-

Growth stocks continue to power markets despite early forecasts for 2023 to be another year of value outperformance

-

Q1 earnings season is off to a decent start. Now all eyes are on mega-cap tech.

-

But we spotted a trio of unusual earnings events within Energy and Financials that may offer clues on the market’s next move

Coming into the year, the mantra across Wall Street was to be long the banks and cyclicals. The “value” trade was in full swing following that style’s best year versus “growth” since 2000. As the market does, the script was flipped on the consensus – long-duration equities kickstarted the year with impressive gains, and many doubted if the rally could last since it was being propped up by a lot of the junky losers of 2022. Then mega-cap tech came to the rescue. Index stalwarts like Apple, Microsoft, Alphabet, Amazon, Tesla, and NVIDIA surged, adding trillions to the collective market cap of the S&P 500.

As we venture further into earnings season – with a host of the former “FANG” names issuing Q1 results this week – will growth continue outshining value? Or will Financials and Energy-sector stocks claw their way back? That’s what the bulls might hope for – sector rotation is typically viewed as a bullish crosscurrent, so a baton toss to what outperformed the SPX for much of last year would be welcomed.

Keeping Ahead of Volatility

Wall Street Horizon tracks more than 40 corporate event types on nearly 10,000 companies worldwide. On their own, traders and portfolio managers can so easily get lost in the key happenings across sectors and even with individual companies. We help market participants navigate this busy stretch of the calendar to stay ahead of and better manage risk. For an in-depth discussion on using data to manage risk, attend the upcoming Data Minds panel Chaos to Clarity: Leveraging Data in a Volatile Market.

Oil M&A On the Way?

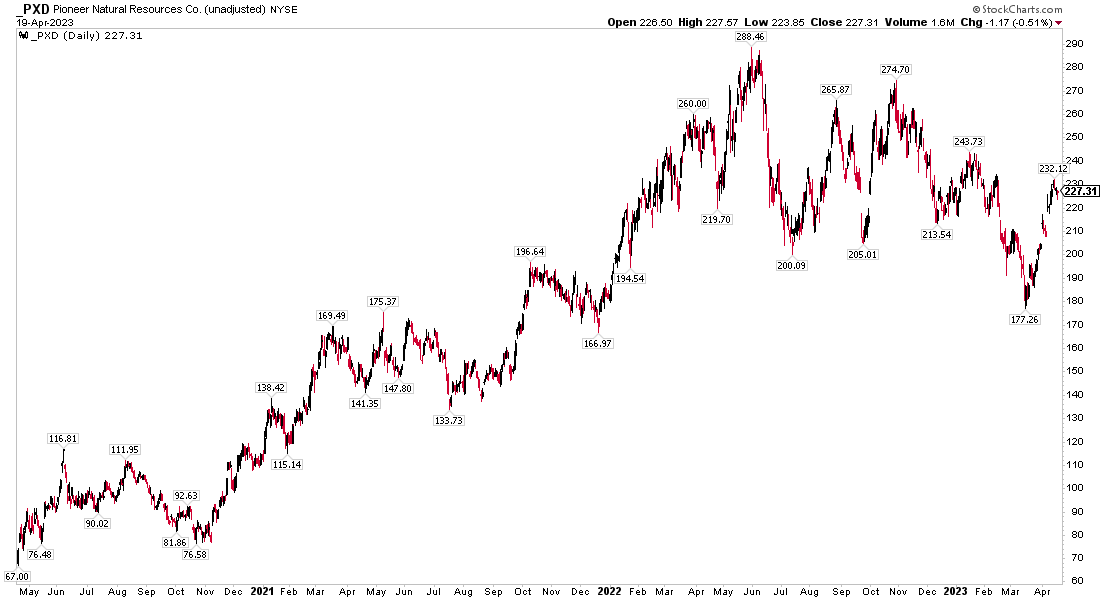

First up on our radar is a company that has recently been the focus of some takeover chatter. Back on April 7, The Wall Street Journal reported that Pioneer Natural Resources (PXD) may be the target of a buyout by sector leader ExxonMobil. Shares rose sharply the following trading day all while the oil & gas niche continued to meander. As oil prices have retreated from nearly $130 in June last year to now around $80, there’s some semblance of market balance.

Perhaps there are clues as to some news pending seen in PXD’s unusually early earnings date confirmed for Wednesday, April 26 AMC with a conference call the following morning. Pioneer then hosts its annual shareholder meeting on Thursday, May 25. The Energy company’s Q1 report comes with a –4.48 earnings date Z-score, indicative of an early outlier. Be on the lookout for unusual news, potentially positive, to be disclosed on the 26th.

PXD has enjoyed a rebound in its stock price since oil faltered under $60 for a time in March. The $53 billion market cap exploration and production industry company has high momentum over the previous few weeks, but shares remain sharply below their all-time high notched in Q2 last year.

Pioneer Natural Resources 3-Year Stock Price History: Shares Spike Amid Acquisition Chatter

