Wall Street Horizon conducted an online survey of institutional traders and investors May 5-13, 2021 focusing on corporate event data. The majority of respondents were quantitative and discretionary fund managers in the US.

Key findings include:

- Increase in the number of corporate events affecting stock price

- Spinoffs and earnings data reported as the top events impacting equity price

- Finding new sources of alpha and working with inaccurate event data are the leading pain points

- Downward trend of losses due to event changes reported by traders and investors

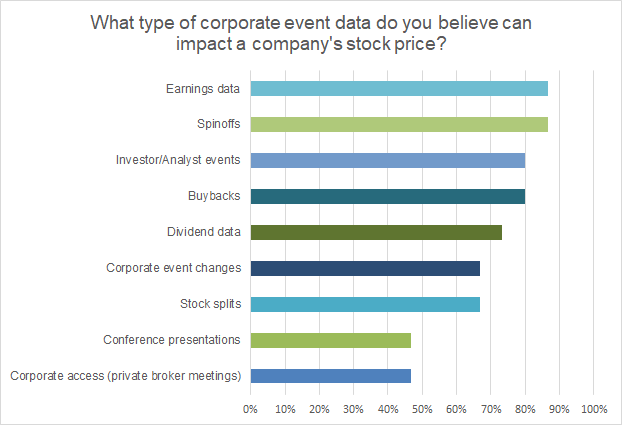

Spinoffs and Earnings Data: Top of Mind for Most Impactful Events

Although earnings-related data leads the charge historically within event data, the survey results recognize that investors pay attention to a wider variety of event data than in the past few years. As Figure 1 shows, the top 5 events impacting stock price include: earnings and spinoffs at 87%, investor/analyst events and buybacks follow with 80%, and dividend data came in at 73%.

Our take:

The findings coincide with our recent research on event clusters. While a standalone event such as a earnings release date may affect volatility, investigating multiple events closely in relationship to one another may give a more complete picture of a company’s financial health. Observing the information pre-event, during the event and post-event and how they interact is critical to understand how events relate to trading and risk strategies. Here’s a specific example Walt Disney Event Cluster Forming Ahead of Q1 Results published on May 13.

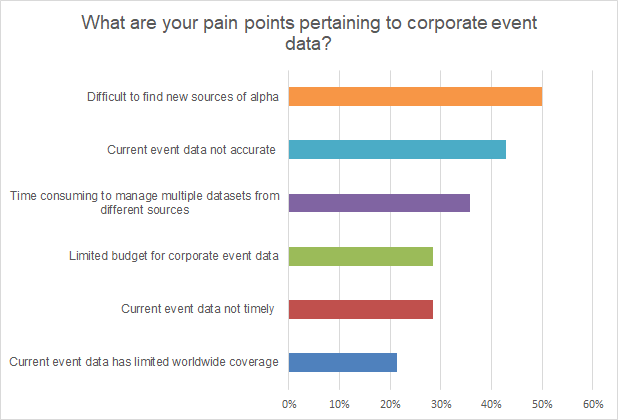

The Leading Pain Points: Finding New Sources of Alpha and Data Inaccuracy

Let’s address the elephant in the room – what pain points around event data are at the forefront for firms today? As Figure 2 shows, difficulty finding new sources of alpha was chosen by half of respondents, with inaccurate event data from their current provider a concern for 42%. In addition, 36% of participants said that it is time consuming to manage multiple datasets from different sources.

Our take:

Finding untapped sources of alpha has been a continued challenge for institutional traders and investors. A recent data science study from RavenPack Trading Around the Earnings Calendar details that calendar earnings changes and news sentiment shows evidence of alpha generation. The paper reaffirms previous academic studies showing that earnings delays can signal weak performance, while advancing the date may be a sign of good news.

It is no surprise that lack of accuracy is the second key concern. Whether building models with historical data, analyzing upcoming calendar items, or forming strategies for future events, the primary element traders need for success is data accuracy. High-quality data can produce valuable insights about risk, trading activity and market responses to corporate event occurrences.

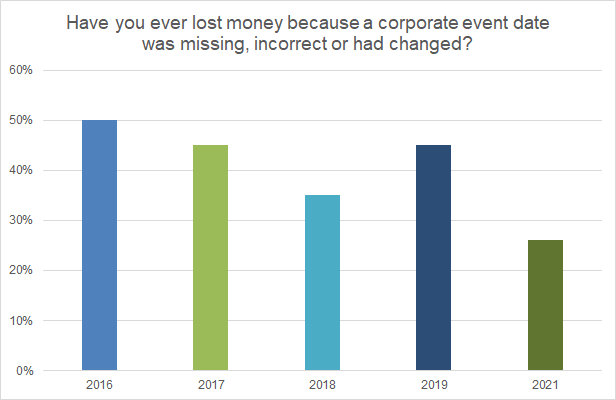

Less About Losing Money

In 2021, 26% of firms reported losing money because a corporate event date was missing, incorrect or had changed. As shown in Figure 3, this compares to 45% in 2019, 35% in 2018, 45% in 2017, and 50% in 2016.

Our take:

Academic research has shown that ‘corporate body language’ ─ changes to a corporate event calendar ─ can provide predictive signals as to the future state of the company's health. Corporate body language is the valuable market intelligence gathered from how a company “acts” versus what it says and can inform strategies and create openings to capitalize on opportunities or avoid risk.

This year shows that it is less about losing money due to inaccurate or changed event date. As Figure 2 indicates, it more about finding new sources of alpha and having accurate and timely event data.

Resources

Walt Disney Event Cluster Forming Ahead of Q1 Results Research blog published by Wall Street Horizon, May 13, 2021.

Trading Around the Earnings Calendar, paper by RavenPack using Wall Street Horizon earnings date revision data, published October 2020.

Time Will Tell: Information in the Timing of Scheduled Earnings News, University of Texas/MIT study by Johnson/So, published 2017. Features Wall Street Horizon earnings data.

Exploring Corporate Event Data & Volatility: Considerations for Academic and Financial Industry Research, whitepaper published by Wall Street Horizon, 2020.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)