Published April 2, 2024.

Last week we shared that CEO sentiment was at its highest level in a year. This week we look at further evidence that corporations are feeling more bullish on economic conditions in 2024 than they were in 2023. This time in the form of dividend and buyback announcements.

Share repurchases and dividend payouts are the two primary vehicles that companies use to return value to shareholders, and both saw meaningful increases in Q1. Buybacks and dividend increases dampened in 2023 as companies remained cautious in the face of higher interest rates, stubbornly elevated levels of inflation and the threat of an impending recession. Unsure of whether a soft-landing was in store for the US, companies held back on returning excess profits to investors.

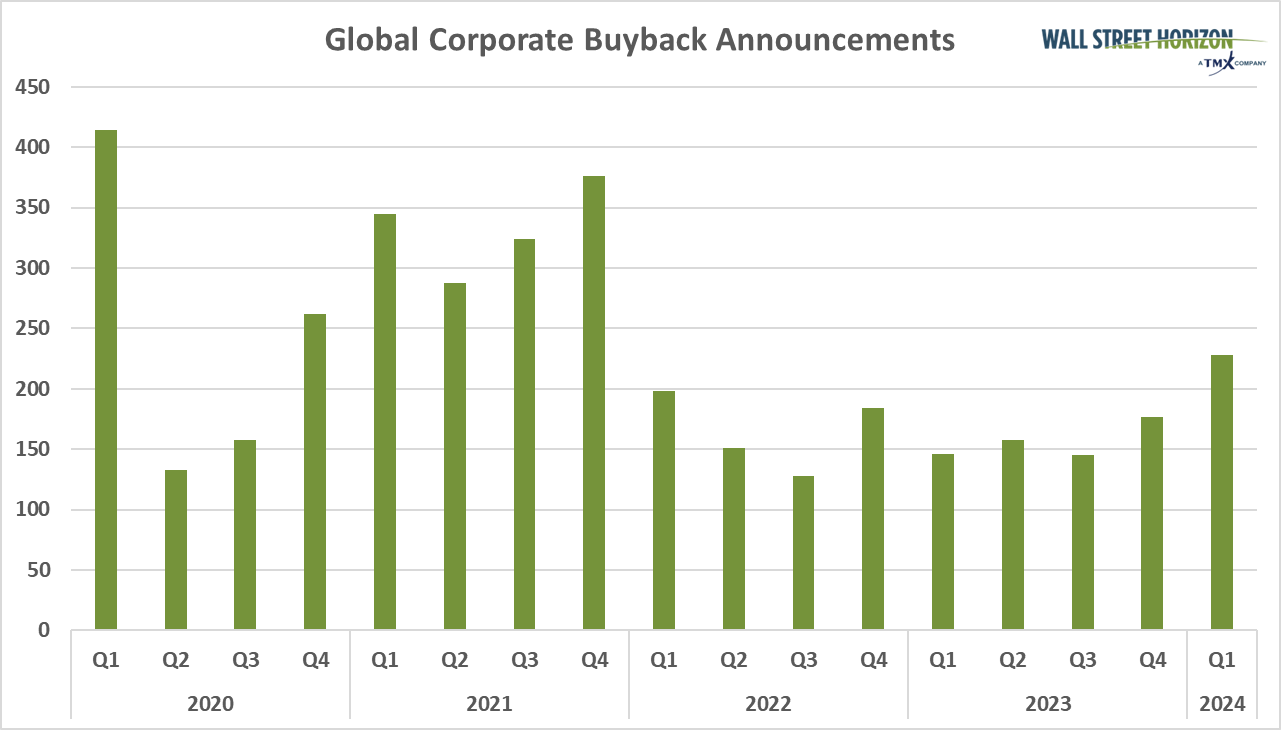

Buyback Announcements at Highest Level in Over 2 Years

Buyback announcements for the first quarter of 2024 clocked in at 228, the highest level since Q4 2021 recorded 376 repurchase announcements (out of our universe of 10,000 equities). This is also the first quarter to record more than 200 repurchase announcements, with every quarter of 2022 and 2023 logging below that amount.

