Published: March 25, 2024.

CEO Optimism Abounds

After a volatile 2023, CEO confidence seems to be rebounding in 2024. A number of readings on CEO sentiment, including our own Late Earnings Report Index (LERI), seem to be indicating that executives are feeling more certain about corporate growth prospects. Investor sentiment has also been improving as of late.

LERI Hits Its Lowest Level in a Year

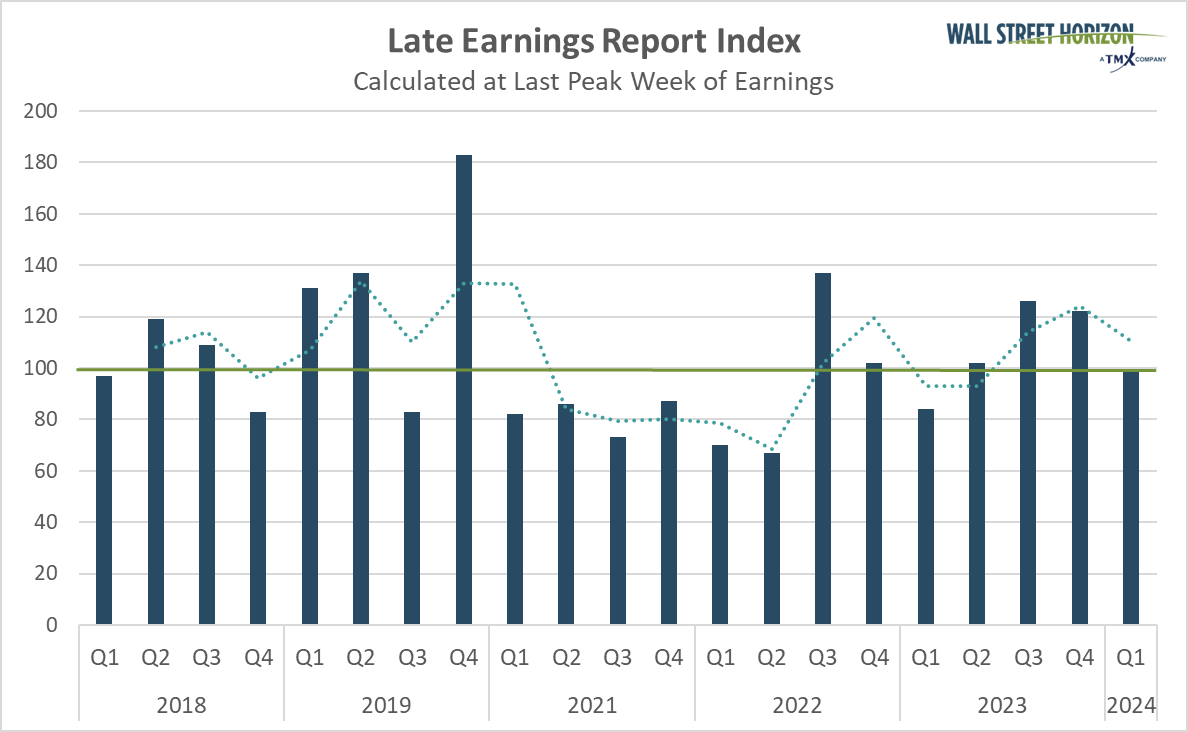

The Late Earnings Report Index (LERI) tracks outlier earnings date changes among publicly traded companies with market capitalizations of $250M and higher. The LERI has a baseline reading of 100, anything above that indicates companies are feeling uncertain about their current and short-term prospects. A LERI reading under 100 suggests companies feel they have a pretty good crystal ball for the near-term.

The LERI ended the Q4 2023 earnings season (data collected in Q1 2024) with a post-peak reading of 99, the lowest in a year, showing that the unwarranted skepticism that built up throughout 2023 was starting to dissipate. The prior low of 84 was reached during the Q4 2022 earnings season (data collected in Q1 2023).

Source: Wall Street Horizon, note: 2020 is excluded due to abnormal delays.

This is in line with other metrics of CEO sentiment such as the CEO Economic Index published by Business Roundtable which also showed business leaders were more confident in the economy with expectations for stronger sales and capital investments.1 Similarly, the Conference Board’s quarterly Measure of CEO Confidence™ also showed an improvement in Q1.2

Survey Says: Investors are Feeling More Bullish Too

It’s not just top management whose sentiment is improving, but investors’ attitudes are positive as well. A recent Bank of America survey showed that Wall Street’s optimism is at its highest level since January 2022. In its survey of 226 fund managers they found the group was also the most bullish they’ve been on stocks since February 2022.3 The main reason for the sunny outlook? Over 90% of participants believe the Fed is done raising interest rates. This could very well be one reason that corporate America is also feeling optimistic.

Looking Ahead

As we head into the Q1 2024 earnings season in a couple of weeks we’ll be monitoring this trend to see if it continues. The next reading of the pre-peak LERI will be published on April 14.

1 Business Roundtable Q1 CEO Economic Index Signals a Resilient, Accelerating U.S. Economy

https://www.businessroundtable.org

2 CEO Confidence Improved in Q1 2024, February 8, 2024, https://www.conference-board.org

3 Optimism Abounds on Wall Street This New Year, Wall Street Journal, January 1, 2024, https://www.wsj.com

Copyright © 2024 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon's prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are the trademarks of TSX Inc. and are used under license. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)