-

Important earnings season ahead as investors look for signs that we are still in soft landing territory despite persistently strong economic data that’s helping to delay rate cuts

-

Q1 S&P 500® EPS growth expected to come in at 3.2%, the third consecutive quarter of growth

-

Banks on deck this week: investors hoping for improved lending, investment banking conditions, but headwinds still persist

-

Peak weeks for Q1 season run from April 22 - May 10

After Breaking Records in Q1, Major Indices Kick Off Q2 on a Tepid Note

The second quarter got off to a bit of a rocky start as major indices headed lower last week. The S&P 500 and DJIA ended the week down 0.1%, while the Nasdaq Composite fell 0.04%. Investor’s were feeling skittish due to a spike in oil prices, and stronger than expected jobs numbers which came when March JOLTs was released Monday, April 1, and nonfarm payrolls, unemployment and wage growth on Friday, April 5. This latest jobs data has investors questioning the pace and timing of rate cuts this year, with the probability of only two rate cuts increasing according to CME Group’s FedWatch tool.1

Markets moved another leg lower this week in response to the higher-than-expected Consumer Price Index (CPI) reading for March which showed an increase of 0.4%.2 This increase puts the 12-month inflation rate at 3.5%, well above the 2% target the Fed would like to move towards before cutting rates.

Will Q1 Earnings Season Turn Markets Around?

Investors have some positives to look forward to this week, however, as Q1 earnings season kicks off with healthy looking estimates.

At present, Q1 2024 S&P 500 EPS growth is expected to come in at 3.2% according to FactSet.3 This would be the third straight quarter of growth after three down quarters. Leading the way is the same smattering of sectors that led in the second half of last year: Utilities (23.7%), Information Technology (20.4%) and Communication Services (19.4%) and Consumer Discretionary (15%). Lagging this quarter are Energy (-25.8%), Materials (-24.1%), Health Care (-7.2%) and Consumer Staples (-0.7%).

Companies Returning Value to Shareholders

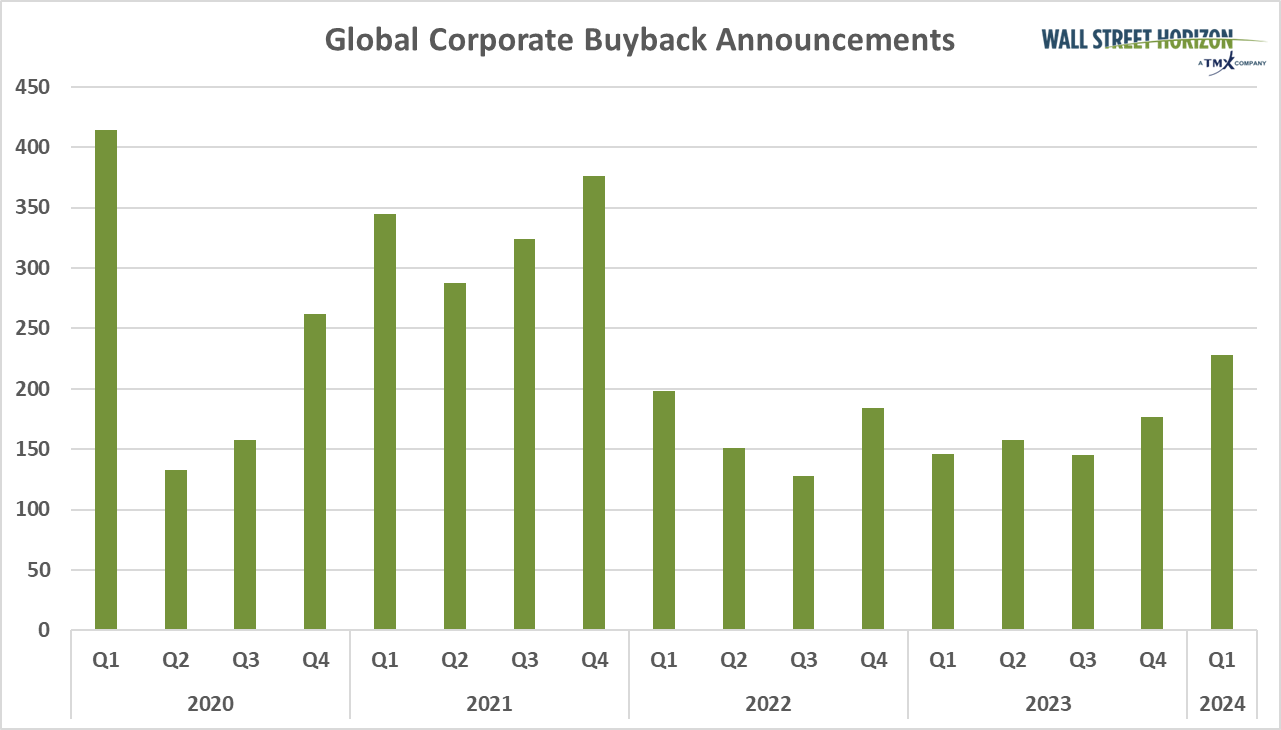

Another positive in the corporate world? Buybacks and dividend increases were on the rise in Q1. As detailed in our report last week, the two main ways companies give profits back to investors were healthily improving last quarter, suggesting companies are confident in their ability to stay profitable.

