Executive Summary

- The U.S. housing market continues to surge as materials prices rally

- It was just a year ago when oil prices experienced a bearish crisis – we feature one small cap energy stock with an earnings date revision

- Asset managers grapple with high retail trading volumes and a challenging fee environment

- The Archegos theatrics may not be done as we review Discovery’s upcoming earnings report as an outlier

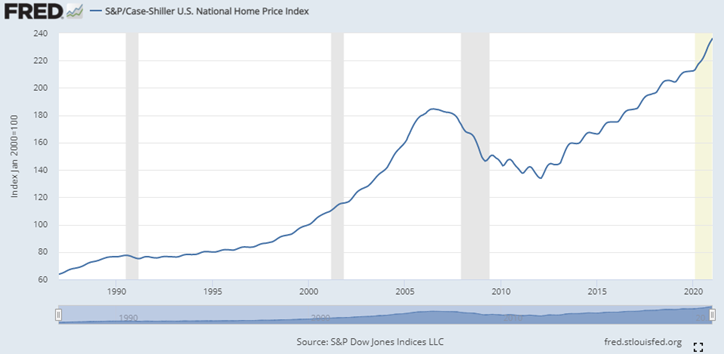

Housing Market Distress

The market is experiencing a different form of distress than during the 2008 financial crisis when US home prices cratered 27% peak to trough. Today the housing market crisis is around strong demand and limited supply. Economics 101 says that prices increase in that scenario.

Driving the bullish fundamentals are a few things:

Material shortages due to the pandemic cutting off supply chain operations

- Historically low interest rates making it cheap to borrow money

- The Millennial generation reaching their peak earning and family-formation years

- The COVID-induced migration from cities to the suburbs

For the commodities market, the prompt-month contract of lumber futures went parabolic recently as traders bear witness to a supply-constrained housing market. This week’s Event Data Outlook features a small cap energy stock that made it through a bearish commodity shock last year. It’s a whole different story in 2021, however.

Figure 1: S&P/Case-Schiller U.S. National Home Price Index*

Earnings Outliers

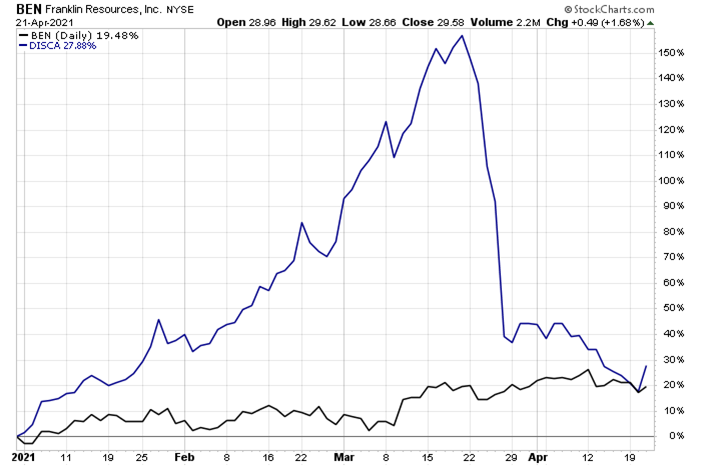

Two S&P 500 companies stood out to us this week with large earnings date change Z-scores. One is a steady asset manager, while the other has seen its share price rocket higher, then crash back down.

Franklin Resources, Inc (BEN) is listed on the S&P 500 and Russell 1000 within the Financials sector. BEN is among the world’s largest asset managers with competitors such as Blackrock, T. Rowe Price, Vanguard, and Fidelity. The Asset Management industry has done well over the last six months as investors flocked to just about any stock in the beaten-down Financials sector in late 2020 and over the first two months of 2021. The steepening yield curve was perhaps the catalyst.

Equity Volatility

Shares of BEN are up 30% since late October, and the same is true for its competitors. Rising equity markets and an influx of fund flows have certainly been tailwinds for the group. The bearish case is, of course, the continued downward trend in fee rates for asset managers. For BEN specifically, last quarter featured a net long-term outflow of $4.5 billion, but analysts expect positive flows following the acquisition of Legg Mason (LM) last year. Traders should be tuned in to the upcoming earnings release for an update on fund flows and the fee rate environment, given unusual retail trading activity this year. Figure 2 displays just how volatile the stock has been this year – more could be on the way around BEN’s quarterly report next week.

