Wall Street Horizon conducted an online survey focused on the impact of event-driven data. Conducted in May 2022, the majority of respondents were portfolio managers, traders/investors, followed by researchers. The firms they represented were mostly institutional quantitative and discretionary US fund managers followed by trading/research platforms.

Key findings include:

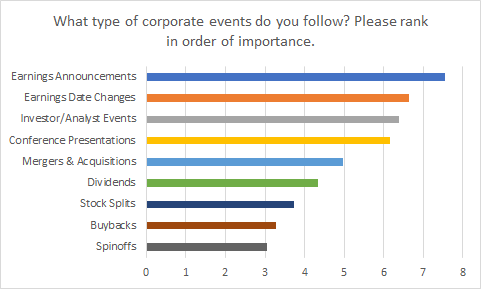

- Earnings announcements and earnings date changes ranked as the top two corporate event types that are most important to follow.

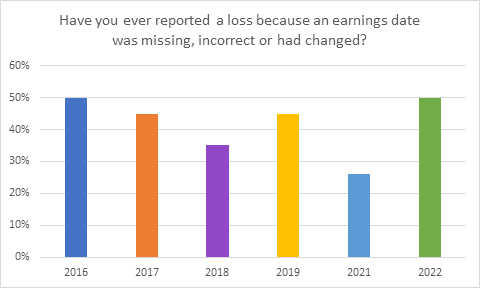

- Half of respondents experienced a loss due to an earnings date that was missing, incorrect or had changed.

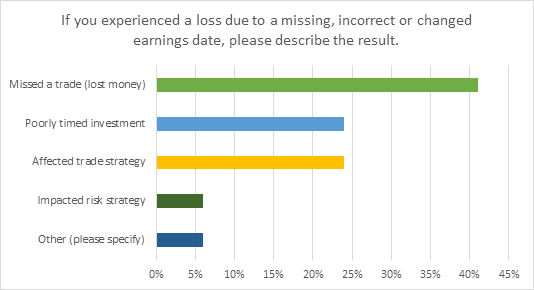

- Out of the 50% that suffered a loss, 41% reported that they missed a trade, 24% resulted in a poorly timed investment and 24% affected trading strategies.

- Macroeconomic risk was the primary risk concern (41%) followed by geopolitical risk (32%) and data and misinformation risk (10%).

Earnings Announcement and Earnings Date Changes Lead the Pack

Earnings-related data led the charge historically and this year is no exception. As Figure 1 shows, the top 5 events impacting stock price include: earnings announcements, earnings date changes, investor/analyst events, conference presentations, and M&As. The survey allowed participants to rank in order of importance, therefore, Figure 1 reflects a weighted average.

Figure 1

Our take:

Investors are becoming increasingly aware that earnings announcement dates and their changes can serve as volatility catalysts. In addition, a key indicator is investigating multiple events closely in relationship to one another to identify a cluster. For example, if a company is presenting at a conference, announces a stock split and advances their earnings date, investors will want to pay close attention.

Half Reported a Loss

In 2022, 50% of firms experienced a loss because an earnings date was missing, incorrect or had changed. Figure 2 shows the results over the past five years: 50% in 2016, 45% in 2017, 35% in 2018, 45% in 2019 and 26% in 2021.

Figure 2

Our take:

Academic research has shown that ‘Corporate Body Language’ ─ changes to a corporate event calendar ─ can provide predictive signals as to the future state of a company's health. Earnings date revisions help traders read the non-financial cues that include the signals public company executives relay to the market in their actions.

Figure 3

What was the result from a bad earnings date? 41% reported that they missed a trade, 24% suffered a poorly timed investment, 24% affected a trading strategy, followed by under 6% said it impacted a risk strategy.

