Published: March 11, 2024.

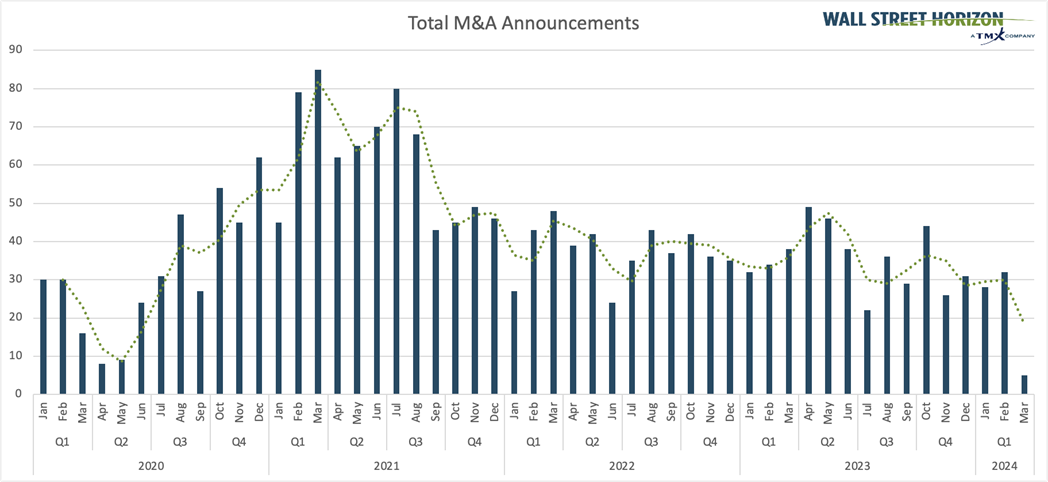

There were high hopes for a pickup in M&A activity heading into the new year, after 2023 hit an all-time low for the decade.1 However, with only three weeks left in the first quarter, it doesn’t look like improvement is on its way just yet.

High Interest Rates Still a Headwind

High interest rates continue to impact dealmaking, making it more expensive for companies and private equity firms to raise financing. Late last year there was hope that the March 20 FOMC meeting would bring the first cut in interest rates in four years. Since then, however, Federal Reserve Chairman Jerome Powell and several Fed presidents have made clear that investors should expect later and fewer cuts in 2024.2 Currently the CME Group’s FedWatch tool only has a 3% probability of a rate cut at the March 20 meeting, with that probability increasing for meetings in the second half of the year.3

Another thing that hampered dealmaking was the economic uncertainty felt last year, exacerbated by pockets of market volatility in certain quarters. Those factors made it difficult for buyers and sellers to agree on terms. However, there is evidence that corporate uncertainty may be dissipating. Our Late Earnings Report Index (LERI) which tracks outlier earnings dates, an indicator of corporate uncertainty, fell to its lowest level in nearly 2 years. A low reading suggests that US companies are markedly more confident than they were in 2022 or 2023. That could bode well for dealmaking as the year continues.

Dealmaking in Jan/Feb 2024 Falls to a 4-Year Low

Despite some recent and exciting M&A announcements, volumes are still low for the year, with only 60 deals announced in January and February. That’s the lowest number of announcements since 2020, which also clocked in at 60. March 2020 marked the beginning of COVID lockdowns, so only 16 deals were announced that month; we'll likely end higher for March 2024. M&A closes are also underwhelming at 45 vs. the 5-year average of 70 closes for the first two months of the year.

Source: Wall Street Horizon, Note: WSH M&A Announcements only include deals where the target is a publicly traded company.

Some big announcements this year that have gotten investors excited are HPE’s bid for Juniper Network back in January which could result in a $14B deal.4 There was also Walmart’s recent bid for Vizio at $2.3B.5 The largest YTD merger announcement, however, is that of Capital One Financial Corporation and Discover Financial Services in a deal that could be worth $35.3B.6

Things have fallen apart on other highly-anticipated deals. JetBlue announced they were scrapping a plan to takeover Spirit Airlines in a deal worth $3.8B7 weeks after losing a federal antitrust lawsuit that challenged the deal because of how it could possibly disadvantage consumers that rely on Spirit’s discount fares.

M&A Rebound Expected As the Year Rolls On

While there is still hope for an M&A rebound this year, it won’t come in the first quarter. Morgan Stanley did say in a note released Monday that they expect global deal-making volumes to rise 50% YoY however, as headwinds that plagued the dealmaking world in 2023 dissipate. "We think that this 'winter' for M&A is thawing and activity is set to return cyclically and secularly," said the investment bank.8

1 Dealmakers see rebound after global M&A volumes hit decade-low, Reuters, December 21, 2023

https://www.reuters.com

2 Semiannual Monetary Policy Report to the Congress, Chair Jerome Powell, March 6, 2024, https://www.federalreserve.gov

3 CME FedWatch Tool, CME Group, March 8, 2024, https://www.cmegroup.com

4 HPE to acquire Juniper Networks to accelerate AI-driven innovation, January 9, 2024, https://www.hpe.com

5 Walmart Agrees To Acquire VIZIO HOLDING CORP. To Facilitate Accelerated Growth of Walmart Connect through VIZIO’s SmartCast Operating System, February 20, 2024, https://corporate.walmart.com

6 Capital One to Acquire Discover, February 16, 2024 https://investor.capitalone.com

7 JetBlue Announces Termination of Merger Agreement with Spirit, March 4, 2024, https://news.jetblue.com

8 An M&A Comeback Is on the Way, Morgan Stanley Says. Why Deals Can Surge 50%, Barron’s, March 6, 2024. https://www.barrons.com

Copyright © 2024 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon's prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are the trademarks of TSX Inc. and are used under license. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)