As we head into prime season for shareholder meetings, investors are taking notice that the number of meetings conducted by publicly traded companies is on the rise. Corporate events like shareholder meetings and changes to those events can cause volatility, which makes accurate and timely knowledge of events extremely important for investors. By keeping track of movement around shareholder meetings alongside other events such as earnings releases, traders can adjust their trading strategies as needed.

Details such as when and where shareholder meetings are held can provide insight into a company’s financial health. For example, research has shown companies with meeting locations far from their corporate headquarters tend to announce disappointing earnings results within the next 90 days.

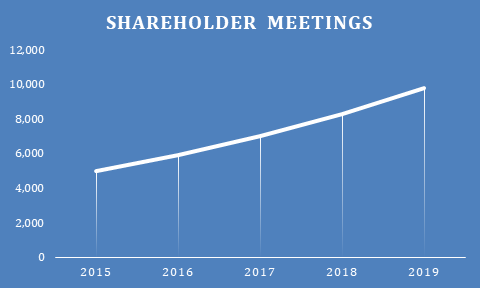

As shown in Figure 1 below, Wall Street Horizon reported the growing frequency of shareholder meetings, approximately 20 percent each year over the past four years. In 2019, the number of shareholder meetings is expected to reach nearly 10,000. This will allow ample opportunity for traders to monitor information that can be crucial to their decision making.

Figure 1

Based on Wall Street Horizon coverage of over 7,000 public companies worldwide.

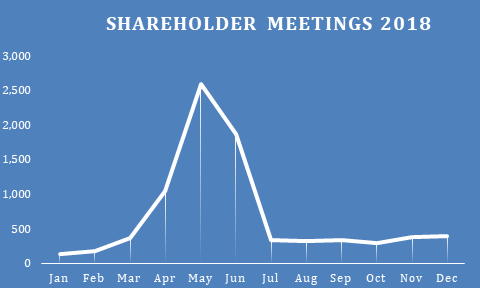

In Figure 2 below, Wall Street Horizon data shows May and June as the peak times for shareholder meetings. In 2018, more than 2,500 shareholder meetings were conducted in May alone.

Figure 2

Based on Wall Street Horizon coverage of over 7,000 public companies worldwide.

However, not all shareholder meetings are on-site. Virtual shareholder meetings (VSMs) are also increasing in popularity. Broadridge Financial Solutions reported a 27 percent increase in VSMs on its platform compared to 2017. VSMs are often cited as an efficient way to expand the reach of a shareholder meeting, reduce costs, and allow those who can’t attend to participate and ask questions of company management.

In a highly competitive landscape, it takes every bit of information to stay ahead of the competition. By keeping track of movement around shareholder meetings, traders can gain access to a source of untapped alpha that others often miss.

At Wall Street Horizon, we track over 40 different corporate event types to keep investors up to date with companies on their watchlist and enhance their investing strategies. Monitoring this corporate event data is crucial to making smart investment decisions and gaining an edge over your peers.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)