Published: April 22, 2024.

-

Markets continue their downward momentum despite a positive start to the Q1 earnings season

-

The LERI shows corporate uncertainty ticking back up after falling in Q4

-

All eyes turn to the Magnificent 7: Tesla (TSLA), Meta (META), Alphabet (GOOGL) and Microsoft (MSFT) out this week.

-

Peak weeks for Q1 season run from April 22 - May 10

Can Big Tech Turn Markets Around? Or Are Investors Too Blinded by Fed Commentary?

US markets continued their downward trajectory last week, even in the face of some decent earnings reports. The S&P 500® headed for its longest losing streak of the year, down for six consecutive days, as investors continued to focus on inflation, Fed commentary and the sinking realization that interest rate cuts might not come until 2025.

Stand-out earnings last week came from the investment banks, Goldman Sachs (GS) and Morgan Stanley (MS) on Monday and Tuesday, and continued with better-than-expected results from United Airlines (UAL) on Tuesday afternoon. The international carrier’s stock jumped 17% after they forecasted Q2 expectations well ahead of Wall Street estimates, signaling a strong start to peak travel season.1

The party continued on Thursday with robust results from tech and communication services names. Taiwan Semiconductor Manufacturing (TSMC) reported robust results on the top and bottom-line before-the-bell on the back of strong AI chip demand.2 Another highly anticipated name, Netflix (NFLX), was out after the bell. Impressive results showed their crackdown on password sharing continued to pay off when total subscribers jumped 16% in Q1.3 Even so, the stock sank following the report, as Netflix said they would no longer report that paid memberships metric starting in 2025 and investors continued to focus on inflation and geopolitical tensions.

Despite better-than-expected results last week, downward revisions to companies that have yet to report lead to a decrease in the blended S&P 500 EPS growth rate for Q1. According to FactSet, the current consensus is for 0.5%, an increase from 0.9% last week. Thus far 74% of companies that have reported have surpassed analyst estimates.4

Investors Reacting More to Tepid CEO Commentary than Actual Q1 Results

Despite better-than-expected results so far this quarter, investors are rewarding companies with positive surprises by less than average, and punishing negative surprises by more than average. So what gives? Well it’s all likely in the commentary. While many companies have been able to put up impressive results for profits and sales, forward-looking guidance and overall commentary have been much more cautionary.

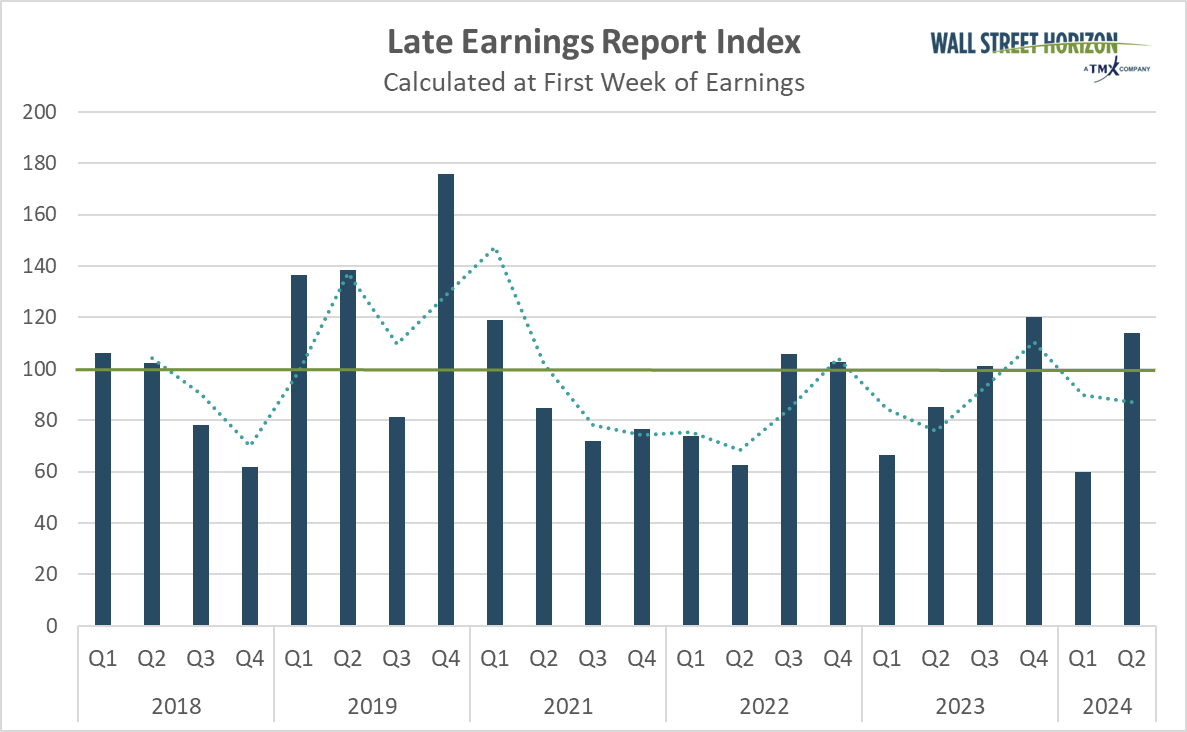

Our proprietary Late Earnings Report Index (LERI), has picked up on that trend and is highlighting how US CEOs may be more uncertain in Q2 as compared to last quarter.

