Key Takeaways:

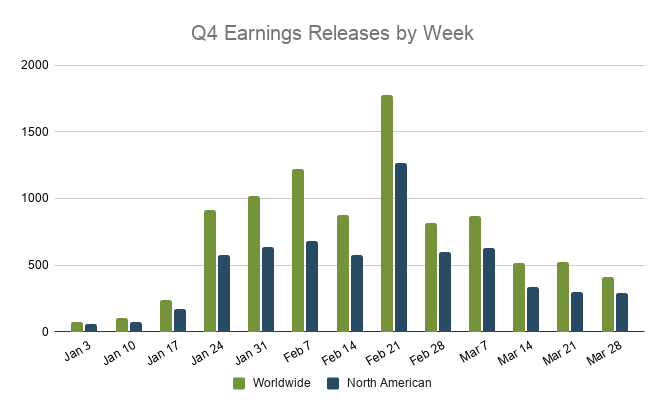

- Busiest week for earnings yet, with 1,776 worldwide names reporting, and 1,265 in North America

- 14 companies have delayed earnings due to severe weather in Texas

- Unusual moves in three other companies this week, not related to weather (CROX, FLR, VIAC)

This week marks the busiest for earnings releases within our universe, 1,265 North American companies will report Q4 results, and 1,776 worldwide.

Those numbers have gotten even larger as several companies with headquarters or major operations in Texas, that were originally expected to report last week, pushed their earnings dates to this week due to the severe weather. I detailed 13 of those names in a special report out 2/18 (click here to read).

Since then, only Exterran has been added to that list, bringing the grand total to 14 companies that have delayed earnings due to weather conditions. These postponements now affect four of the 11 sectors: Energy, Industrials, Real Estate, Technology.

Exterran Corporation (EXTN) New Q4 Report Date: Tuesday, March 2, BMO Prior Date: Thursday, February 25, BMO

On February 19, Exterran rescheduled their Q4 earnings release to Tuesday, March 2 BMO from a previously confirmed date of Thursday, February 25. The conference call will be held the same day at 10am CT. The Houston-based oil & natural gas producer rescheduled results as many of their peers did, due to “the severe inclement weather causing power outages across Southeast Texas.”

Other companies with unusual moves this week, not weather related

Crocs, Inc. (CROX) Company Confirmed Report Date: Tuesday, February 23, BMO Previously Inferred Report Date (based on historical data): February 25, BMO Z-Score: -4.13 DateBreaks Factor: 3

Over the last 6 years Crocs has reported Q4 results between February 26 and March 1 with no day of the week trend. On February 16 they confirmed they would be reporting on February 23, a few days earlier than normal. This change resulted in a high Z-score of -4.13. A high negative Z-score (we consider anything higher than 3 or lower than -3 to be significant) reflects an earlier than usual confirmed earnings date, which in this case could signal that CROX is getting ready to announce better-than-expected results. Z-score is also incorporated into our DateBreaks Factor*, for which CROX has a factor of 3, meaning there is a high positive deviation from the historical trend for the same quarter.

Crocs might very well be the official footwear choice of the COVID-19 pandemic, right up there with slippers. Just as sweats and loungewear have remained popular in the last year, so has comfortable footwear. The Crocs brand was already making a comeback prior to the pandemic, but on-trend products, excellent marketing and collaborations with artists such as Post Malone, Justin Bieber and Bad Bunny, as well as co-marketing with brands such as Chinatown Market, Vera Bradley and others, has only helped to further elevate the brand. The company even raised their Q4 expectations last month, now expecting YoY revenues to surge 55% vs. the prior guidance range of 20 - 30%. In the last year alone the stock has catapulted ~135%.

Fluor Corporation (FLR) Company Confirmed Report Date: Friday, February 26, BMO Previously Inferred Report Date (based on historical data): February 16, BMO Z-Score: 4.87 DateBreaks Factor: -3

Over the last decade Fluor has reported Q4 results between February 17 and February 22 with no day of the week trend. On January 14 they confirmed they would be reporting on February 26, a week or more later than usual. This change resulted in a high Z-score of 4.87. A high positive Z-score (we consider anything higher than 3 or lower than -3 to be significant) reflects a later than usual confirmed earnings date, which in this case could signal that FLR is getting ready to announce disappointing news. Z-score is also incorporated into our DateBreaks Factor*, for which FLR has a factor of -3, meaning there is a high negative deviation from the historical trend for the same quarter.

Industrials was one of the hardest hit sectors in 2020. Current FactSet estimates show that for Q4, Industrials have the second deepest YoY decline for earnings at -52.2% and revenue decline of 7.7%, just behind Energy. However Fluor, which serves the oil & gas, infrastructure and government sectors, seemed bullish on the future at their January 28 Strategy Day, mostly as a result of President Biden’s commitment and potential $2T investment into infrastructure and energy.

ViacomCBS (VIAC) Company Confirmed Report Date: Wednesday, February 24, AMC Previously Inferred Report Date (based on historical data): February 18, BMO Z-Score: -4.13 DateBreaks Factor: 3

This one gets a little tricky since the Viacom CBS merger in December 2019. Previously both companies reported Q4 results sometime in the third week of February, typically February 13 - 20, AMC. The joint company held to that convention in Q4 2020, but opted to report before the bell. The fourth quarter of 2021 has seen a return to AMC reporting, but with a postponed date of February 24. This change resulted in a high Z-score of 3.02. A high positive Z-score (we consider anything higher than 3 or lower than -3 to be significant) reflects a later than usual confirmed earnings date, which in this case could signal that VIAC is getting ready to announce disappointing news. Z-score is also incorporated into our DateBreaks Factor*, for which VIAC has a factor of -3, meaning there is a high negative deviation from the historical trend for the same quarter.

Some bright spots for ViacomCBS in Q4 will be the return of live sports around the globe, a return to ad-spending and success with on-demand and streaming services. However, offsetting those improvements will once again be YoY weakness in movie-related revenues as both production delays and limited capacity in movie theaters will remain an issue.

That’s a wrap for Q4 peak season. Next week things start to quiet down with only 815 companies reporting from Mar 1 - Mar 5.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)