Key Takeaways:

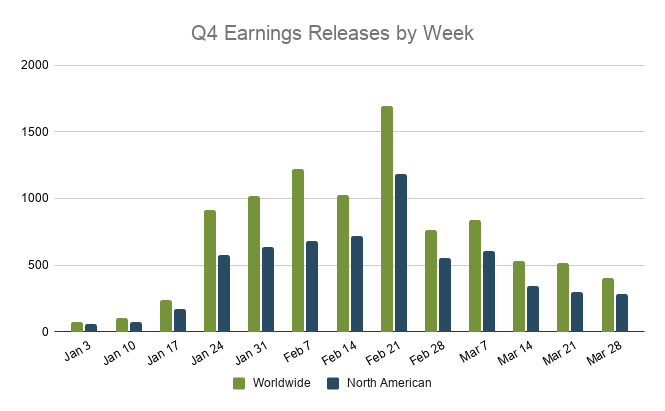

Peak earnings season continues this week with 985 worldwide names reporting, and 675 in North America.

- 25% of companies are reporting 4+ days later than usual

- 20 North American companies report on Presidents day this year, double what we’ve seen the last two years

- Unusual moves in two COVID-19 beneficiaries this week (MEDP, AFI) and one name whose business has been severely impacted by the pandemic (TRIP)

Peak earnings season continues to prove one point, analysts way underestimated company performance in Q4, even more so than usual. With 74% of the S&P 500 reporting, 80% have beaten on EPS, pushing the YoY growth rate up to 2.9% according to FactSet.

This week we’re gearing up for another heavy week of earnings, with 985 worldwide names reporting, and 675 in North America.

One quarter of companies are reporting 4+ days later than usual - up from 20% at the half point.

Just looking at the most important companies (those on the F1000 and NASD100, SP500, and DOW 30 indexes), we see 85% have confirmed and/or reported their earnings release dates for the quarter. One trend that has only proliferated since the halfway mark of earnings season is the number of companies reporting later than usual. Of the companies that have confirmed (or reported) earnings dates thus far, 25% are reporting 4 days or later than they did in Q4 2020.

Why does this matter? Research shows postponing earnings announcements is often predictive of bad news ahead.

How does this square with a higher than average beat rate? Remember that sell side analysts tend to follow corporate guidance which is typically very conservative, and even more so since the on-set of the pandemic. This makes EPS estimates an easy hurdle to jump. It’s also important to keep in mind how many of these companies got to earnings growth in Q4, by cutting costs. Even so, this earnings season, as with every one since the pandemic, is one of haves and have-nots. While some businesses have flourished in this environment, others are on the brink of collapse. Downtrodden sectors include Utilities, Real Estate, Industrials and Energy, with Consumer Discretionary just recently popping over to the positive side for YoY EPS growth.

Financials postponing earnings releases the most this week, Industrials moving them up

For the week of February 15, twenty companies are set to report with historically unusual earnings dates. The sector confirming most outside of their historical report date range is

Industrials with 5 companies, three of those (PST.IT, AFI, RBA) were advancements, and two (MXCYY, RXN) postponements. Financials had the next largest amount of movements, although that sector tells a much different story with all 4 companies postponing dates (MCY, GNW, AEL, ESNT).

Reporting the Friday afternoon before a 3-day weekend … or on the holiday itself

The old PR trick to bury bad news was to have your company report earnings results the Friday afternoon before a 3-day weekend. Back in 2014 an academic study showed this is actually the wrong thing to do, and may get your company more attention. We saw two companies report Friday after the close. But what about companies that report on said holiday, when markets are closed? There is no research (that we’ve found) on that, but we did notice an increase in the number of companies doing that this year. Twenty names are reporting on Presidents day this year, vs. 9 last year and 11 in 2019.

Unusual movements to pay attention to this week

TripAdvisor (TRIP)

Company Confirmed Report Date: Thursday, February 18, AMC Previously Inferred Report Date (based on historical data): February 10, AMC Z-Score: 3.35 DateBreaks Factor: -3

TripAdvisor usually reports Q4 results between Feb 12 and Feb 14 with no day of the week trend. On January 29 they confirmed they would be reporting on February 18, a week later than normal. This change resulted in a high Z-score of 3.35. A high positive Z-score (we consider anything higher than 3 or lower than -3 to be significant) reflects a later than usual confirmed earnings date, which in this case could signal that TRIP is getting ready to announce disappointing results. Z-score is also incorporated into our DateBreaks Factor*, for which TRIP has a factor of -3, meaning there is a high negative deviation from the historical trend for the same quarter.

Like other travel related businesses, TRIP has not been immune to the devastating impact the COVID-19 pandemic has had on their bottom-line. As vaccine distribution ramps up, many are expecting travel names to bounce. Even so, TRIP’s stock and fundamentals seem to be underperforming peers in the space such as Expedia and Booking.com. The entrance of big tech names like Google into the travel category also adds to the already heated competition in the OTA space, possibly making it harder for TRIP to bounce back.

Medpace (MEDP) Company Confirmed Report Date: Monday, February 15, AMC Previously Inferred Report Date (based on historical data): February 22, AMC Z-Score: -8.13 DateBreaks Factor: 3

For the last four Q4s, Medpace has reported the last week of February with a strong Monday trend, moving it forward one week this year, to a holiday nonetheless. This change resulted in a high Z-score of -8.13. A high negative Z-score (we consider anything higher than 3 or lower than -3 to be significant) reflects an earlier than usual confirmed earnings date, which in this case could signal that MEDP is getting ready to announce better-than-expected results. Z-score is also incorporated into our DateBreaks Factor*, for which MEDP has a factor of 3, meaning there is a high positive deviation from the historical trend for the same quarter.

Medpace is a clinical contract research organization that provides laboratory services for drug development and testing. Their involvement in COVID-19 testing, assisting with the processing of both PCR tests and antibody tests, helped drive significant growth on the top and bottom-line in Q3, which they are poised to see again in this Q4 report.

Armstrong Flooring (AFI) Company Confirmed Report Date: Wednesday, February 17, AMC Previously Inferred Report Date (based on historical data): February 25, AMC Z-Score: -16.97 DateBreaks Factor: 3

Since Armstrong Flooring separated from Armstrong World Industries in 2016 they have always reported Q4 results on the first Tuesday of March. But since switching over to an interim CFO in June and a permanent CFO in October, reports have been coming in a bit earlier. Based on that we set a Q4 report date of February 25. On February 3 AFI confirmed they would release Q4 earnings on Wednesday, February 17. This change resulted in a high Z-score of -16.97. A high negative Z-score (we consider anything higher than 3 or lower than -3 to be significant) reflects an earlier than usual confirmed earnings date, which in this case could signal that AFI is getting ready to surprise to the upside. Z-score is also incorporated into our DateBreaks Factor*, for which AFI has a factor of 3, meaning there is a high positive deviation from the historical trend for the same quarter.

The home improvement industry continues to boom in the wake of COVID-19, as consumers spend more time in their houses. And unlike competitors such as Lumber Liquidators which focuses primarily on hardwood flooring, a large part of Armstrong’s business is around engineered wood and vinyl flooring. This is important as lumber prices hit record highs, rising 113% from the same point last year due to strong demand for both new homes and home remodeling.

The busiest week is ahead of us, with 1,187 companies reporting from Feb 21 - Feb 27, including those with unusual earnings date patterns which we will be analyzing: ViacomCBS and Fluor Corporation.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)