The LERI tracks outlier earnings date changes among publicly traded companies with market capitalizations of $250M and higher. The LERI has a baseline reading of 100, anything above that indicates companies are feeling uncertain about their current and short-term prospects. A LERI reading under 100 suggests companies feel they have a pretty good crystal ball for the near-term.

The official pre-peak season LERI reading for Q1 (data collected in Q2) stands at 114, back above the baseline reading, suggesting companies are feeling less certain about economic conditions than they were at the beginning of the year. As of April 12, there were 43 late outliers and 34 early outliers.

Source: Wall Street Horizon, 2020 is excluded due to an abnormally high amount of delays.

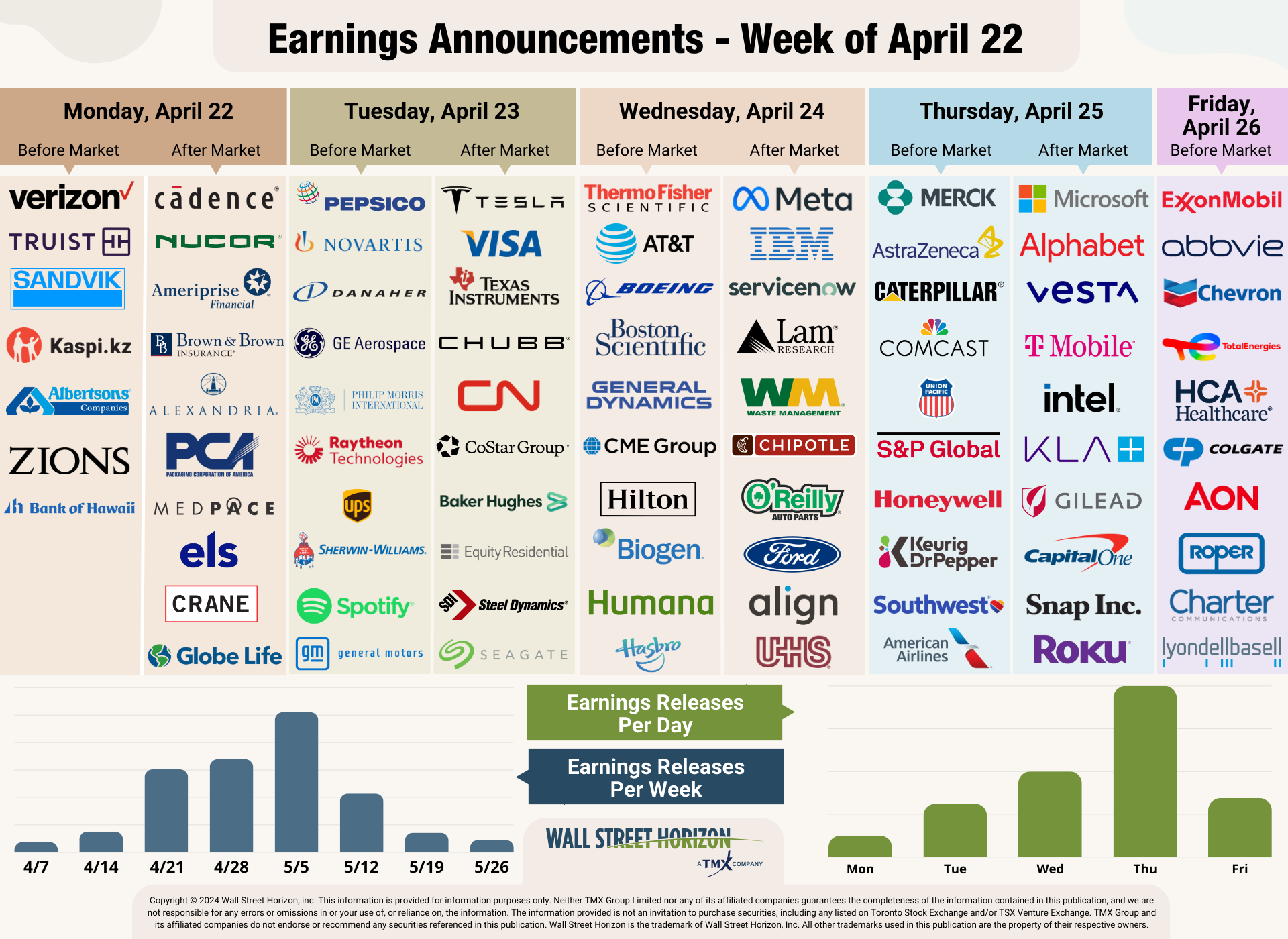

On Deck this Week - The Magnificent 7

It will be all about big tech this week, more specifically the Magnificent 7, of which four constituents are reporting. On the docket we have: Tesla (TSLA) out with Q1 2024 results on Tuesday after the bell, followed by Meta (META) out AMC on Wednesday and Microsoft (MSFT) and Alphabet (GOOGL) closing out the week on Thursday after the close. Intel (INTC) is not in the Magnificent 7, but it is expected to post one of the highest growth rates in the S&P 500 tech sector due to continued demand for generative AI products. According to FactSet, the tech behemoth is anticipated to show EPS growth of 475% YoY.

