-

The momentum factor has been revived in recent months, led by powerful rallies among AI-related stocks and Healthcare sector behemoths

-

Two companies, one from each space, hold investor events this week before their respective quarterly earnings reports due out in Q2

-

Ahead of the next reporting period, we highlight other meetings to monitor for trends on the health of firms across sectors

Momentum has been a powerful force so far in 2024. Year to date, in fact, among all equity factors, shares of companies that won the most over the tail end of last year have continued to be among this year’s leaders, according to data from S&P Dow Jones Indices.1 Catalysts that have driven momentum stocks to all-time highs are themes the public as well as market watchers know well. The AI revolution and clinical progress among weight-loss drugs are in the mainstream, and benefits to the corporate world and individuals’ health are already happening.

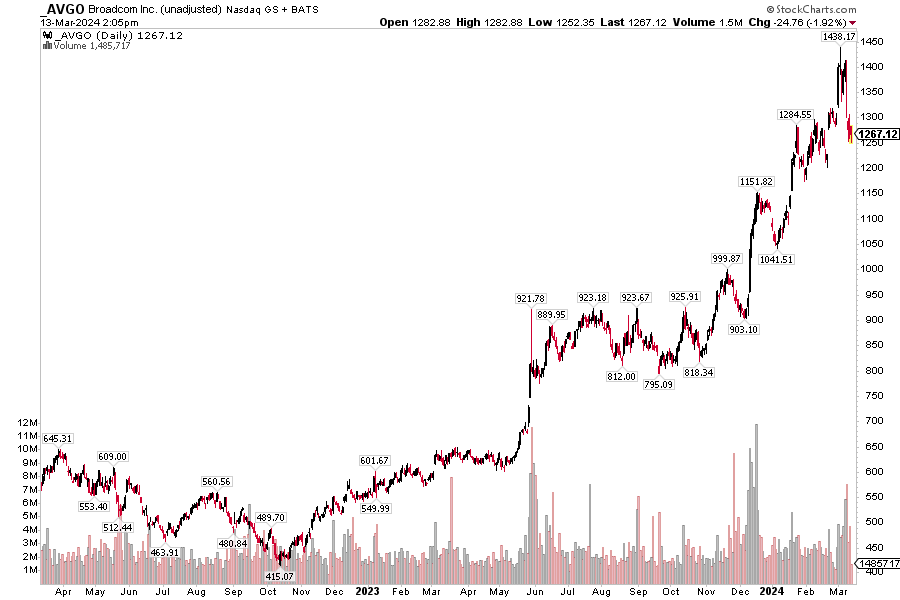

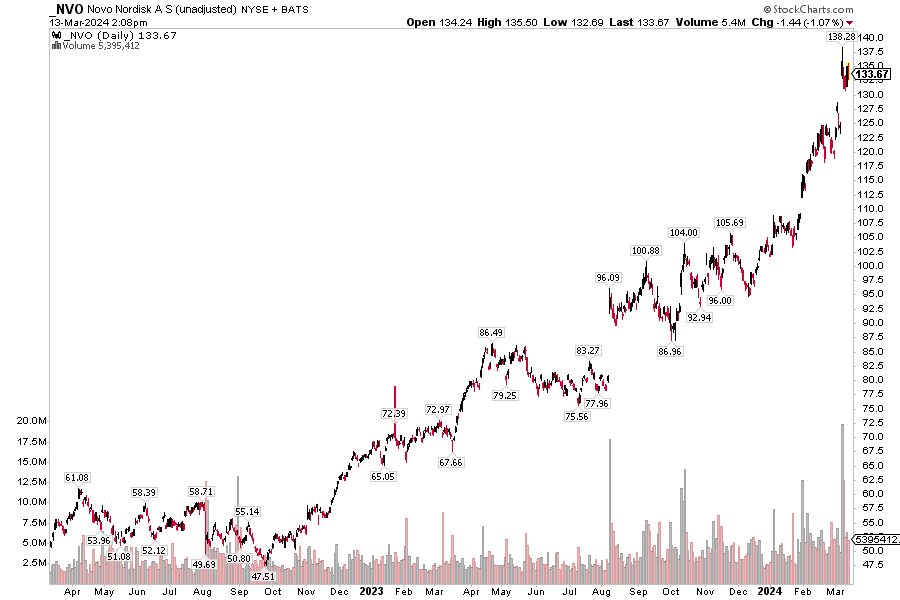

Companies like NVIDIA (NVDA) and Eli Lilly (LLY) have emerged as mega-cap stalwarts, now both among the top 10 most valuable global publicly traded firms.2 Their respective competitors have performed well, too. Shares of Broadcom (AVGO) and Novo Nordisk (NVO) are near all-time highs, and both stocks are in the high-momentum trade today.

