Ford Motor’s social calendar was packed during the first half of Q3 — Wall Street Horizon investigates why and what it says about the company.

On July 28, Ford reported Q2 2021 financial results, beating expectations on both the top and bottom-line as well as raising full-year earnings guidance. We noticed that after the report, the auto maker had a solid line-up of conferences scheduled. Typically when a company hosts, sponsors and/or attends several corporate events in a short period of time, it’s worth paying attention to as it stokes volatility. In this case, it might even be a bullish sign to see that Ford is attending these conferences in the wake of their earnings release, a potential indicator that the company is confident in their financial standing and has nothing to hide.

While a standalone event such as an upcoming conference date may affect volatility, investigating multiple events closely in relation to one another can give a stronger sense of a company’s financial health. Observing the information pre-event, during the event and post-event and how they interact is critical to understand how events relate to trading and risk strategies.

The last of the conferences in the Ford “cluster” for Q3 takes place today, August 12, the JPMorgan Auto Conference 2021. Let’s recap what’s happened since Ford reported for Q2, and see if we can cull any insights related to future performance.

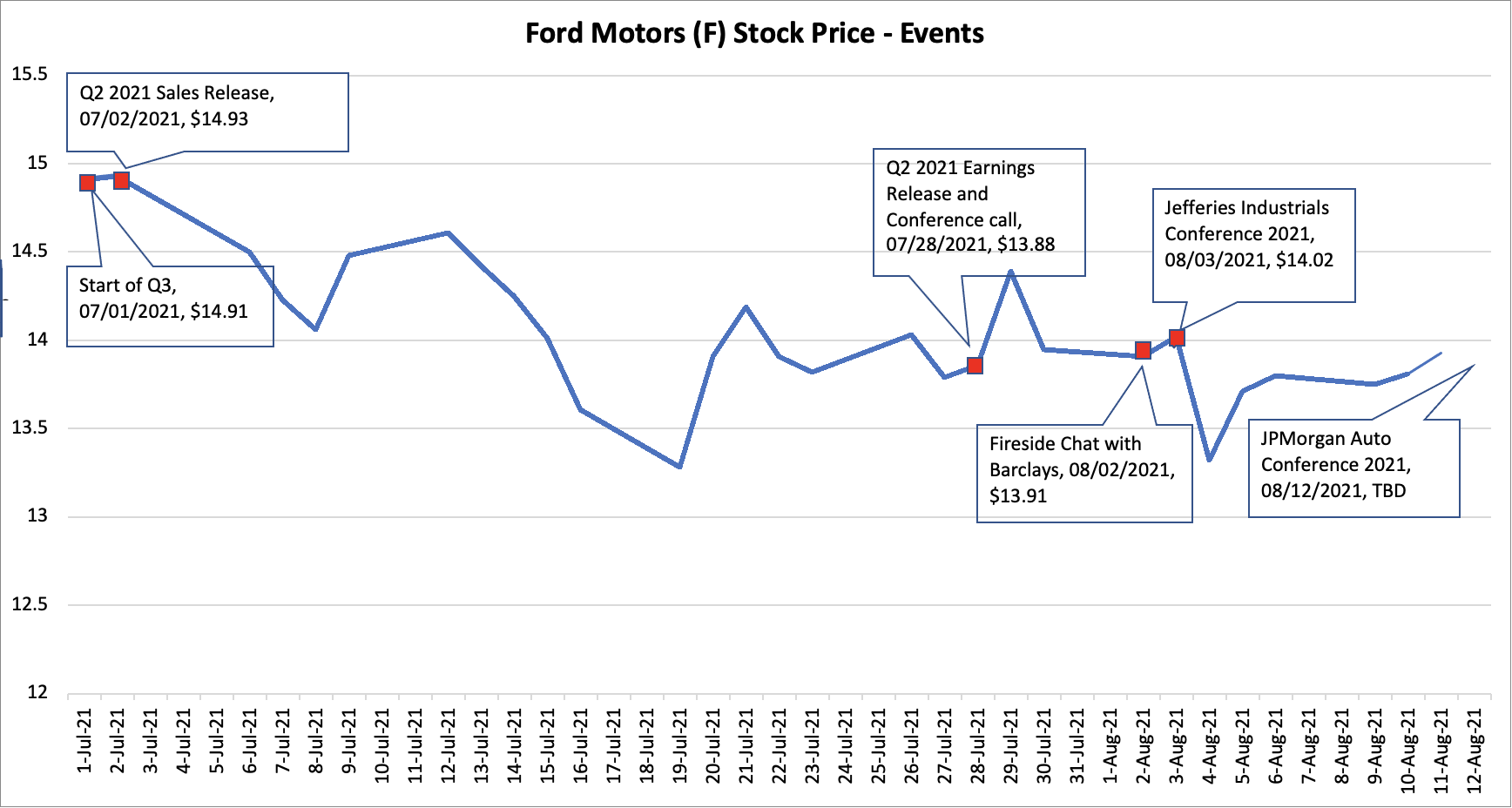

Above is a chart showing Ford’s Q3 events up to this point (with a focus on sales/earnings updates, and investor conferences). The stock has trended downward slightly since the beginning of the quarter, sparked by a June Sales report (released July 2) that showed revenues fell 27% year-over-year. There was a brief recovery after the better-than-expected earnings report (July 28), after which the company went on to participate in three conferences.

The first a Fireside Chat with Barclays where Ford CFO, John Lawler and Ford COO North America, Lisa Drake, discussed second quarter and full year results. The following day, the automotive company participated in the Jefferies Industrials Conference. Alex Purdy, Director of Operations for Enterprise Connectivity, spoke on Ford Connected Services growth. The stock dropped slightly after this most recent conference but started to rise again heading into their last conference of the quarter, the JPMorgan Auto Conference. Ford Credit CFO Brian Schaaf is expected to cover financial results, funding, liquidity and portfolio performance as well as participate in Q&A. Given this cluster we would expect to see the stock rise again in the near-term, barring any other negative news.

Not only is it important to note the confluence of events, but we also like to look at who is presenting. In this case, all three events were attended by individuals that were management-level or C-suite. In our 17-year history of reviewing this level of detail, having higher-up employees speak at conferences also bodes well for share prices.

The combination of Ford’s better-than-expected second quarter results, ability to manage the impact of the global semiconductor shortage, and participation in three major conference events in the weeks following should be a recipe for a risking stock in the wake of today’s JPMorgan event.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)