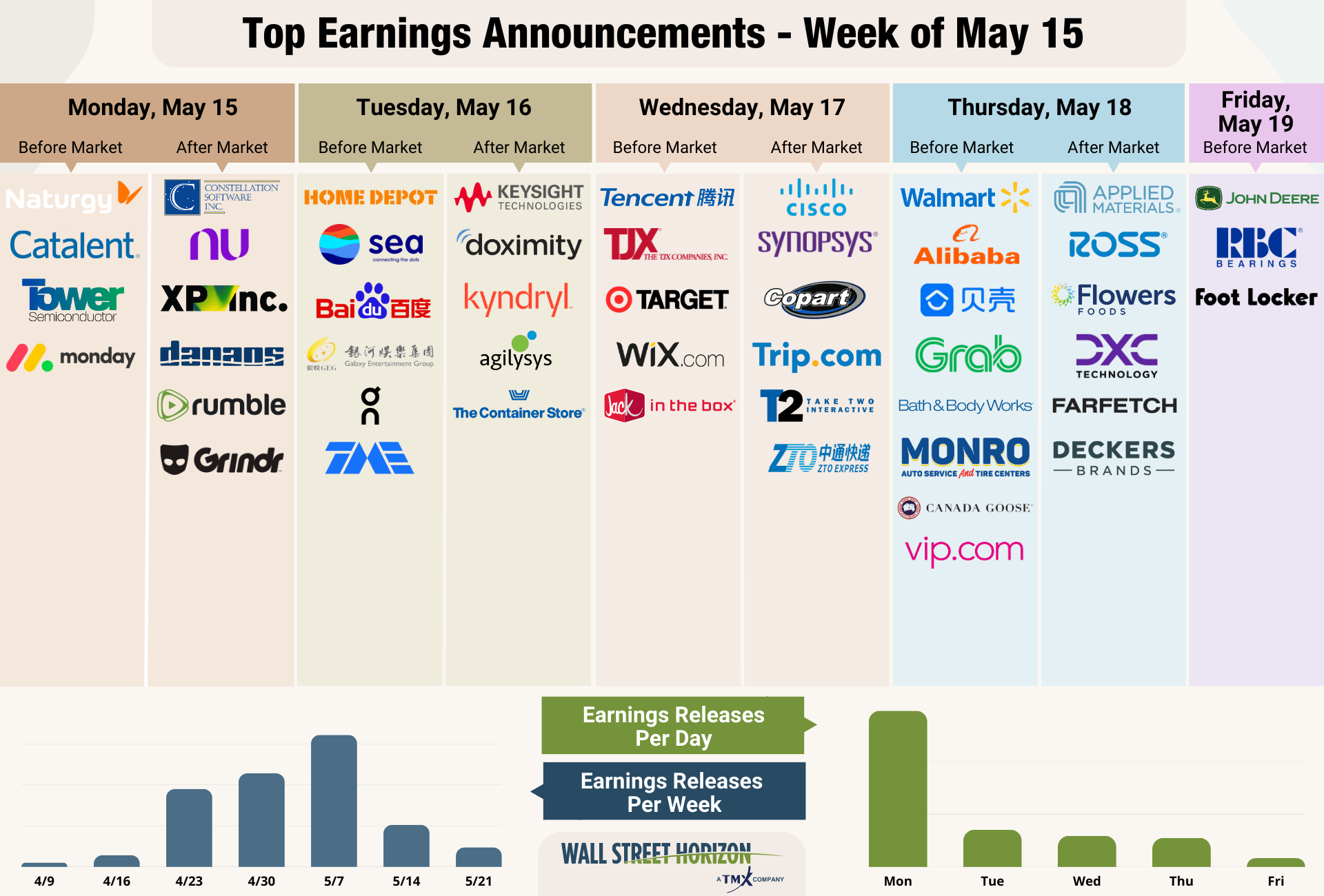

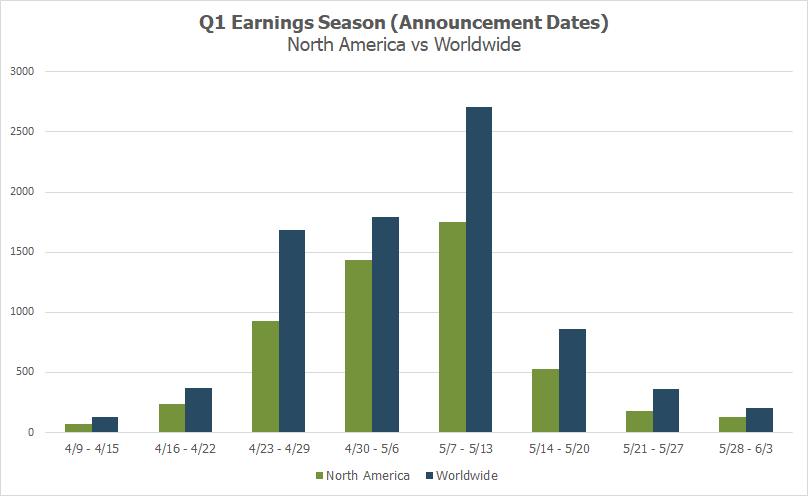

After a mixed week of results, S&P 500 EPS growth for Q1 2023 falls slightly from last week, now set to come in at -2.5% Potential earnings surprise this week: Boohoo Group (BHOOY) Retailers out in full force this week: HD, LOW, TGT, WMT, TJX, ROST, FTCH Earnings season winds down, 1,244 companies expected to report this week

Two key inflation readings came in below expectations last week just as the markets were readying themselves for a slew of retail earnings reports. On Wednesday, the Consumer Price Index showed a 4.9% increase for April on a YoY basis, below the 5% estimate, while the monthly increase of 0.4% was in-line with expectations. On Thursday, the Producer Price Index showed a yearly increase of 0.2%, also falling slightly below the expectation for 0.3%. Although inflation is increasing more slowly, investors took it as further proof that a recession is imminent, pouring into treasuries and big tech stocks as a result. Other concerns on investors’ minds included softening jobs data and a banking crisis that continues to unfold. On Thursday, US Initial jobless claims increased to 264,000 for the week ending May 6, the highest reading since October 20, 2021. Also on Thursday, PacWest Bancorp revealed in their 10Q filing that deposits plunged 9.5% in the previous week. All this worry caused cyclicals to dip mid-week, as investors continue to favor tech behemoths as a safe haven in this environment, a reversal from last year’s playbook which supported value stocks. An early read on the state of the consumer came last week as a handful of retailers and apparel names released Q1 results. While names like Under Armour and Dillard’s beat both top and bottom-line expectations, it was Under Armour’s weakened guidance and Dillard’s same store sales decline that investors were paying attention to. On the flipside, Tapestry (parent company of Coach, Kate Spade) delivered stellar results due to higher sales in China which led to an increase in the full year profit forecast. The continued trend that has seen a majority of S&P 500 companies beating first quarter expectations helped lift the overall EPS growth rate to -2.5%, an improvement from the -6.5% estimated a month ago.