Buyback announcements for the first quarter of 2024 clocked in at 228, the highest level since Q4 2021 recorded 376 repurchase announcements (out of our universe of 10,000 equities). This is also the first quarter to record more than 200 repurchase announcements, with every quarter of 2022 and 2023 logging below that amount.

Source: Wall Street Horizon

In the same vein, dividend increases in Q1 2024 were at their highest level since before 2018. In Q1 2024, a total of 1,639 companies (in our universe of 10,000) increased dividends vs. 542 which decreased dividends. Not only is that the highest number of increases in over 7 years, but the highest percentage of increases (39%) vs. decreases (13%) since Q1 2022.

Buyback announcements for the first quarter of 2024 clocked in at 228, the highest level since Q4 2021 recorded 376 repurchase announcements (out of our universe of 10,000 equities). This is also the first quarter to record more than 200 repurchase announcements, with every quarter of 2022 and 2023 logging below that amount.

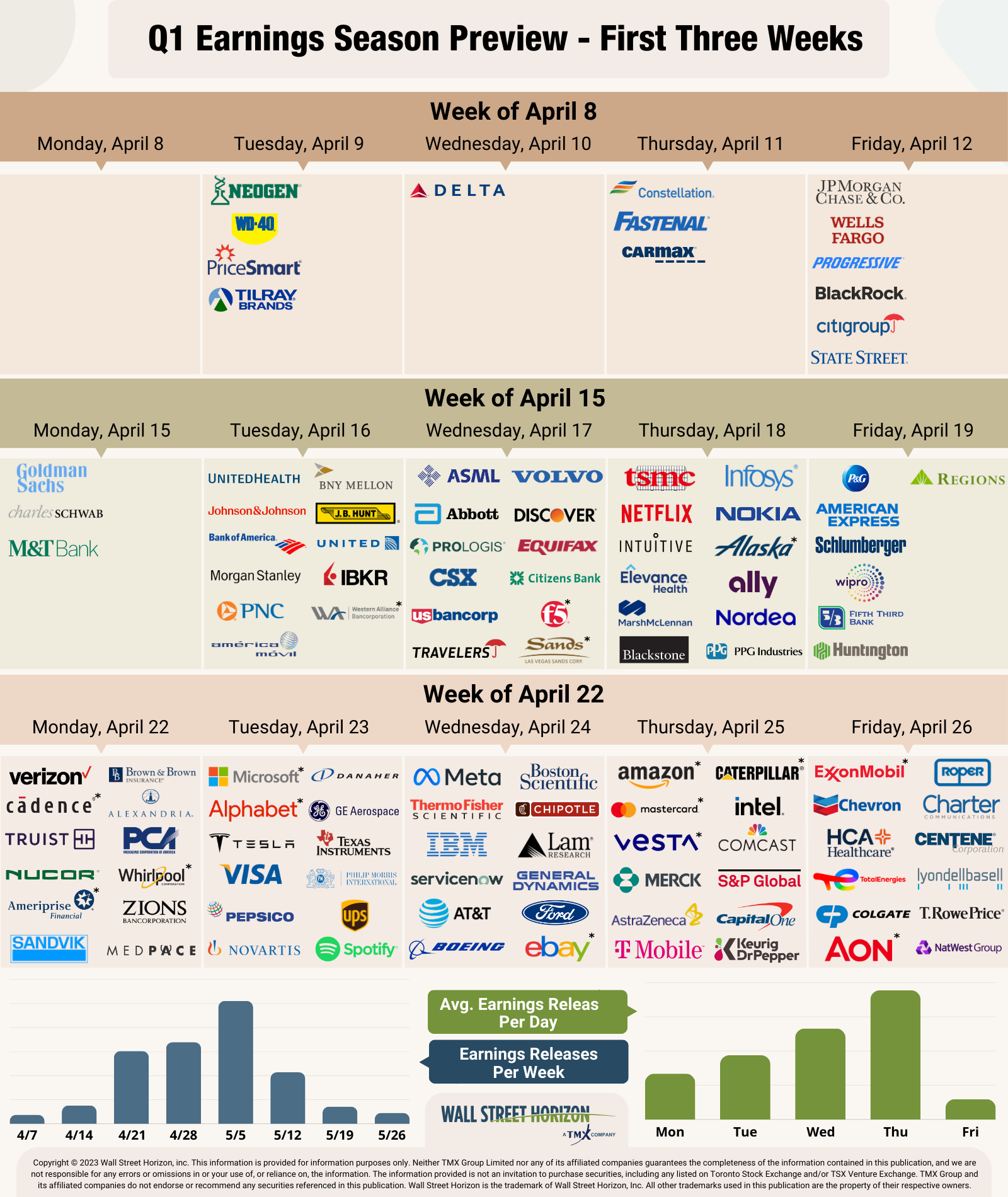

Up This Week: Big Banks

In its usual fashion, Q1 earnings season will begin with the big banks, with JPMorgan Chase (JPM), Citigroup (C), and Wells Fargo (WFC), reporting on Friday. Investors will be looking towards bank CEO comments for continued signs of a resilient economy and confirmation of a soft landing in 2024.

