-

The start of 2024 has been hallmarked by several big themes, among them is a jump in both debt and equity financing

-

We found that global companies have been more active in announcing secondary equity offerings

-

There are several possible reasons for this increased capital demand, some of which may be positive for the macro road ahead

It has been a record-breaking start to the year in capital markets. Following the past two years’ trend of quickly rising interest rates, companies have been aggressively seeking liquidity, at least according to the data. In the fixed-income space, January and February 2024 were both extremely strong in terms of new corporate bond issuance, according to Bloomberg.1 This comes as looming debt maturity walls have cast some fears regarding firms’ ability to repay lenders. So far so good.

Data from the Securities Industry and Financial Markets Association reveals that total US corporate bond supply as of February 2024 was up 31% year-over-year.2 It’s reasonable to conclude that a higher average borrowing cost for multinational corporations is not a major challenge today.

More Shares Hitting the Tape

Are there additional clues to be found in the equity issuance arena? Wall Street Horizon tracks dozens of pieces of revealing corporate data, including IPOs and secondary offerings. While the former market continues to run cold, albeit with some optimism for later in the year, it turns out that firms have also turned more active in seeking tack-on equity financing.

Increasing Secondaries

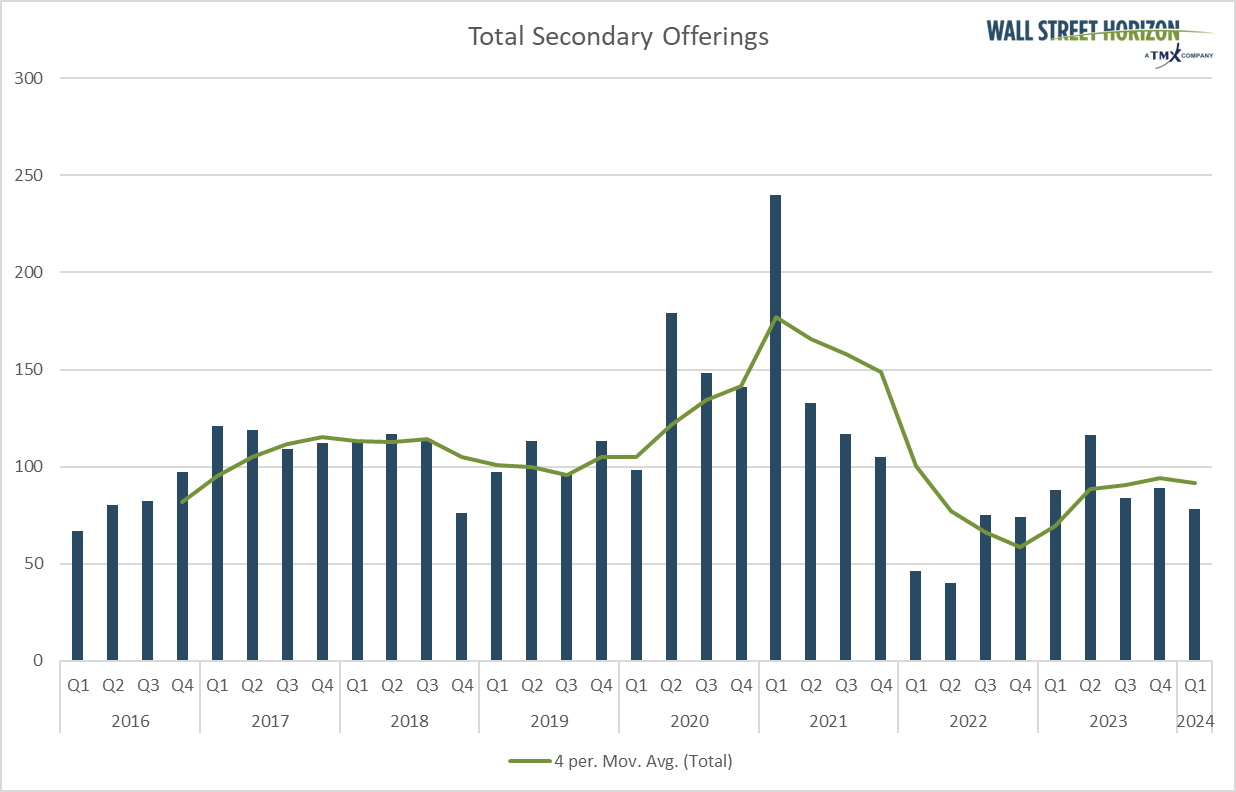

Total secondary offerings are indeed on the rise. The chart below reveals that the first quarter of 2024 paces for yet another annual increase. What’s more, the four-quarter moving average has been trending upward after troughing in the fourth quarter of 2022. This trend, along with intense investment-grade credit hitting the market, could assert that executives are increasingly sanguine about the future of the global economy.

Total Shareholder Offerings Continue to Recover After a 2021-2022 Slump

Source: Wall Street Horizon

Key Economic and Investment Themes Driving the Trend

There is always nuance when interpreting macro and micro data. In this case, follow-on stock offerings could signal increased future capital expenditures amid a growing global economy. While we do not know how the financial proceeds will be deployed, investments into the megatrends of artificial intelligence (AI) and increased “re-shoring” efforts are likely.

What’s encouraging is that corporate balance sheets and profit margins remain healthy, so higher costs of capital today can be more easily absorbed compared to previous economic cycles.3 A sector to watch is Health Care. The GLP-1 weight-loss drugs and breakthroughs in other medtech areas would benefit from increased spending on research and development.