Buybacks are seen as a positive for investors. By reducing the number of outstanding shares, current investors will have a higher percentage of ownership. A fewer number of outstanding shares also increases the company’s earnings per share, which could in turn boost share prices (although temporarily). Buyback programs also signal that the company has excess cash on hand, and while opponents will argue that this isn’t always the best use of that cash, investors can find solace in the fact that they likely don’t need to worry about the company’s cash flow position in this scenario.

Source: Wall Street Horizon

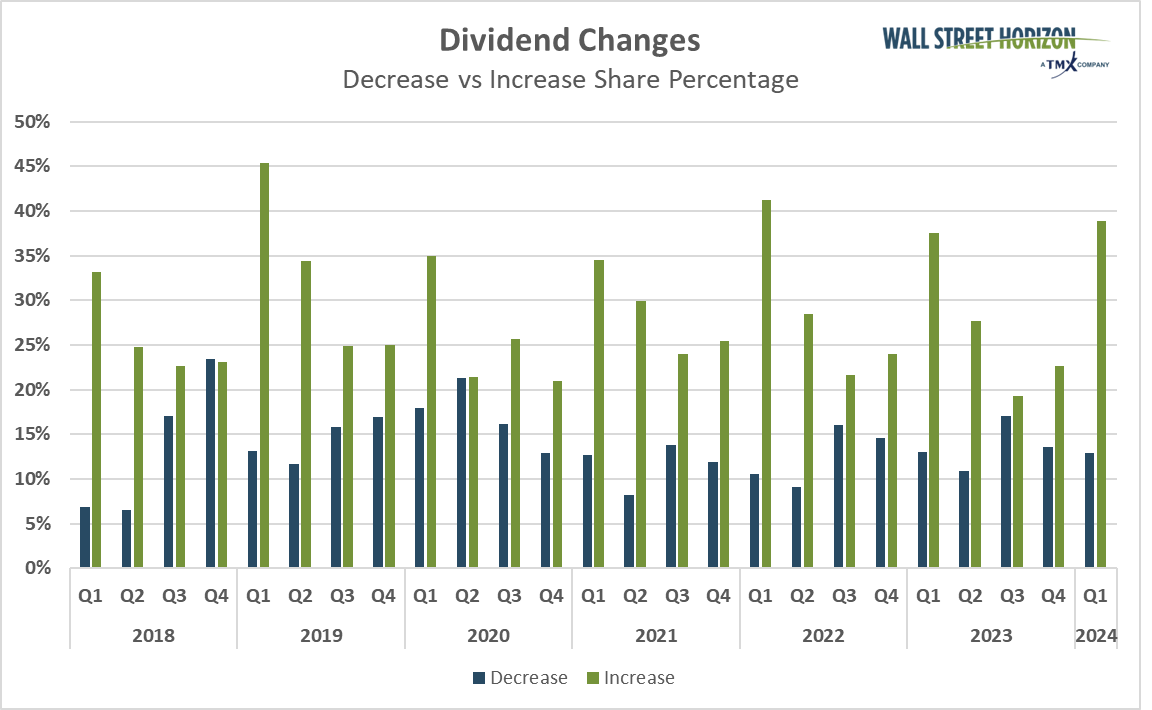

Dividend Increases Hit Highest Level Since Before 2018

In the same vein, dividend increases in Q1 2024 were at their highest level since before 2018. In Q1 2024, a total of 1,639 companies (in our universe of 10,000) increased dividends vs. 542 which decreased dividends. Not only is that the highest number of increases in over 7 years, but the highest percentage of increases (39%) vs. decreases (13%) since Q1 2022.

Dividends benefit investors by providing income, but also work as a gauge for the company’s financial well-being. For this reason, high dividend payers tend to be very in demand.

Source: Wall Street Horizon

The Bottom Line

We’re only one quarter into 2024, but between improving CEO sentiment, dividends and buybacks, there are a lot of positive corporate developments. With the Q1 2024 earnings season set to begin next Friday, April 12, we’ll be getting a deeper read on the state of US corporations as well as updates on whether these gains in buybacks and dividends will continue in the second quarter of the year.

Copyright © 2024 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon's prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are the trademarks of TSX Inc. and are used under license. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)