Published: March 18, 2024.

Last week we wrote about how M&A activity has been light so far for 2024, well the same holds for IPO activity. However, this week brings two highly anticipated public debuts that could reignite hopes for an upswing in IPOs.

Astera Labs and Reddit Going Public

Astera Labs, a semiconductor company that builds connectivity solutions to help with AI and Machine Learning workloads, is set to IPO on Wednesday, March 20. The Intel-backed company will make their public debut by offering 17.8M shares in a share price range of $27 - 30, putting their IPO raise at as much as $534M, with a valuation of $5B. This will mark the first big semiconductor debut since ARM Holdings back in September. Speaking of ARM, their IPO lockup period ended on Tuesday, March 13 and was met with increased trading activity, but ultimately share prices have remained flat since then.

Reddit will make its long-awaited public debut on Thursday, March 21. The debut offering will feature 22M shares, in a price range of $31 - 34, making for a total raise amount of $715M on the high end, and a valuation of close to $6.5B.

IPO Activity Light Year-to-Date

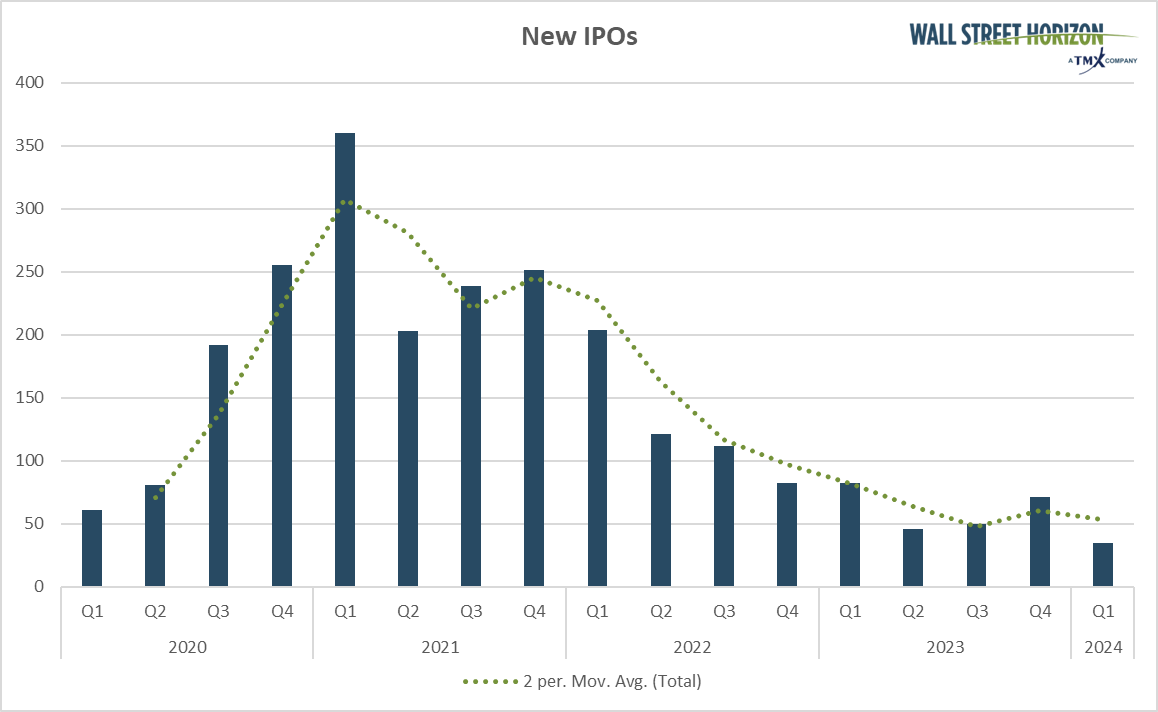

Despite these two high-profile debuts, YTD has otherwise been light for IPOs which are still facing headwinds from higher interest rates making private companies hesitant to come to market. In January and February there were only 34 IPOs, vs. a 5-year average of 93. So far in March only NeOnc Technologies Holdings has filed for an IPO.

Source: Wall Street Horizon

Looking Ahead

How Astera Labs and Reddit perform this week and in the weeks following their public entrance will likely impact how confident other private companies are in IPOing in 2024. Last year’s IPO glut was in-part due to the worse-than-expected performance of many newly public companies.1 Poor business conditions caused companies such as Reddit to delay their plans to go public. With interest rates expected to fall later this year and the continued path to a soft landing,2 this could be just the recipe needed for a resurgence in IPO activity.

1 EY Global IPO Trends 2023, December 13, 2023 https://assets.ey.com

2 Semiannual Monetary Policy Report to the Congress, Chair Jerome Powell, March 6, 2024, https://www.federalreserve.gov

Copyright © 2024 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon's prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are the trademarks of TSX Inc. and are used under license. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)