Over the past year, I have written extensively on the

benefits of a multi-strategy investment approach.

A diversified, long/short portfolio that consists of uncorrelated strategies is

designed to profit in both risk-on and risk-off regimes.

It may not be a total surprise

how at times even the most obvious event-based signals can be essential when

combining them with other unrelated signals for a combined novel outcome.

Wall Street Horizon’s earnings

date revision data is one empirical example of the above. Lucena, in

consultation with Wall Street Horizon’s event data, was able to anticipate with

high conviction a company’s earnings outlook based on whether they postponed

their previously stated earnings date (bearish), of whether they changed the

date to be prior than previously stated (bullish).

Fabulous-5 our multi-strategy portfolio has proven empirically how combining Wall Street Horizon’s earnings date revision signals and interleaving them with fundamental, and technical datasets could bring forth a robust long/short market neutral strategy.

Below are two independent

strategies, one long and the other short among five in total in Lucena’s Fab-5

long/short portfolio.

Pre-Earnings Long - predicated on Wall Street Horizon’s earnings date revision event. Lucena further hones in on additional fundamental factors (such as free cash flow, asset turnover, etc.) set to identify companies with positive outlook into their earnings release dates.

Pre-Earnings Short - predicated on Wall Street Horizon’s earnings date postponement event. Lucena further hones in on additional technical and fundamental factors set to identify companies with bearish outlook into their earnings release dates.

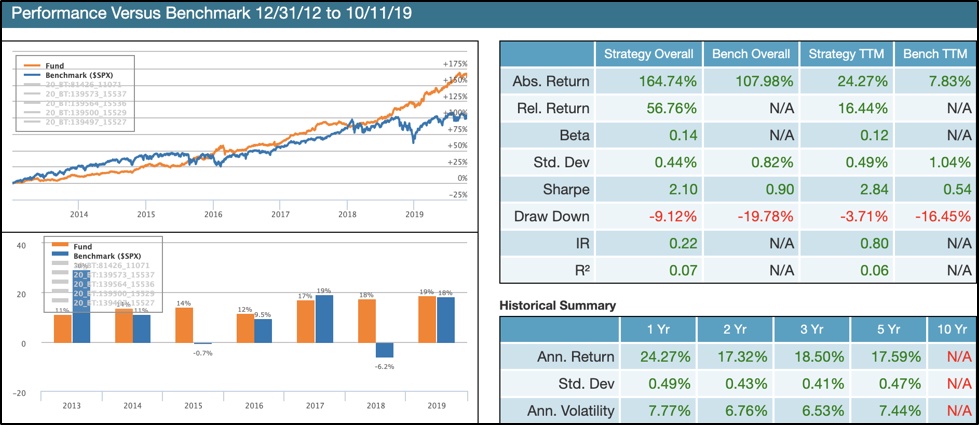

Fab-5 Perpetual Performance

Fabulous 5 is a combination of 5 uncorrelated long

and short strategies working together to create a highly dynamic, market

neutral, long/short portfolio. Below you can see a backtest of the fund from

12/31/12 to 10/11/19.

As can be seen, the Fab-5 fund outperformed the benchmark

($SPX) during the out-of-sample analysis period (12/31/12 to 10/11/19) by

56.76% while maintaining a lower drawdown of -9.12% vs. -19.8% and more than

double in Sharpe ratio of 2.10 vs. 0.90

of the S&P 500.

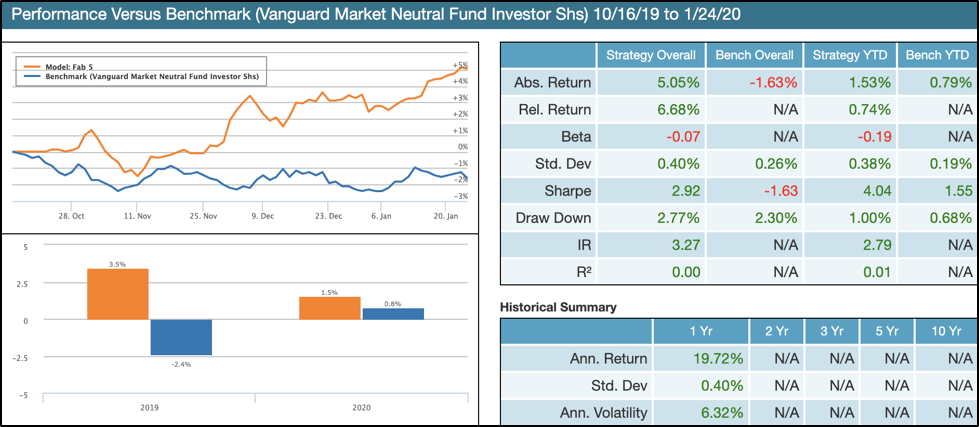

In order to further validate our results, I wanted to

also showcase Fab-5’s perpetual performance. Lucena’s platform, QuantDesk, is

able to carry forward in a perpetual paper trading simulation the execution

rules of any backtest. It is a powerful mechanism set to validate if a

backtest’s performance is a result of overfitting or user bias.

The model portfolio would normally roll perpetually

into the future past the end of the backtest. Under the perpetual trading

simulation premise it can’t “cheat” since all trades are published at 7:30AM ET,

well before the market opens.

As can be seen, in the short 3 months period of 10/16/2019 to present, Fab-5 was able to outperform its benchmark by 6.68% with a Sharpe ratio of 2.92 vs. (-1.63) of the benchmark. You can view the full live report here.

Wall Street Horizon’s data is an important piece of Fab-5’s puzzle and has proven valuable for high-conviction stock selection on both long and short legs.

If you have any questions please don’t hesitate to reach out to Wall Street Horizon or to Lucena Research.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)