Executive Summary

- US Technology stocks are once again on the move higher as the S&P 500 surges above 4,000

- Chinese equities have taken a beating over the last two months

- All eyes are on the Q1 reporting season as corporate profits are set to jump relative to a year ago

- We highlight three firms set to report results

Sector Themes – What’s Old is New Again

Technology shares have surged in the last month. The iShares Technology Sector Fund (XLK) is up more than 10% in the five weeks with our old familiar friends – Apple, Amazon, Google, Facebook, and Microsoft – leading the global equity market higher. We will highlight a Health Care/Technology firm later on in our Earnings Outlier analysis.

What has not worked of late are Energy and Financial stocks. Those two sectors are the darlings of value investors. The rotation of sectors in and out of favor over the last year has been swift but healthy as markets rise.

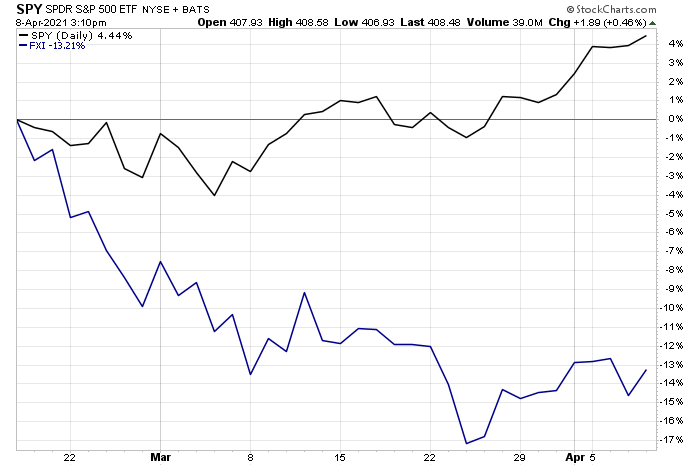

Regional Perspective – China Shares Turn Lower

Let’s continue to slice and dice the markets. Regionally, China was on fire to kick-off 2021. Sellers emerged in mid-February, though. Shares of Alibaba and Tencent, the two biggest holdings in the iShares China Large-Cap ETF (FXI), are off 15-20% from their February peaks. As Technology stocks take charge, so too is the US stock market relative to the China market. We feature a Chinese education company in the consumer arena ahead of its earnings report.

Figure 1: S&P 500 Pushes to Highs as China Stocks Suffer*

First Quarter Earnings Outlook

Optimism reigns supreme. In last week’s S&P 500 earnings update, FactSet noted that S&P 500 bottom-up earnings estimates increased by 6% since December 31**. The upward revision is the largest increase during a quarter since FactSet began tracking the metric in Q2 2002. On average, S&P 500 EPS estimates decrease in advance of reporting season as companies temper expectations.

First quarter earnings have a lot to live up to, however. Traders must monitor how the Financial sector performs as the big banks begin the Q1 reporting season. Last quarter, the stock price reactions were negative among firms that beat quarterly earnings estimates in the days after earnings announcements. It harkened traders back to the tumultuous tech market crash of 2000 when stock price performances post-earnings were also poor.

Earnings Outliers

Two companies stood out to us this week with reporting season on the doorstep.

IQVIA Holdings Inc. (IQV) is a global provider of advanced analytics, technology solutions, and clinical research services to the life science industry within the Health Care sector. The firm prides itself on protecting individual patient privacy, a hot-button issue right now considering the trend of data breaches. IQV’s stock price fell sharply early last year, as many did, but recently jumped to fresh highs as traders embrace tech-related firms once again.

On February 11, Wall Street Horizon set an Unconfirmed Q1 2021 earnings date of April 27 (before market) based on its reporting trends. IQV had a history of reporting Q1 results between April 28 and May 3, often on Wednesday. On April 6, however, IQV issued a press release stating Q1 2021 results would be released on April 22 (before market). WSH promptly notified clients of the change from April 27 Unconfirmed to April 22 Confirmed. The resulting Z-score was high at -4.29. IQV will also host a conference call and webcast at 9:00 a.m. Eastern Time on April 27.

Wall Street Horizon Z-score: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company's 5-year trend for the same quarter. This metric is included in our DateBreaks product, learn more.