Source: Stockcharts.com

Hartford Financial: A Bearish Preliminary Earnings Report

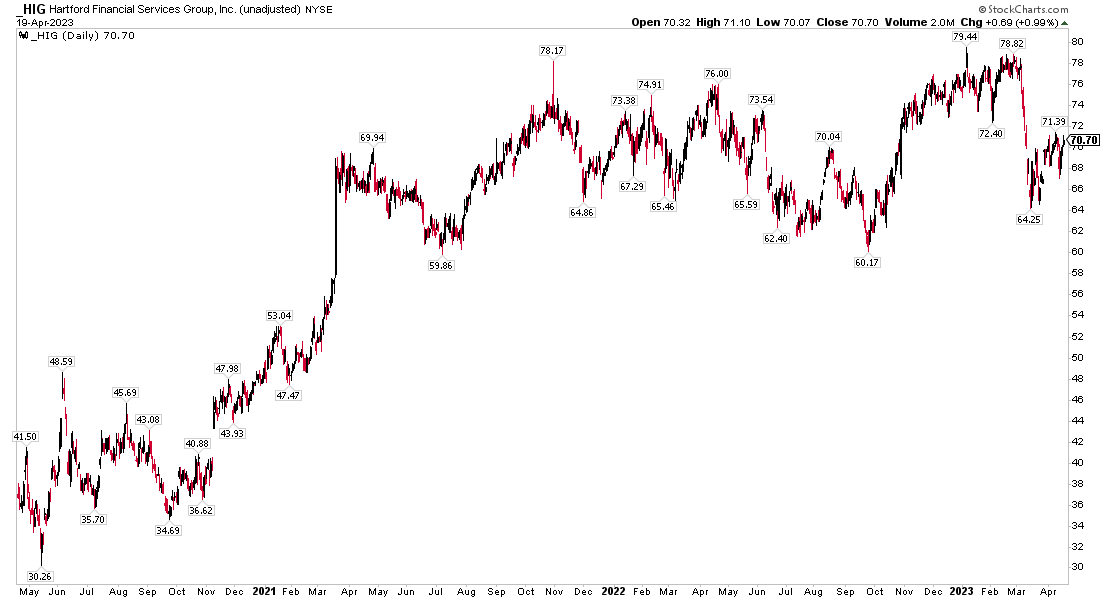

Shifting gears to the embattled Financials sector, disappointing numbers were reported by Hartford Financial (HIG) on April 13. The major insurance player issued a preliminary earnings report ahead of its April 27 Q1 reporting date. HIG tumbled about 3% immediately after the bearish preannouncement crossed the wires.

What was the culprit? Like Travelers that recently issued results, a slew of storms that socked the east and west coasts during the winter led to substantial catastrophe losses. Still, the firm said it was a share repurchaser in the quarter, and maybe the management team simply wanted to get the bad news out of the way. Still, bearish preannouncements are often not a good thing and can portend more negative news in the actual quarterly report. Value investors should indeed parse through the upcoming profit report.

Amid a flurry of troubling industry news in the last two months, HIG is simply in its trading range that began more than two years ago. Before the Silicon Valley Bank crisis and Financials sector turmoil that ensued for a few days, the Connecticut-based insurer held support on the chart and has since rebounded.

Hartford Financial 3-Year Stock Price History: Shares Rangebound

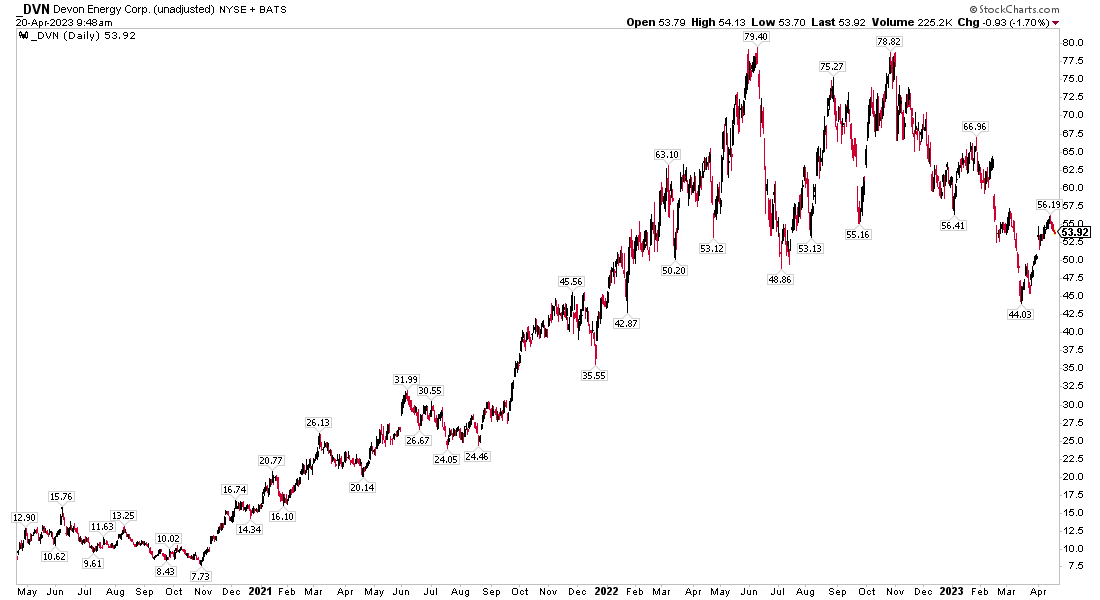

Source: Stockcharts.com Devon Energy: A Late Earnings Date Lastly, let’s go back to the Energy sector and drill down into Devon Energy (DVN). The Oklahoma-based $36 billion market cap E&P name is one of the sellside’s favorites for its strong free cash flow and low price-to-earnings ratio. With a forward operating P/E under 8, value investors love to buy the dip on this oil play. But we spotted a red flag. DVN has a confirmed Q1 earnings date of Monday, May 8 AMC with a conference call the following morning. That is six calendar days later than its previously inferred and unconfirmed May 2 reporting date. The Z-score is 2.54. While not a massive outlier, it's still later than we would expect, so bearish news could be reported. Recall back in February, the S&P 500-listed company missed on its adjusted EPS expectation. Devon Energy 3-Year Stock Price History: Recovering From 52-Week Lows Source: Stockcharts.com The Bottom Line It has been a solid start to earnings season, but a strong equity market rally leading into the reporting period makes for a high hurdle in terms of stock price reactions. Big tech names report this week but keep your eye on what’s happening within Energy and Financials.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)