Executive Summary

- Rising hopes, rising inflation? Interest rates moved higher as important macro trends shift in 2021

- Companies are upbeat on Q4 earnings amid more stimulus in the US

- Off-trend earnings dates that traders should monitor

Inflation in the Offing?

More fiscal stimulus may be on the way in the US under President Biden. Inflation is a risk given near-term stimulus plans and intermediate-term pent-up demand. Assuming the US and Europe reach herd immunity for COVID-19 toward late Q2, it is likely that consumers around the world will start enjoying ‘the old life’ – dining out, traveling, attending events, and other recreational activities. That means more consumer spending and perhaps strong hiring trends in the developed world.

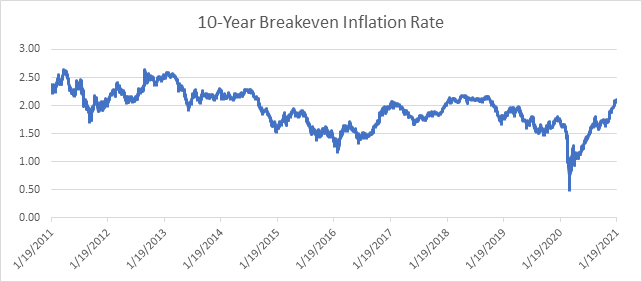

The market expects inflation to tick up. Just look at the US 10-year breakeven spread inflation rate – it rose to 2.10% recently, the highest since October 2018.

Traders and economists expect a spending boom once social and economic restrictions are lifted. New cars and new bikes (more on that later) will be in demand.

There are other impacts, too. It could be the dawning of a new era for assets that have underperformed in the last decade. International stocks, small caps, value plays, commodities, and banks could finally reap rewards from a new secular trend.

The upcoming earnings seasons (including the current one) will be fascinating to digest. How will executives place their bets? What will be the tone of companies within the sectors that could benefit from higher inflation and better growth prospects? Traders and portfolio managers must be in the loop regarding the latest corporate events to stay ahead this changing landscape.

Earnings Season Update

Q4 reporting season is off to a hot start. It is still early, but 88% of the first 26 S&P 500 companies to provide results have beaten Wall Street analyst EPS expectations, according to Bank of America research & FactSet data. The healthy beat-rate thus far buttresses the strong earnings quarters (relative to expectations) of Q2 and Q3 2020.

Earnings Outlier - HOG

One company is spinning its wheels. Harley Davidson Inc. (HOG) is scheduled to report earnings and host a conference call on February 2, an unusual date for the well-known Consumer Discretionary stock. Wall Street Horizon tracks expected earnings dates closely, and HOG’s late reporting date flashed a warning signal.

On October 28, 2020, we set an inferred Q4 earnings date of January 26, 2021 (before market) based on the firm’s historical reporting trends. HOG usually reports Q4 results on January 28-30 (often on a Tuesday). Harley-Davison announced on January 12 that Q4 results would be released on Groundhog Day, February 2 (before market). Our data analysis yielded a high Z-score of 3.28 – this means the earnings date is far later than usual. Investors should monitor the report and conference call next Tuesday for potential extraordinary news.

HOG stock rose from $14 to $42 from the March 2020 low through January 2021. It was in a downtrend since early 2014. The stock broke out to 2-year highs as investors thought it to be a beneficiary of the COVID environment – much like RVs’ popularity. HOG’s recent bounce could be indicative of further optimism heading into the post-COVID world, too.

Earnings Reconfirmation - ASRV

Banks stand to benefit from the recently steepening yield curve. The sector has been among the best performers since early November. AmeriServ Financial (ASRV), a small cap headquartered in Pennsylvania, stood out with an unusual earnings date reconfirmation earlier this month. ASRV has been a high-flyer since late September, rising from $2.65 to $3.80. It’s just a $60 million market cap, so this stock will be volatile on news.

ASRV scored a 4.01 Z-score for its unusual earnings date reconfirmation. A direct contact at the bank updated the earnings announcement date to be January 19 (before market). The company’s investor relations calendar was later changed to show the earnings date of January 29 (before market). Traders in small and micro cap stocks should keep this stock on their radar. ASRV will host an analyst & investor day on April 28 along with its shareholder meeting.

Conclusion

Earnings season is in full swing around the world. Investors need the most accurate and up-to-date corporate event data to stay on top of this shifting market environment. Traders and portfolio managers must be tuned-in to the latest happenings and announcements made within quarterly reports and shareholder meetings. Wall Street Horizon tracks all the key events promptly for our clients.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)