Key Takeaways:

- Themes of Q3 earnings season: labor shortages, supply chain delays, inflation, but expected growth remains high.

- Banks kick it off - Financials anticipated to be a safe haven in this environment

- Earnings Confirmations for Q3 in-line with historical average

- Less companies are delaying earnings reports, a sign that upcoming reports should contain good, or at least not-that-bad, news.

US companies are facing a number of headwinds as we enter Q3 earnings season, but they seem to be signaling to investors that they are weathering the storm... for now anyway. In addition to high expected year-over-year growth and analyst estimates that are rising ahead of reports, we take our cues from the companies themselves and the subtle signals they are sending (whether they know it or not). One such measure is the rate of earnings date confirmation, and just as many S&P 500 companies are confirming earnings dates as they have historically, a positive sign that there is good news on the horizon. We’re also seeing fewer delayed earnings reports, meaning not as many companies are pushing off earnings to a later date, usually a sign that the company will disappoint.

Growth Expectations Continue to Climb

Despite the many issues impacting certain sectors of the economy heading into the Q3 earnings season, expectations are still favorable. According to FactSet, S&P 500 growth is estimated to top 27.6%, which would mark the third-highest YoY earnings growth rate reported since 2010. This includes rising expectations for seven of the 11 sectors.

Labor shortages, Supply Chain Disruptions and Inflationary Pressures, Oh My!

High expectations aside, there is no doubt a significant number of economic concerns mounting as we head into 2022. However, certain sectors will be impacted more than others.

The sectors seeing the biggest drop in expectations since June 30 (according to FactSet) are Industrials, Consumer Discretionary, Consumer Staples and Utilities. And it’s not hard to see why.

Within Industrials, airlines have been hit hard by jet fuel shortages and labor shortages as demand for travel soared this summer. Despite high demand for equipment, machinery companies are having a hard time keeping up due to supply chain disruptions that have left them short on things like steel, plastics and microchips.

Consumer Discretionary possibly has some of the most talked about subsectors disrupted by the supply chain delays and an increase in raw material costs. It’s no secret the automotive industry is getting crushed by the continuing chip shortage. The September US Auto Sales report showed a 26% slump. Homebuilders too were hurt by higher lumber prices for most of 2021, and even though that has cooled, they are now struggling with labor shortages and higher prices on just about everything else needed to build and furnish a home. Even apparel retailers will feel the squeeze soon with cotton prices rising to a 10-year high. As is commonplace, those costs will be passed onto shoppers, but there are some concerns about how that will test consumers who have been driving earnings and economic growth this past year.

Consumer Staples is also struggling with increased pricing for commodities such as wheat and corn, after a particularly poor crop season marked by extreme weather conditions and drought.

As always, it’s going to be the guidance that sets the tone for how shareholders feel as we head into 2022. Many of the aforementioned negatives will be partially offset by the positives: robust labor demand, stabilization of COVID infections in part due to increasing vaccination rates, improving oil prices and the return of consumer demand for travel.

Banks Kick it Off Wednesday

Financials might be a good place to hide this quarter as it’s one of the sectors least impacted by looming supply chain disruptions. The expected growth rate currently stands at 17.3%, and that’s moved up from 14.8% on June 30.

This week we’ll hear from:

Wednesday, October 13, 2021

JPMorgan Chase (JPM) - Earnings release BMO, conference call 8:30AM EDT

Thursday, October 14, 2021

Bank of America (BAC) - Earnings release BMO, conference call 9:00AM EDT

Citigroup Inc. (C) - Earnings release BMO, conference call 10:00AM EDT

Wells Fargo & Co. (WFC) - Earnings release BMO, conference call 11:30AM EDT

Morgan Stanley (MS) - Earnings release BMO, conference call 8:30AM EDT

Friday, October 15, 2021

Goldman Sachs (GS) - Earnings release BMO, conference call 10:30AM EDT

Other companies to pay attention to:

Delta Airlines (DAL) is out Wednesday morning and will set the tone for airlines this season.

Taiwan Semiconductor Manufacturing (TSM) is out Thursday and will give a read on the semiconductor shortage.

Earnings Confirmations In-line with Historical Averages

Despite all of the aforementioned issues, companies are confirming their earnings dates on schedule. Thus far, 62% of S&P 500 companies have confirmed their earnings dates for the Q3 season, the 8 year historical average for S&P 500 confirmation rate on the Friday before banks report is also 62%. Looking at our entire universe of 9,200+ companies, only 35% have confirmed their earnings dates, which is also in-line historically. So far only 21 S&P 500 names have reported.

Fewer Companies Delaying Q3 Earnings Reports

Thus far there are 21 S&P 500 companies confirming off-trend earnings dates for Q3, meaning outside of the historical range in which they’ve typically reported. Of those, 8 companies have pulled their earnings date earlier than their historical average, and 13 have pushed their date back.

Over the last 8 years, by the Friday before bank earnings, we’ve seen an average of 16 companies advance their earnings date on a quarterly basis, while 35 have delayed. Academic research shows that when a company delays earnings, bad news typically follows on the earnings call. Similarly, advancing an earnings date is highly correlated with good news being shared on the quarterly call. The suggestion here is that despite all of the economic headwinds, we are still only seeing a little more than a third of the average number of S&P 500 companies delaying earnings, and only half of the average number of companies advancing earnings, overall indicating it should be a fairly stable reporting season.

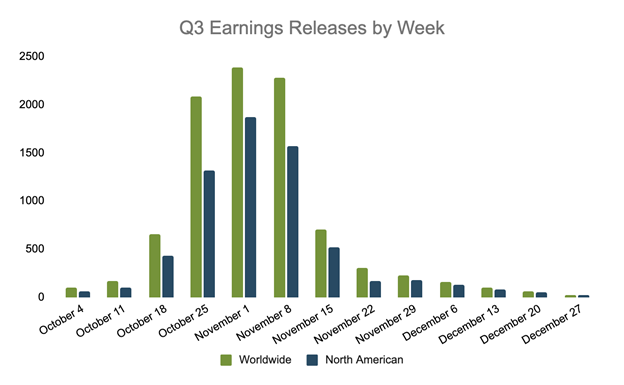

Earnings Wave

This season peak weeks will fall between October 25 - November 12, with November 2 predicted to be the most active day with 1,106 companies anticipated to report. Again, only 35% of companies have confirmed at this point, so this is subject to change. The remaining dates are estimated based on historical reporting data.

This week will see 19 S&P 500 companies report, and 186 for our broader universe (9,300+).

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)