Executive Summary

- The $2.2 trillion infrastructure bill will have significant impacts on the economy and stock market

- We profile an Earnings Outlier with exposure to Defense Spending

- Volatility in micro cap and small cap stocks surged last quarter, and traders should brace for more big moves this earnings season

- A micro cap biotech firm caught our eye as an Earnings Outlier

- Earnings season kicked off with a bang with big banks beating the Street estimates by large margins. We analyzed the corporate body language to garner extra clues on what to expect.

What Infrastructure Spending Might Mean For Investors

President Biden announced plans for a broad infrastructure investment package late last month. The $2+ trillion proposal could benefit a variety of sectors; not just the ones that immediately come to mind. The details remain sketchy at this time, but investors should expect a tremendous boost to U.S. GDP due to increased government spending.

A bevy of industries look to get a piece of the infrastructure pie. Municipal roads and bridges will surely get some attention, but so too will areas like electric vehicles and perhaps an upgrade to the nation’s cybersecurity defense arena. We profile CACI International (CACI) in this week’s report. CACI has direct exposure to that niche of the defense industry.

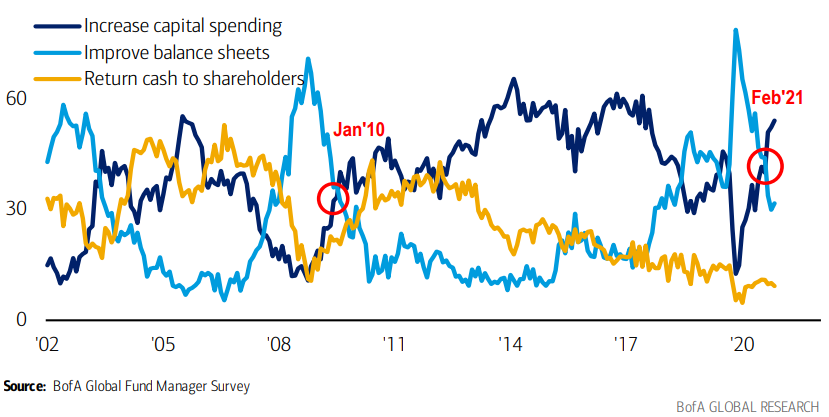

The package should implore companies to invest in capital expenditures. Capex was essentially put on hold during the height of the pandemic. A year ago, investors preferred that companies shore up their balance sheets to weather the COVID storm before taking risks on future projects. The latest Bank of America Global Research Fund Manager Survey in Figure 1 below indicates that money managers feel more confident about the markets and economy today, so they now prefer more capital spending activity.

Putting it all together, significant government spending and increasing corporate cash deployment into long-term projects will undoubtedly spur tremendous U.S. economic activity in 2021. 7%+ U.S. real GDP growth this year will also benefit the global economy, though world GDP will have some catch-up to do in the coming years to match the U.S. recovery.

Figure 1: Bank of America Global Fund Manager Survey

What would you most like to see companies do with cash flow?

First Quarter Earnings Update

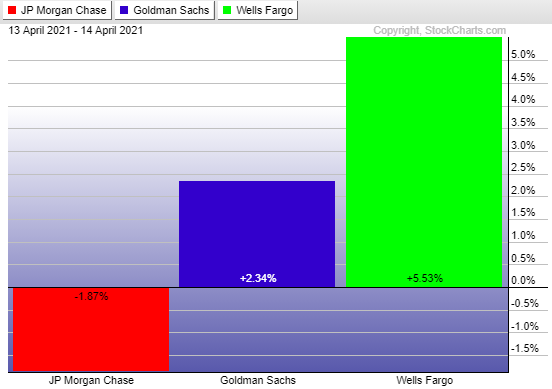

We highlighted corporate body language last week ahead of earnings reports from the big banks. Bullish indicators from corporate actions included earlier year-over-year earnings date confirmations, increased confirmed shareholder meetings, and a jolt of dividend increases. So the fuse has been lit, and now it’s time for companies to deliver. JPMorgan, Goldman Sachs, and Wells Fargo reported last Wednesday.