Source: Wall Street Horizon

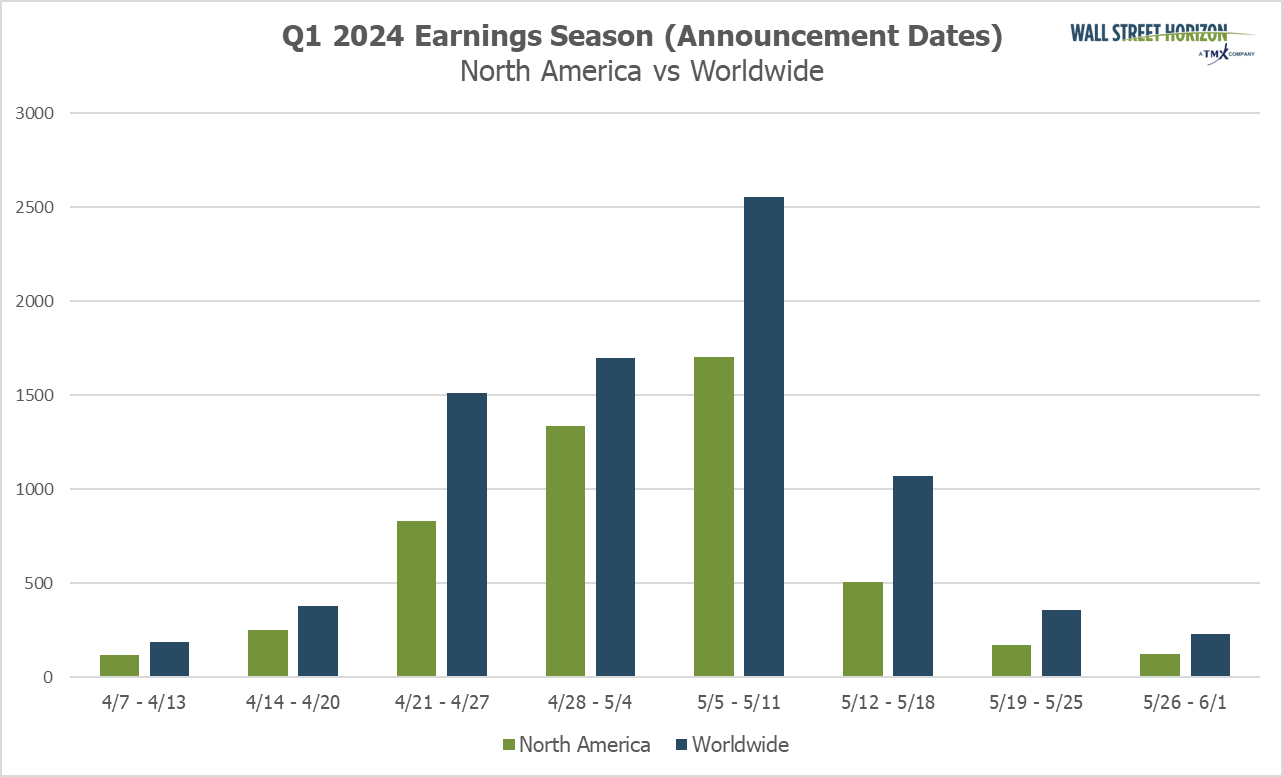

Q1 Earnings Wave

This season peak weeks will fall between April 22 - May 10, with each week expected to see over 1,500 reports. Currently May 9 is predicted to be the most active day with 1,236 companies anticipated to report. Thus far 59% of companies have confirmed their earnings date (out of our universe of 10,000+ global names), so this is subject to change. The remaining dates are estimated based on historical reporting data.

Source: Wall Street Horizon

1 United Airlines Announces First-Quarter 2024 Financial Results; Exceeds Revenue and EPS Expectations, April 16, 2024, https://www.united.com

2 TSMC Reports First Quarter EPS of NT$8.70, April 18, 2024, https://investor.tsmc.com

3 Netflix Q1 2024 Shareholder Letter, April 18, 2024, https://s22.q4cdn.com

4 Earnings Insight, FactSet, John Butters, April 19, 2024,https://advantage.factset.com

Copyright © 2024 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon's prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are the trademarks of TSX Inc. and are used under license. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)