Monitoring M&A, IPOs, and Earnings Reports

What else could increased corporate liquidity be purposed for? How about mergers and acquisitions? M&A activity has been soft over the last handful of quarters, but we have seen a slew of deals in the oil patch.4 Further consolidation across sectors could be sparked by cash infusions that come with secondary stock offerings.

Bears might point to the risks associated with both higher financial leverage that comes with debt issuance as well as potential dilution that happens mathematically with more shares of stock hitting the market. In today’s market, though, companies are not facing extreme stress. Hence, firms are choosing to tap capital markets rather than being forced to. That is a key difference. Just take a look at the S&P 500 price-to-earnings multiple today north of 20 – selling shares at relatively pricey levels could end up being a savvy move by some executives.5

Future Trends

Looking ahead, a slow and steady rise in secondary offering announcements would be a welcome sign to feed a healthy global bull market. If we see a sudden boom in secondaries, it could eventually indicate overheated capital markets, so that would be a risk. Additionally, should the Fed keep its policy rate ‘higher for longer’ then that could eventually weigh on firms that are more debt-heavy and might make equity financing relatively attractive.

The Bottom Line

Companies around the world are looking to both debt and equity markets to raise capital. The trend can be viewed positively, but there are always risks that come alongside higher supply in markets. Piecing together what it all means by analyzing other corporate data trends is key. Furthermore, developments in the IPO market, M&A activity, and broad themes in company earnings can all help investors form a well-rounded mosaic of the global marketplace.

1 US Corporate Bond Sales Hit $153 Billion in February Record, Bloomberg, Allison Nicole Smith, Olivia Raimonde, February 26, 2024, https://www.bloomberg.com

2 US Corporate Bonds Statistics, Sifma, March 7, 2024, https://www.sifma.org

3 Net interest and miscellaneous payments on assets, Economic Research, February 28, 2024, https://fred.stlouisfed.org

4 M&A deals in Permian basin exceeds $100 billion in 2023 - WoodMac, Reuters, December 12, 2023, https://www.reuters.com

5 Earnings Insight, FactSet, John Butters, February 29, 2024, https://advantage.factset.com

Copyright © 2024 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon's prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are the trademarks of TSX Inc. and are used under license. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)