With Q4 2023 earnings season in the books, shareholder and analyst meetings are critical to watch for investors seeking to effectively manage risk. According to Wall Street Horizon data, March is a busy time for such events. This week, both AVGO and NVO host corporate gatherings that could shed light on the latest AI trends and updates on the GLP-1 medication market. Then next week, keep a pair of S&P 500® names on your radar for potential volatility – we'll spotlight those later.

March 20: Broadcom (AVGO) Investor Meeting

First up, Broadcom hosts its Enabling AI in Infrastructure Investor Meeting on Wednesday, March 20. Charlie Kawwas, President, Semiconductor Solutions Group and General Managers on Broadcom's merchant silicon portfolio will present during the morning with the event expected to wrap up at 10:45 a.m. PT. Recall that AVGO topped analysts’ bottom-line estimates in its most recent quarterly report. Q1 non-GAAP earnings of $10.99 were above the Wall Street consensus forecast while revenue grew 34% year-over-year to $11.96 billion.3 The firm has been buying back shares and a strong stock-price uptrend has been in place since October 2022.

Still, the bears have re-asserted themselves since the March 7 quarterly release. Shares are well off their high of $1438 despite a slew of EPS upgrades and price target increases in the last few months. While anything can happen at Investor and Analyst Day events, it’s not uncommon for new business updates to offer additional insights into the fiscal year ahead.

Looking forward, Broadcom will host its annual shareholder meeting on April 22 and has an unconfirmed Q2 2024 earnings date of Thursday, May 30 AMC.

Broadcom (AVGO): 2-Year Stock Price History

Source: Stockcharts.com

March 21: Novo Nordisk (NVO) Shareholder Meeting

Following the US Food and Drug Administration’s approval of Wegovy as a treatment for cardiovascular risks,4 the second-largest non-US company by market cap holds its Annual General Meeting on Thursday, March 21. The event comes after the Danish Health Care firm's generally upbeat Capital Markets Day back on March 7.5 The stock surged from under $125 to an all-time high above $138 earlier this month following promising early Phase I trial results of its experimental oral obesity drug.6

Within its most recent earnings report, though, results were mixed with strong profits from Ozempic and Rybelsus, but small misses related to Wegovy and Saxenda, according to analysts at BofA Global Research. At the Investor Day, the company confirmed that it anticipates that a Phase II trial will commence in the second half of this year, with results expected in early 2026.

It has been good news after good news for both Novo and Lilly. Will more updates be provided at the annual shareholder meeting? While we never know for sure, it may be a more muted event compared to the Capital Markets Day, but Q1 2024 quarterly earnings results are not far off. Europe’s largest company by market cap reports on Thursday, May 2 BMO and the US ADR shares trade ex a $0.93 dividend this Friday, March 22.

Novo Nordisk (NVO): 2-Year Stock Price History

Source: Stockcharts.com

Other Company Meetings on Tap

It will be an active stretch for investor conferences and company events over the next few weeks before the beginning of the Q1 earning season. UPS (UPS) holds its Investor & Analyst Day next Tuesday, March 26, and Adobe, another AI player, hosts an Investor Meeting the same day. Further down the road, Disney’s (DIS) shareholder meeting takes place on April 3 along with Schlumberger (SLB).

The Bottom Line

Investor and analyst events, along with industry conferences, are in the spotlight between earnings seasons. As AI and GLP-1 weight-loss drugs command the attention of momentum investors, key news commonly breaks at important company meetings. Keep both Broadcom and Novo Nordisk on your watch list for potential volatility this week as other high-profile large caps host events later this month and in April.

1 Index Dashboard: S&P 500® Factor Indices, S&P Dow Jones Indices, February 2024, https://www.spglobal.com/

2 Semiannual Monetary Policy Report to the Congress, Chair Jerome Powell, March 6, 2024, https://www.federalreserve.gov

3 iShares MSCI ACWI ETF, iShares, March 15, 2024, https://www.ishares.com

4 Broadcom Inc. Announces First Quarter Fiscal Year 2024 Financial Results and Quarterly Dividend, Broadcom, March 7, 2024, https://investors.broadcom.com

5 Financial calendar, Novo Nordisk, March 15, 2024, https://www.novonordisk.com

6 Novo Nordisk shares jump 8% on promising weight loss trial results; Eli Lilly dips, CNBC, Elliot Smith, March 7, 2024, https://www.cnbc.com

Copyright © 2024 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon's prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are the trademarks of TSX Inc. and are used under license. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)