Key Takeaways:

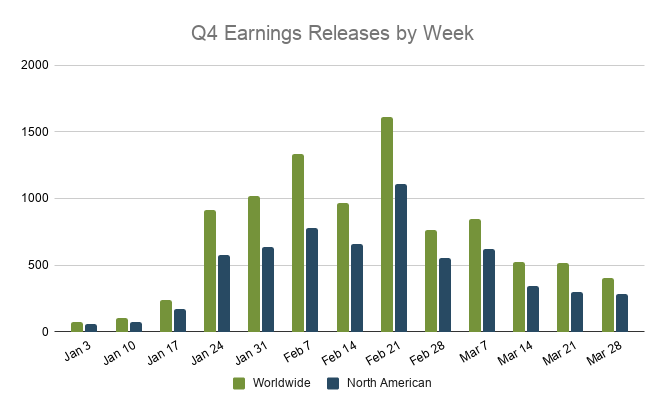

Peak earnings season continues this week with 1,338 worldwide names reporting, and 784 in North America.

- REITs remain under pressure, postponing earnings dates or simply not providing them at all.

- Energy sector signals are bifurcated depending on what sub-industry you look at, clean/green tech showing momentum heading into earnings.

- While the restaurant industry has been hit the hardest by the COVID-19 pandemic, there are still stand out names in the space.

Last week the markets refocused on earnings season, and some of the blow out reports, especially amongst big tech names such as Alphabet and Amazon. This kept the beat rate high at 81%, and pushed the overall YoY growth rate positive at 1.7%.

This week we’re gearing up for another heavy week of earnings, with 1,338 worldwide names reporting, and 784 in North America.

Unusual movements to pay attention to this week

REITS continue to postpone earnings dates, if they're even providing them at all

Simon Property Group (SPG)

- Company Confirmed Report Date: Monday, February 8, AMC

- Previously Inferred Report Date (based on historical data): February 4, AMC

- Z-Score: 3.71

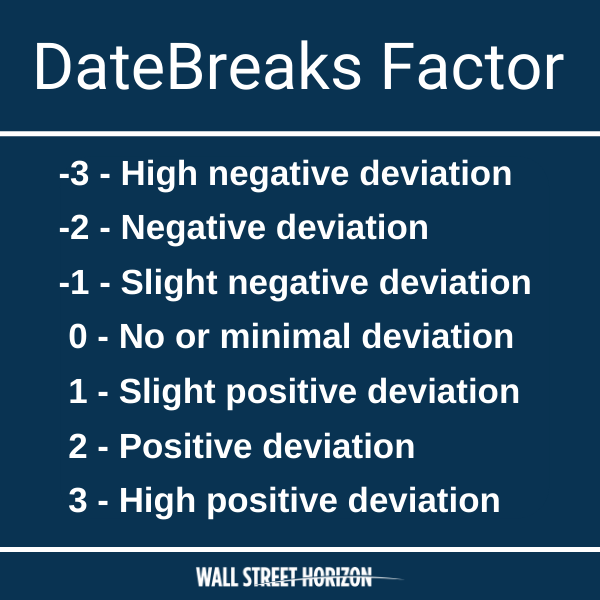

- DateBreaks Factor: -3

Simon Property usually reports Q4 results in the last week of January or first week of February, with no strong day of the week trend. This is their first report that falls into the second week of February. Even more interesting is that SPG is a regular before market open (BMO) reporter, now moving to after market close (AMC), a transition they started when reporting Q1 2020 results. The change in date results in a high Z-score of 3.71. A high positive Z-score (we consider anything higher than 3 or lower than -3 to be significant) reflects a later than usual confirmed earnings date, which in this case could signal that SPG is getting ready to announce some not so flattering numbers. Z-score is also incorporated into our DateBreaks Factor*, for which SPG has a factor of -3, meaning there is a high negative deviation from the historical trend for the same quarter.

As we noted in last week’s report, Real Estate is one of the sectors postponing earnings dates by the greatest amount, REITs in particular. Not only that, but we’re seeing some REITs even delay confirming their report dates.

As one of the largest retail REITs and shopping mall operators in the US, Simon Property’s troubles pre-date COVID-19, with mall foot traffic declining steadily over the last decade. The pandemic only helped to expedite the demise of some already struggling mall staples such as J.Crew, J.C. Penney, Neiman Marcus, Brooks Brothers and over a dozen other publicly traded retailers that filed for bankruptcy in 2020. Even retailers that have kept their proverbial heads above water still may be struggling to pay rent, affecting SPG’s ability to recognize lease related revenues.

Equity Residential (EQR)

- Company Confirmed Report Date: Wednesday, February 10, AMC

- Previously Confirmed Report Date (based on company announcement): February 2, AMC

- Z-Score: 4.39

- DateBreaks Factor: -3

Equity Residential did something quite unusual this quarter. On October 28 they confirmed their Q4 report date for February 2, AMC. Then on January 6 they changed their date to February 10. Here’s why this is significant: we only see a handful of companies updating confirmed dates each quarter, and when they move it out as EQR has, there is a high correlation with that action and the release containing bad news. Also, in doing so, they are changing a longstanding tradition of reporting on a Tuesday, by reporting on a Wednesday this quarter.