¹ On Deck this Week: We’ll continue to get updates on the US consumer this week when the retail earnings parade kicks off with reports from Home Depot (HD), Lowe’s (LOW), Target (TGT), Walmart (WMT), Ross Stores (ROST), TJX Companies (TJX), Farfetch (FTCH) and more. Source: Wall Street Horizon Potential Earnings Surprise this Week - Boohoo Group Boohoo Group (BHOOY) The Gen Z fashion brand beloved by TikTokers, Boohoo Group, reports H2 2023 results this week, nearly two weeks later than expected. The British online fashion retailer and parent of brands such as PrettyLittleThing, boohooMAN and Nasty Gal, has had a rough year. During their H1 2023 release in September they warned that full year sales would fall 10% on account of a worsening macro-economic and consumer backdrop. Peer fast fashion retailer ASOS reported interim results last Wednesday to a similar tune, sales fell 8% for H2 2023. High inflation has squeezed margins and profits as well as customer purchasing power, with customers buying less and returning more. As a result, ASOS enacted major cost cutting and price increase initiatives, which could be a route BHOOY takes when they report Tuesday. Q1 Earnings Wind Down Last week marked the final peak week of the Q1 2023 earnings season, with 79% of our universe now having reported. This week we will see 1,244 companies release results, mostly from the consumer discretionary and tech sectors. Source: Wall Street Horizon

¹ https://advantage.factset.com/hubfs * Wall Street Horizon DateBreaks Factor: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company's 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

Company Confirmed Report Date: Tuesday, May 16, Unspecified

Projected Report Date (based on historical data): Wednesday, May 3

DateBreaks Factor: -3*

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)