- JPM posted solid EPS results, but its share price dropped nearly 2% amid a modest decline on the S&P 500 last Wednesday.

- GS also beat analyst expectations with $18.60 of EPS, and its share price ticked up by more than 2%.

- WFC was the financial sector standout, advancing more than 5% after reiterating improved net interest income expectations.

Figure 2: JPM, GS, WFC 1-Day Post-Earnings Performance*

Earnings Outliers

Two companies stood out to us this week with large earnings date change Z-scores.

CACI International (CACI) is listed on the Russell 1000 index. CACI is an information domain expertise, solutions, and service provider in the Information Technology sector. We profiled IQVIA Holdings, Inc. in last week’s Event Data Outlook, and CACI is another cybersecurity player that appeared on our radar as an earnings outlier. CACI, however, has a niche in innovating technologies for the Department of Defense in the U.S., among other national security agencies. At the firm-specific levels, CACI recently announced a $500 million accelerated share repurchase program to be completed by the end of the year. More broadly, heavy government spending associated with the upcoming infrastructure bill could benefit CACI. In the near term, traders should be on guard for unusual earnings.

- On January 28, Wall Street Horizon set an Unconfirmed Q3 2021 earnings date of April 28 (after market) for CACI based on its reporting trends. The company has a history of reporting Q3 results between April 27 and May 3, often on Wednesdays. On April 9, however, CACI issued an 8am press release stating quarterly results would be released on April 21 (after market). WSH promptly notified clients of the change from April 28 Unconfirmed to April 21 Confirmed. The sooner than expected earnings date resulted in a high Z-score of -4.11.

Wall Street Horizon Z-score: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company's 5-year trend for the same quarter. This metric is included in our DateBreaks product, learn more.

Plus Therapeutics (PSTV) is a microcap biotechnology company in the Health Care sector. The $19 million market cap pharmaceutical firm is engaged in developing, manufacturing, and commercializing treatments for cancer patients. Its headline drug candidate is Rhenium NanoLiposomes. On March 23**, the Texas-based biotech announced that it entered a master services agreement (MSA) with Piramal Pharma Solutions for the development, manufacture, and supply of the drug. Share volume surged, and the stock price spiked to near $3.50 on the news. Gains were given back, however, and today PSTV trades near $2. It has been a wild ride for those trading PSTV in 2021. The year's high was above $5 intraday on February 10 before the stock was cut in half by March 4. Expect more volatility around earnings which will arrive much earlier than usual.

- On February 23, WSH set an Inferred Q1 2021 earnings date of May 13 (after market) based on its historical reporting trends. On March 11, we changed the earnings date from May 13 Inferred to May 13 Unconfirmed. PSTV usually reports results between May 10 and 14, often on Mondays or Thursdays. On the morning of April 8, PSTV issued a press release stating Q1 earnings would be released on April 22 (after market) – three weeks earlier than what is typical. WSH changed the earnings date from May 13 Unconfirmed to April 22 Confirmed. The sooner than expected earnings date resulted in a massive Z-score of -10.00.

Figure 3: CACI and PSTV Year-to-Date Performance Chart**

Conclusion

All eyes are on global earnings as the corporate world emerges from the pandemic. Base effects will be substantial this reporting season and next as many firms experienced sharp losses due to the steep decline in economic activity a year ago. Investors must pick up on clues from executives and corporate body language to gain an edge as the year progresses. Many macro factors influence decision-making – the major U.S. infrastructure bill and continued restrictions in Europe make for an uncertain environment. Investors need to keep monitoring trends in corporate event activity to stay ahead of the street.

*https://stockcharts.com/freecharts/perf.php?JPM,GS,WFC&p=0&O=111000

**https://www.bioworld.com/articles/505066-other-news-to-note-for-march-23-2021

***http://stockcharts.com/h-perf/ui?s=CACI&compare=PSTV&id=p49771504266

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)