The change in date results in a high Z-score of 4.39. A high positive Z-score (we consider anything higher than 3 or lower than -3 to be significant) reflects a later than usual confirmed earnings date, which in this case could signal that EQR is getting ready to share disappointing news on Wednesday. Z-score is also incorporated into our DateBreaks Factor*, for which EQR has a factor of -3, meaning there is a high negative deviation from the historical trend for the same quarter.

One doesn’t have to think too deeply about what negative news EQR could have to share with investors. This REIT invests in apartments in major cities such as San Francisco, New York City, Boston, Washington DC, among other places. With the pandemic causing people to leave cities in droves, the rental market is suffering. Another in this space, Apartment Investment & Management (AIV), has not even confirmed their date yet, perhaps an even more ominous sign. Their stock plummeted 9% in January after falling 86% in December.

A tale of 2 energy companies - Solar tech continues to trend higher while E&P remains under pressure

Enphase Energy (ENPH)

Company Confirmed Report Date: Tuesday, February 9, AMC

- Previously Inferred Report Date (based on historical data): February 16, AMC

- Z-Score: -3.01

- DateBreaks Factor: 3

Enphase Energy, an energy tech company focusing on solar solutions, typically reports Q4 earnings one of the last two weeks of February with a strong Tuesday trend. The confirmed February 9th report date is the earliest the company has ever reported for this quarter.

The change in date results in a high Z-score of -3.01. A high negative Z-score (we consider anything higher than 3 or lower than -3 to be significant) reflects an earlier than usual confirmed earnings date, which in this case could signal that ENPH will deliver good news. Z-score is also incorporated into our DateBreaks Factor*, for which ENPH has a factor of 3, meaning there is a high positive deviation from the historical trend for the same quarter.

In the last few years the solar power industry has exploded, propelled by declining development costs and rapid advancements in technology. This expansion is only expected to continue with the Biden administration’s commitment to clean energy which should support the overall industry.

Helmerich & Payne (HP)

- Company Confirmed Report Date: Tuesday, February 9, AMC

- Previously Inferred Report Date (based on historical data): February 3, AMC

- Z-Score: 3.65

- DateBreaks Factor: -3

Helmerich & Payne typically reports their fiscal Q1 results the last week of January or first week of February with no day of week trend. This quarter’s change results in a high Z-score of 3.65. A high positive Z-score (we consider anything higher than 3 or lower than -3 to be significant) reflects a later than usual confirmed earnings date, which in this case could signal that HP is gearing up to disappoint investors. Z-score is also incorporated into our DateBreaks Factor*, for which HP has a factor of -3, meaning there is a high negative deviation from the historical trend for the same quarter.

Weakness in oil prices and decreased drilling activity in the US was likely enough to keep HP under pressure in the final quarter of the year. The oil & gas exploration & production company has reported triple digit declines in YoY profit growth for the last three quarters, and this quarter is expected to continue that trend with an expectation that earnings will drop 708% from the year-ago quarter (according to FactSet’s aggregated sell side consensus).

Surprise of the week? Restaurants have been hit hard, but BJRI continues to make strategic investments to weather the storm

BJs Restaurants (BJRI)

- Company Confirmed Report Date: Thursday, February 11, AMC

- Previously Inferred Report Date (based on historical data): February 18, AMC

- Z-Score: -4.52

- DateBreaks Factor: 3

BJs Restaurants has a history of reporting Q4 results between 2/20-2/22 with a trend of reporting on Thursdays. Changing their report date to the week earlier created a high Z-score of -4.52. A high negative Z-score (we consider anything higher than 3 or lower than -3 to be significant) reflects an earlier than usual confirmed earnings date, which in this case could signal that BJRI is setting up to surprise to the upside. Z-score is also incorporated into our DateBreaks Factor*, for which BJRI has a factor of 3, meaning there is a high positive deviation from the historical trend for the same quarter.

BJRI is an American restaurant chain that owns and operates over 200 restaurants and breweries. This may not seem like an obvious pick considering many locations are only offering limited dine-in capacity due to the COVID-19 pandemic, but the company has invested heavily in many initiatives in order to boost sales during this time, and it seems to be paying off. A few of those initiatives include: digital ordering and delivery options, expanding both indoor and outdoor dining areas in almost all locations, and beta testing a beer subscription service. Just this year alone the stock is up almost 40%.

Next week peak season rolls on with 963 companies reporting, including those with unusual earnings date patterns which we will be analyzing: TripAdvisor, Park City Group, Medpace Holdings and Armstrong Flooring.

*The DateBreaks Factor is a Wall Street Horizon proprietary measure, using a modified z-score protocol which looks at standard deviations from the norm and that captures the extent to which a confirmed earnings dates deviates or breaks from historical trend (last 5 years) for the same quarter.

Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)