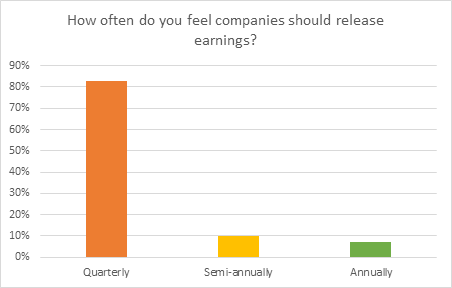

Timing of Earnings Releases

Those who follow global corporate earnings are aware of one glaring difference between US companies as compared to the rest of the world. While the SEC requires US companies to file earnings results quarterly, a majority of global governing bodies require semi-annual filings (twice per year). As Figure 4 indicates, the respondents favor releasing earnings quarterly.

Figure 4

Our take:

Since the majority of respondents were US based, this corresponds with recent Wall Street Horizon research showing the companies in the Company universe (10,000 global equities) that report twice a year, 14% are North American and 86% are non-US and Canadian companies. During a recent Data Minds panel Matt Amberson, principal of Option Research & Technology (ORATS), advocated for companies to increase transparency and release earnings results more frequently so financial professionals can better protect their investments.

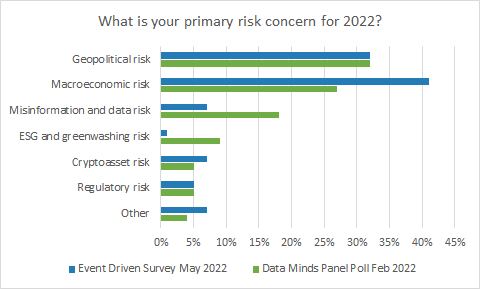

Primary Risk Concern

The participants ranked macroeconomic risk as the primary risk concern (60%) followed by geopolitical risk (47%), as shown in Figure 5.

Figure 5

Our take:

Wall Street Horizon conducted the same survey during “The Risk Outlook for 2022” Data Minds panel on February 2, 2022. A notable difference in the trend was data and misinformation risk was lower from the survey (10%) than the Data Minds poll (18%). For a panel recap, view Top Risk Trends Driving Markets by Ivy Schmerken of FlexTrade.

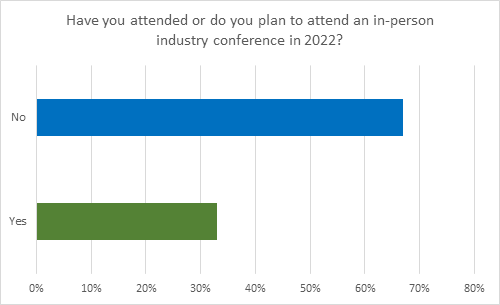

Attending In-Person Conferences

The majority responded a resounding “no” (68%) to whether they plan to attend an in-person industry conference as shown in Figure 6.

Figure 6

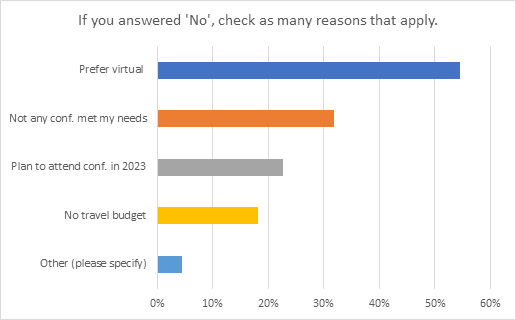

The most popular reasons were that the respondents prefer virtual and secondly there were not any conferences in 2022 to date that met their needs, as shown in Figure 7.

Figure 7

Our take:

Although Covid was the primary driver of why conferences went virtual, it has shifted the way people view in-person conferences.

The positive news is that Wall Street Horizon data show an encouraging 94% of conferences are expected to be in-person in Q2. That is up from 79% in Q1 2022.

Our corporate event data also reveal a total of 266 conferences (which includes investor forums, seminars, business summits, and trade shows) impacting all 11 sectors in Q2. Reading Corporate Body Language is a critical part of analyzing information shared by executives at corporate conferences.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)