The same headwinds and tailwinds are in play for banks this year as in 2023. High interest rates still help banks maintain healthy levels of net interest income, but on the flipside have negative implications when they lead to loan defaults from borrowers that can no longer contend with higher costs. The promise of lower interest rates had fueled a rally in the banks this year, but with a tight labor market and stubbornly high inflation readings, that expectation has sputtered.

Investment banking is another area that is slowly making a comeback, helped in part by a successful IPO from Reddit last month. However, despite the excitement, both M&A and IPO activity were light to start the year. There were only 88 M&A announcements in Q1, just slightly edging out Q3 2023 which had 87, but otherwise the lowest tally since Q2 2020. IPO activity was even worse, with only 51 announcements, the lowest in over 5 years.

Source: Wall Street Horizon

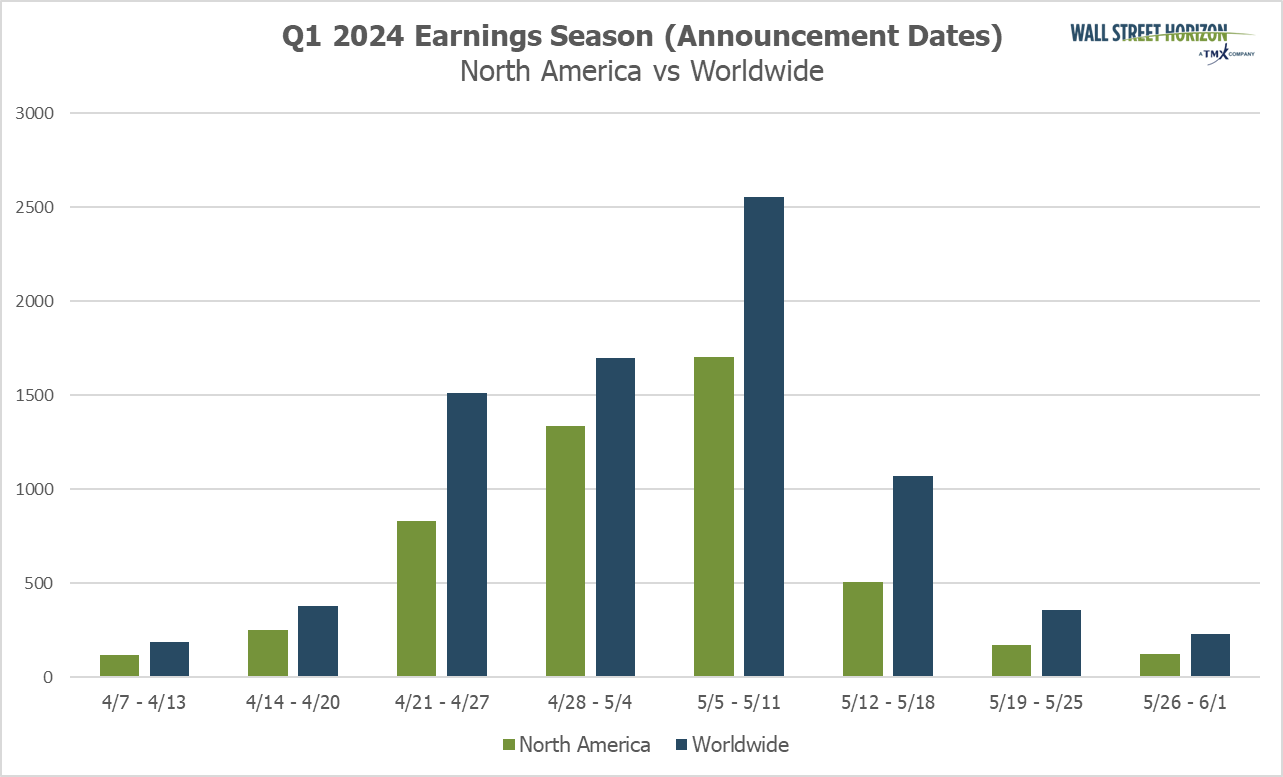

Q1 Earnings Wave

This season peak weeks will fall between April 22 - May 10, with each week expected to see over 1,000 reports. Currently May 9 is predicted to be the most active day with 1,278 companies anticipated to report. Thus far only 42% of companies have confirmed their earnings date (out of our universe of 10,000+ global names), so this is subject to change. The remaining dates are estimated based on historical reporting data.

Source: Wall Street Horizon

1 CME FedWatch Tool, U.S. BUREAU OF LABOR STATISTICS, April 10, 2024, https://www.cmegroup.com

2 Consumer Price Index Summary, April 10, 2024, https://www.bls.gov

3 FactSet Earnings Insight, FactSet, John Butters, April 5, 2024, https://advantage.factset.com

Copyright © 2024 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon's prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are the trademarks of TSX Inc. and are used under license. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)