Event Highlights - Week of September 23rd, 2019

9/20/19

Read More

_thumb.png)

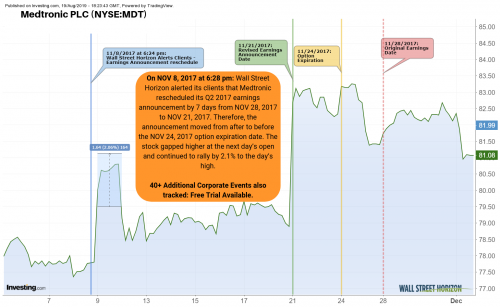

The stock declines 12.8% from the announcement of the postponement to the low on the revised earnings announcement date.

Read More_thumb.png)

The stock continues to fall after the market gets going, and from the close of the first half-hour to the low of the decline, the stock shed another 13% of its value.

Read More

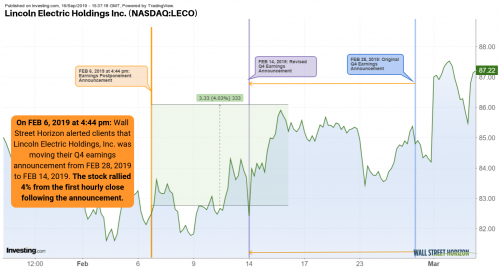

Following the revised earnings postponement, LECO gapped higher at the next day's open and continued to rally by 2.1% to the day's high.

Read More

Wall Street Horizon participating in roundtable at the Trading Show New York...

Read More