Executive Summary

- COVID-19 is rampant – US state-by-state containment measures are being taken which could negatively impact economic growth. Europeans are turning more optimistic, however.

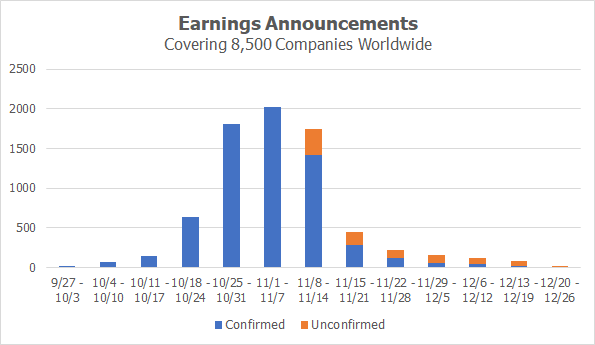

- Earnings season is winding down after a record-breaking EPS beat rate among large and small companies

- Dividend trends reveal optimism despite an uncertain business environment in the months ahead

- Earnings date outliers caught our attention

Restrictions Mounting Across the US

By now you’ve seen the news reports. COVID-19 cases are breaking records and hospitalizations related to the virus are above the summertime peak. Community spread infections are sharply on the rise. The positivity rate is growing dangerously high while deaths are accelerating, too.

Wall Street Horizon’s state-by-state data tracking has picked up on a surge in restrictive measures taken by officials to combat the pandemic. Specifically, Illinois is targeting high-risk regions in the northwestern portion of the Land of Lincoln and Iowa set limits on public gatherings. Wisconsin, one of the epicenters, issued a new order advising residents to stay home. While the focus of the autumnal outbreak is the Upper Midwest, other states are trying to get ahead of the situation. Ohio and Pennsylvania are in the news (not for the election) as state officials are expected to announce possible mini-lockdown measures in the next few weeks.

Europe Flattening the Curve?

Turning overseas, the picture is bleak as well, but there could be some light at the end of the tunnel. The focus remains on the big 5 nations (UK, Germany, France, Spain & Italy). Those countries are working to flatten the curve (it will be nice to stop using that phrase soon!). For some optimism, when polled more than 60% of Europeans expect life to return to normal in 2021 – the highest percentage since April, according to Bank of America.

A Look Back at Earnings Results

What a contrast earnings season is to the COVID-19 situation. Q3 managed to outshine Q2’s stellar performance. According to FactSet, the earnings per share beat rate was a massive 86% while 79% of S&P 500 firms exceeded sales expectations. And it wasn’t just US large companies – small caps exceeded its total earnings estimate by 50% according to BofA. Wall Street Horizon data shows that the recent quarter featured EPS increases among 76% of global firms while just 24% had EPS declines – the greatest increase-to-decrease spread of the past three years. The strong reporting season comes at a time when COVID was still prevalent, and was all the more impressive considering the lack of additional stimulus. The market now looks ahead to the all-important Q4 shopping season.

The Dividend Trend

Wall Street Horizon closely tracks changes in dividend policy among global firms. We noticed an interesting theme in this week’s data. There are 11 dividend status changes – all but 1 are resumptions. This is an encouraging sign for market participants. Companies are becoming more optimistic – and they aren’t just saying it, they are putting their money on the line by dolling out cash to shareholders. What’s promising about the data is that the sectors resuming dividends are those that were hit the hardest by the pandemic and social restrictions including Real Estate, Energy, and Consumer Discretionary. Some of the major companies resuming dividends are Tenneco Inc (TEN) and Weyerhaeuser (WY).

Earnings Date Outlier

For Gap Inc (GPS), we set an inferred Q3 2020 earnings date of November 19 based on its historical reporting trend. The major clothing retailer usually reports on a Tuesday or Thursday. On November 9, the company announced Q3 2020 results would be released on November 24 aftermarket. The result was more than a 3 standard deviation event in terms of earnings date deviation from expectations (Z-score of 3.22). Not only was it a big move on the calendar, but it also crossed the November 20 options expiration date – crucial for options traders. Gap has been in the news recently for announcing a shift in its retail strategy. The details of the change were issued at a corporate event we highlighted in advance during October. Shares of GPS rallied sharply.

Wall Street Horizon Z-score: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company's 5-year trend for the same quarter. This metric is included in our DateBreaks product, learn more.

Earnings Date Revision

Cabot Corporation (CBT) was an even bigger outlier. The Materials company issued a press release on October 8 stating it would release Q3 2020 results on November 9. A subsequent news release on November 4 pushed back the reporting date to November 23 aftermarket. The Z-score of change is a whopping 9.12. We don’t see a number that high very often. What does it mean? There could be unexpected news or corporate actions taking place that make management hesitant to report earnings too soon. Investors should investigate company financial statements to find further clues, but the change is certainly a red flag. Wall Street Horizon closely tracks earnings date changes and reconfirmations so our customers are in the know before the crowd.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)