TAL Education Group (TAL) is a K-12 after-school tutoring services provider in China. The stock trades in the Consumer Staples sector. “Tomorrow Advancing Life” is the acronym, and the firm specializes in a unique teaching method leveraging technology. The stock was a high-flyer earlier this year during the surge in Chinese markets through mid-February. TAL has since fallen off a cliff with a stock price chart more akin to February-March 2020 than 2021.

On January 22, WSH set an Unconfirmed Q4 2021 earnings date of April 29 (before market) for TAL based on its Q4 reporting trends. TAL has a history of reporting Q4 results between April 25-28, normally on Thursday. On April 6, TAL issued a press release stating Q4 2021 results would be released April 22 (before market). WSH quickly alerted clients to the change. WSH changed the Q4 earnings date from April 29 Unconfirmed to April 22 Confirmed. The change resulted in a high Z-score of -3.27.

Figure 2: IQVIA and TAL Education Since 2020***

Earnings Date Revision

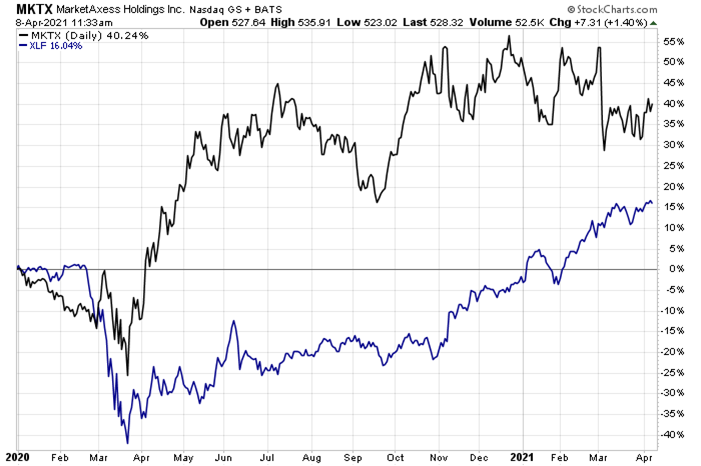

This week’s Event Data Outlook wraps up with MarketAxess Holdings Inc. (MKTX), a Financial sector stock, reconfirming its earnings date. MKTX is a global institutional electronic trading platform in the fixed-income space. MarketAxess provides an all-to-all trading solution to financial institutions and aims to enhance liquidity within the credit asset class. MKTX has been range-bound over the last six months after recovering sharply from its COVID-crash lows.

On March 19, the Q1 2021 earnings date for MKTX was updated to April 28 (before market) based on its Investor Relations website. MKTX was updated on April 6 to report on April 22 (before market) based on a subsequent change on the company’s website. An earnings date reconfirmation occurs when a firm publicly declares an earnings date, then publicly changes it. Reconfirmations and many other data points are available in the WSH DateBreaks product available in FTP and API interfaces.

Figure 3: MKTX and US the Financial Sector ETF (XLF) Since 2020****

Conclusion

Global investors have dealt with a shifting trading environment so far in 2021. China, and other emerging market countries, got off to a great start through the first seven weeks of the year but have experienced a correction as we head into the second quarter. All the while, the US technology sector has given new life to the S&P 500. The US large cap index, which is heavily weighted to the top handful of tech-related firms, is at fresh highs in advance of Wall Street’s Q1 earnings period. Expectations for corporate profits are high. We will closely monitor corporate event data and trends during this critical and busy time.

*https://info.wallstreethorizon.com/e/787713/PY-compare-FXI-id-p13361909239/5m9tg/185779981?h=j28FcBeJ-oyIKeVRKw-h_bFXm6K9xkgXOgVW0gnyqrA

**https://info.wallstreethorizon.com/e/787713/in-sp-500-eps-estimates-for-q1/5m9tj/185779981?h=j28FcBeJ-oyIKeVRKw-h_bFXm6K9xkgXOgVW0gnyqrA

***https://info.wallstreethorizon.com/e/787713/QV-compare-TAL-id-p89433032683/5m9tl/185779981?h=j28FcBeJ-oyIKeVRKw-h_bFXm6K9xkgXOgVW0gnyqrA

****https://info.wallstreethorizon.com/e/787713/TX-compare-XLF-id-p97989816024/5m9tn/185779981?h=j28FcBeJ-oyIKeVRKw-h_bFXm6K9xkgXOgVW0gnyqrA

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)