Not only are we looking ahead to another peak week for earnings, but this week also marks the busiest week for Shareholder Meetings, with 657 companies within our universe holding their annual meetings. Of those, 62 hail from the S&P 500, and 57 of those will be held virtually. Who is hosting in-person meetings this week? Prudential financial (Newark, NJ, corporate headquarters), Willis Towers Watson PLC (Miami, FL corporate office), Everest Re Group, Ltd. (Hamilton, Bermuda, corporate headquarters) SBA communications Corp(Boca Raton, FL corporate office), Martin Marietta Materials Inc. (Raleigh, NC corporate office).

Reporting this week

Companies from a variety of sectors will report this week, with tech and retail in focus, including a couple of new IPOs with their first earnings release since going public. Details on other events on the horizon for these companies below.

Palantir (PLTR)

May 11 - Earnings Report BMO

May 11 - Earnings conference call, 8:30AM ET

June 8 - Shareholder Meeting

Electronic Arts (EA)

May 11 – Earnings Report AMC

May 11 – Earnings conference call, 5PM ET

Sonos (SONO)

May 12 – Earnings Report AMC

May 12 – Earnings conference call, 5PM ET

Bumble (BMBL)

May 12 – Earnings Report AMC

May 12 – Earnings conference call, 4:30PM ET

Poshmark, Inc (POSH)

May 12 – Earnings Report AMC

May 12 - Earnings conference call, 4:45PM ET

July 11 – IPO Lock-up expiration date

ThredUp Inc. (TDUP)

May 12 – Earnings Report AMC

May 12 – Earnings conference call, 4:30PM ET

Alibaba Group (BABA)

May 13 – Earnings Report BMO

May 13 – Earnings conference call, 7:30AM ET

Walt Disney Co. (DIS)

May 13 – Earnings Report AMC

May 13 - Earnings conference call, 4:30PM ET

May 25 – Hitachi Social Innovation Forum (HSIF) Americas 2021

May 28 - Release date for Cruella

June 1 - Release date for Changing the Game (Hulu)

Airbnb (ABNB)

May 13 – Earnings Report AMC

May 13 - Earnings conference call, 5PM ET

June 4 – IPO Lock-up expiration date

June 22 - Shareholder Meeting

Coinbase Global (COIN)

May 13 – Earnings Report AMC

May 13 - Earnings conference call, 5PM ET

Earnings Date Outliers

Occidental Petroleum Corporation (OXY)

Company Confirmed Report Date: Monday, May 10, AMC

Projected Report Date (based on historical data): May 5, AMC

Z-Score: 3.13

DateBreaks Factor: -3

After reporting in late April from 2006 - 2013, OXY began reporting during the first week of May, usually somewhere between May 4 - 8 and typically on a Monday or Tuesday. As such, we set a report date of May 5. On April 8 they issued a press release stating that Q1 2021 results would be released on May 10 AMC, with the conference call the following day at 1pm EDT. This change resulted in a high Z-score of 3.13. A high positive Z-score (we consider anything higher than 3 or lower than -3 to be significant) reflects a later than usual confirmed earnings date, which in this case could signal that OXY is getting ready to surprise to the downside. Z-score is also incorporated into our DateBreaks Factor*, for which OXY has a factor of -3, meaning there is a high negative deviation from the historical trend for the same quarter.

RealNetworks (RNWK)

Company Confirmed Report Date: Wednesday, May 12, AMC

Projected Report Date (based on historical data): May 5, AMC

Z-Score: 3.62

DateBreaks Factor: -3

Real Networks has a history of reporting Q1 results between May 2 - 6, usually on Wednesdays and Thursdays. As such, we set a report date of May 5. On April 28 they issued a press release stating that fiscal Q2 2021 results would be released on May 12 AMC. This change resulted in a high Z-score of 3.62. A high positive Z-score (we consider anything higher than 3 or lower than -3 to be significant) reflects a later than usual confirmed earnings date, which in this case could signal that RNWK is getting ready to surprise to the downside. Z-score is also incorporated into our DateBreaks Factor*, for which RNWK has a factor of -3, meaning there is a high negative deviation from the historical trend for the same quarter.

RNWK is maybe best known for its RealPlayer media player, a software that enables consumers to discover, play, download, and save videos from the web, transfer and share content across social networks, and edit photos and video content. The company looks to grow its presence in artificial intelligence and machine learning, but investors are not so optimistic about that lofty mission at the moment. After announcing a secondary equity offering on April 27, shares of RNWK collapsed, investors disapproving of the $2.70 offering price for a stock that was trading at nearly $3.50 before the announcement. Those still invested will be looking for additional details on the call regarding what the additional liquidity will be used for.

Earnings Date Revision

Accel Entertainment (ACEL)

Company Confirmed Report Date: Wednesday, May 10, AMC

Previously Confirmed Report Date : May 6, BMO

On April 14, WSH received an email stating Q1 2021 results would be released on May 6 Before Market. On the morning of May 4, however, the company issued a press release stating Q1 results would be reported on May 10 AMC with a conference call on May 11 at 12:00 ET. Academic research has shown that when a company confirms an earnings date, and then subsequently changes it to a later date, it is more than likely the company is getting ready to share bad news.

ACEL is a small cap Consumer Discretionary company, focused on providing slot machines and gaming equipment to restaurants, bars and other establishments. Traders have had to balance the positive news of business growth and expansion into new states, with the negative headline of a possible securities fraud investigation. On March 21, 2021, it was reported that Pomerantz LLP is investigating claims on behalf of investors of Accel Entertainment regarding whether the company and certain officers or directors have engaged in securities fraud or other unlawful business practices. The stock price dropped about 4% when the news hit, so ACEL’s upcoming earnings release and conference call could be particularly interesting given this recent investigation and significant stock price reaction.

Next week the earnings season tapers off a bit with 609 companies reporting worldwide, and 387 in North America, mostly within the consumer discretionary sector. We’ll also see 647 shareholder meetings being held.

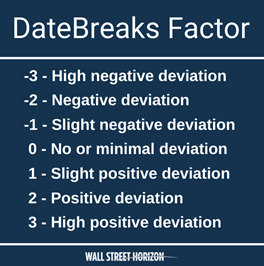

The DateBreaks Factor is a Wall Street Horizon proprietary measure, using a modified Z-score protocol which looks at standard deviations from the norm and that captures the extent to which a confirmed earnings date deviates or breaks from historical trend (last 5 years) for the same quarter.

Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)