Erez Katz, CEO and Co-founder, Lucena Research

Our partnership with Wall Street Horizon has enabled us to shine a light on the benefits of combining powerful data combined with predictive analytics.

Our team first validated Wall Street Horizon's data for accuracy and completeness. We then extrapolated daily features from sparse corporate events data points and ultimately deployed two distinct models to drive live perpetually simulated investment strategies. Our main goal is to provide empirical evidence of how actionable Wall Street Horizon's data can be by carrying the same rules of the backtest, perpetually into the future.

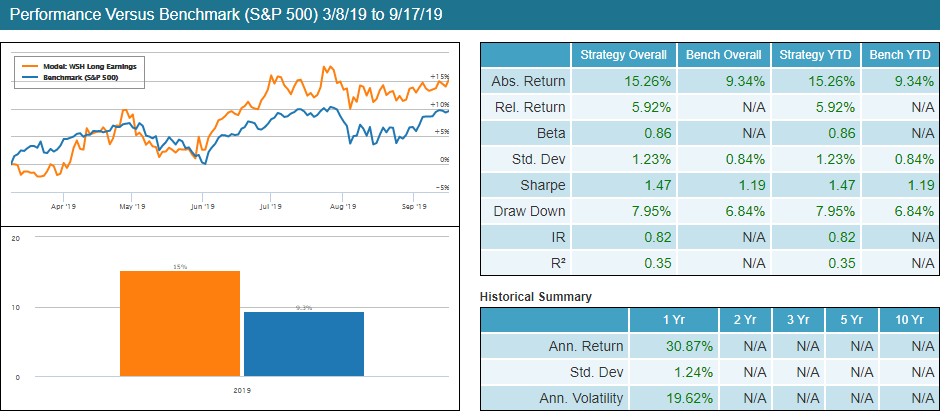

- Long Only: Based on earnings-date restatement to be earlier than previously published. Combined with Lucena's technical and fundamental factors.

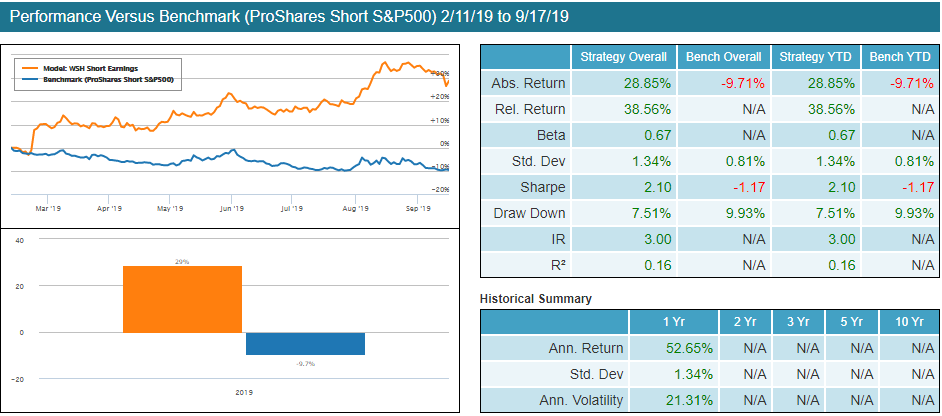

- Short Only: Based on earnings date delayed restatement. Setting new earnings date to be later than previously published. Combined with Lucena's technical and fundamental factors.

Since backtests are not sufficient enough to evaluate the potency of a signal, we've established Model Portfolios and Smart Data Feeds to perpetually evaluate the strategies over time.

In February, we launched two live paper-traded portfolios where we deliver trades daily before the market opens. The results have been VERY encouraging:

- The long portfolio is beating the SP 500 index by more than 5%

- The short portfolio generated alpha to the tune of 32% beating the benchmark (SH—S&P 500 short) by more than 40%!

Each strategy is carefully crafted by combining Wall Street Horizon's data with fundamental and technical features. By combining Wall Street Horizon's corporate event data with advanced fundamental and technical features created by Lucena, we were able to achieve a high degree of accuracy over multiple market regimes in backtesting and perpetually since the model portfolios were created.

Choosing the right data partner and deploying their data with advanced perspective analytics can translate to investment success. All signs point to strong market relative outperformance on both the short and long legs.

On Thursday, Sept. 26th, Lucena Research will host a panel event to discuss the successful deployment of alternative data in investments. I will begin the panel discussion with a brief intro and share additional highlights from our partnership with Wall Street Horizon and our ongoing research. Registration for the event is open, reserve your seat and find out more information here.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)