Earlier

this year we announced our partnership with Wall

Street Horizon to

highlight how quality alternative data

combined with machine learning can make all the difference in the world for

deploying successful investment signals. Lucena validated, enhanced, and

deployed Wall Street Horizon's earnings date restatement data.

Today

I will be sharing a single example from the long portfolio which highlights how

timely entry and exit was achieved for serious alpha.

More specifically, Lucena was able to identify optimal conditions for entry and

exit based on Wall Street Horizon’s earnings restatement data. The long model

portfolio actually looks for companies who shifted their earnings to occur

earlier than originally published. In addition, our portfolio mostly focuses on

large caps from the S&P.

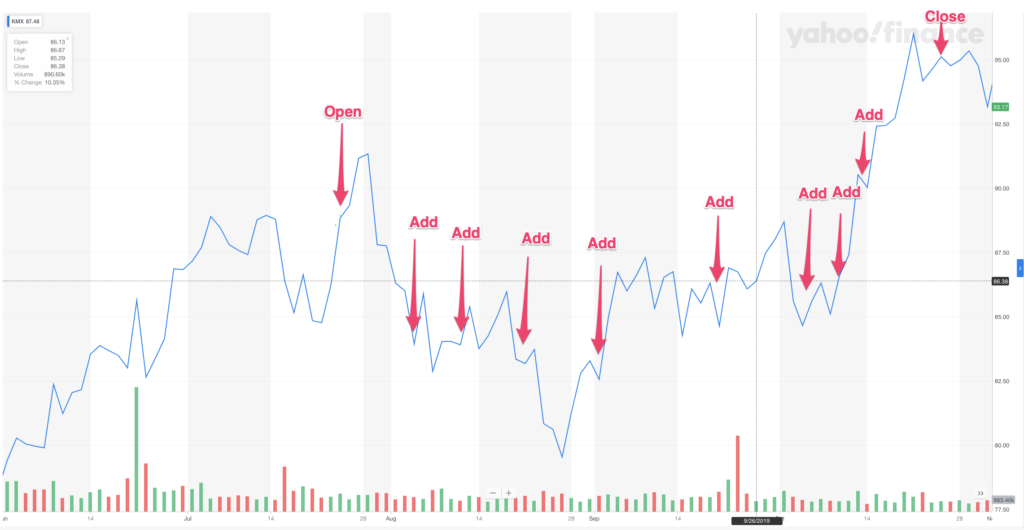

On July 25th we received a high confidence buy signal for KMX (Carmax Inc.) - see below denoted with the label “Open”. Since Wall Street Horizon’s signals are a few months forward-looking (into earnings season), we kept on getting “Buy” signals during the weeks following the initial buy signal.

As can be seen below, throughout July, August, September and October the portfolio accrued additional shares. In mid-October, we finally received a “Close” signal in which all open positions were closed on October 24th yielding a profit of 18.43%!!

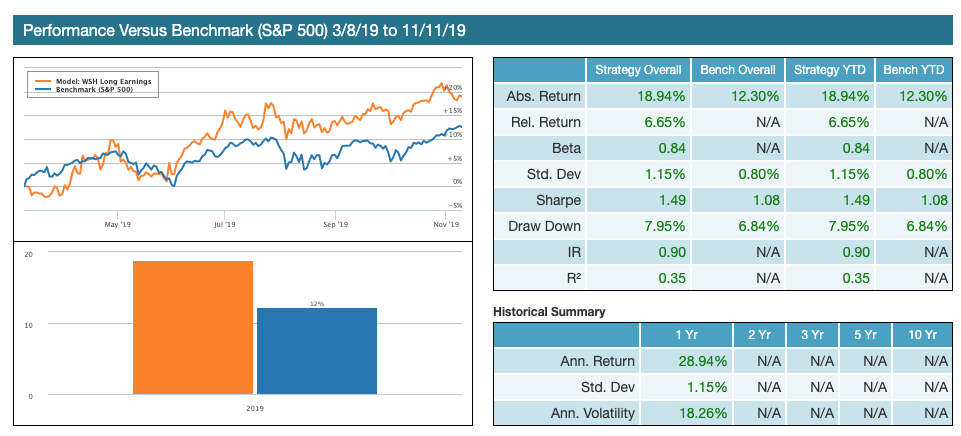

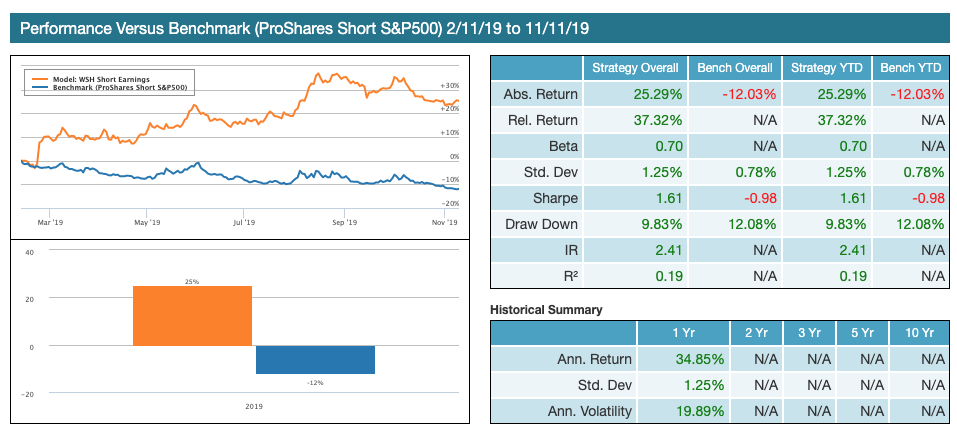

The above example can be attributed to both the Long and the Short Wall Street Horizon portfolios. As they both generated alpha and handsomely beat their respective benchmarks.

Next month we will share highlights from the ongoing success of the Short Portfolio. If you have any questions please don’t hesitate to reach out to Wall Street Horizon or to Lucena Research.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)