Earnings Date Outlier Details

- On February 3, Wall Street Horizon set an Unconfirmed Q2 2021 earnings date of April 29 Before Market for BEN based on its reporting trends. The company has a history of reporting Q2 results between April 26 and April 30, without a bias toward a particular day of the week. On April 20, however, BEN issued an evening press release stating Q2 results would be released on May 4 Before Market. WSH promptly notified clients of the change from April 29 Before Market Unconfirmed to May 4 Before Market Confirmed. This change created a high Z-score of 3.16.

Wall Street Horizon Z-score: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company's 5-year trend for the same quarter. This metric is included in our DateBreaks product, learn more.

Discovery, Inc. (DISCA) is listed on the S&P 500 and Russell 1000 within the Communications Services sector. DISCA comes in class B and K share classes. The company is a leading global cable network provider and operates channels such as Discovery Channel, Food Network, HGTV, and Eurosport.

Equity Volatility

- The once little-known communications firm became mainstream when it got caught up in the Archegos family office saga last month. The story is ongoing, with Credit Suisse continuing to sell shares of DISCA into April**. It has been a wild ride for long-term stockholders, while short-term traders have been salivating at its volatility. Expect more exciting price-action around the company’s earnings report next week. Fundamentally, Discovery and Viacom continue their efforts to shift to the Direct-to-Consumer form of media services, so a lot is happening in the firm’s operations right now that could perhaps drive volatility, too. The earnings date outlier is a red flag that this particular report could feature unusual news or results.

Earnings Date Outlier Details

- On February 23, WSH set an Unconfirmed Q1 earnings date of May 5 Before Market based on its reporting trends. DISCA has a history of reporting Q1 results between May 2 and May 9 with no day of the week trend. On the morning of April 20, however, DISCA issued a press release stating Q1 results would be released on April 28 Before Market. WSH changed the earnings date from May 5 Before Market Unconfirmed to April 28 Before Market Confirmed. This change resulted in a Z-score of -3.15.

Figure 2: BEN and DISCA Year-to-Date Performance Chart***

Earnings Date Revision

Ranger Energy Services Inc. (RNGR) wraps up our Event Data Outlook with an earnings reconfirmation. This company in the Energy sector has just an $82 million market cap, but it weathered the oil storm over the last year. Recall that it was just over 12 months ago when the prompt-month price of crude oil dropped to negative $40 per barrel as ample supply met nearly non-existent demand care of the COVID-19 shutdowns. Who would have imagined the turnaround the global commodity markets would experience over the ensuing year? Today, oil prices are stable in the upper $50 to low $60s on West Texas Intermediate while Brent prices, more globally-traded, are a few dollars higher. Other commodity markets, like lumber, are seeing intense demand from the housing market while experiencing a current supply shortage.

Equity Volatility

RNGR, a Houston-based independent oil well servicing company, was at the heart of the bearish oil crisis last year as its stock price dropped to near $2. The energy sector recovered as oil prices rose in late Q2 2020, and so too did the price of RNGR. Oil stocks were the darling of Wall Street’s eye in late 2020 and early 2021. RNGR rose above $6, but has since pulled back to near $5 with high price volatility. Volatility will likely continue through next week due to an earnings reconfirmation.

Earnings Date Revision Details

- On April 5, RNGR issued a press release stating Q1 2021 results would be released on April 22 After Market with a conference call on the morning of April 23. On the afternoon of April 19, however, the company issued a subsequent press release delaying Q1 2021 results until May 5 After Market with a conference call on May 6 at 11:00 am ET.

Figure 3: RNGR Stock Price Performance (Last 14 Months)****

Conclusion

Each sector seems to have its own theme right now. There is so much information to be gleaned from earnings season as to what the future holds for the balance of the year. How will asset managers fare with high trading volume, but low fees? Will the Archegos saga persist for exposed firms like Credit Suisse? What will price-action be like in the commodities space with tight supply-demand balances right now?

Traders must pay attention to the tone of the corporate world over the next few weeks as we hear from many of the biggest companies. Wall Street Horizon keeps portfolio managers in-the-know when critical events take place.

**https://info.wallstreethorizon.com/e/787713/f-discovery-from-archegos-html/5zhg8/193711625?h=boJHjR4341O6B-BE8gd2HeO6qk8bZR6tfybRuFOhmC0

***https://info.wallstreethorizon.com/e/787713/-compare-DISCA-id-p60583531403/5zhgb/193711625?h=boJHjR4341O6B-BE8gd2HeO6qk8bZR6tfybRuFOhmC0

****https://info.wallstreethorizon.com/e/787713/-st-2020-02-22-id-p53151378948/5zhgd/193711625?h=boJHjR4341O6B-BE8gd2HeO6qk8bZR6tfybRuFOhmC0

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)