PDUFA dates and content are essential for portfolio managers of healthcare stocks. A single positive or negative announcement from the US Food and Drug Administration (FDA) can send shares of a biotech firm soaring or turn a hot name quickly into a bear market. Among the dozens of corporate event data points provided to our customers, Wall Street Horizon gathers PDUFA dates and content so our clients stay in the know.

PDUFA Details and Market Impact

Specifically, a PDUFA date is the goal date set by the FDA for announcing its decision on a company’s New Drug Application/Biologics License Application/ Supplemental Biologics License Application (sBLA)/ Supplemental New Drug Application (sNDA) after reviewing applications. Traders should be aware that the FDA may rule before the announced PDUFA date. PDUFA dates can even fall on weekends.

Pharmaceutical companies, particularly small biotech companies, can experience significant volatility around PDUFA dates. One of the stocks we feature in this report rallied following positive news, but then recently experienced a gap-down in price associated with a delay in the FDA review process for a key drug in its pipeline.

Viewing PDUFA dates and content along with additional corporate event data allows money managers to see the crucial events on the “horizon”. In addition to FDA Drug Approval dates (sourced from Informa’s BioMedTracker), Wall Street Horizon provides URLs to source documents regarding content updates allowing customers to quickly dig into the PDUFA update.

Why It’s Different This Time

2020 was a year we’ll never forget for reasons beyond trading. The last 15 months might have marked a turning point in the healthcare sector specifically regarding the drug development and approval process.I The FDA even said that 2020 was a strong year for drug therapy approvals despite the focus on COVID-19.II The vaccines were fast-tracked by the FDA, and the process was generally smooth despite small hiccups such as the Johnson & Johnson vaccine pause earlier this year.

Industry experts are optimistic that an outcome of the COVID-19 pandemic will be enhanced cooperation among drug companies, researchers, hospitals, and regulators. The lessons learned from the process of researching, developing, performing clinical trials, approving, and administering the shots might also remove silos that once existed, according to some.III

The post-COVID world could feature increased pharmaceutical company drug development and the potential for more efficient and effective FDA oversight.IV The result could be more drug manufacturers requesting approval from the FDA, hence more PDUFA dates for traders to monitor.

The trend of speeding up drug approval is nothing new. It is how PDUFA dates came to existence in 1992. The process used to take about 30 months before the 1992 PDUFA law, which we detailed in our 2018 piece.

FDA Drug Approval Process Dates to Track

It is important to understand that the following dates represent stages of drug trials, and it may mean there are content updates available as well. Investors can view source documents to read firsthand about the PDUFA update.

PD Start – Date the drug manufacturer submits its NDA

PD Expect – Date the FDA is expected to respond to the drug manufacturer with its approval/non-approval

PD Update – Dates for any/all events that occur during the review process, e.g. FDA updates, changes to the Expect date, etc.

PD End – Date the FDA responds to the drug manufacturer

Companies In-Play with Upcoming PDUFA Dates

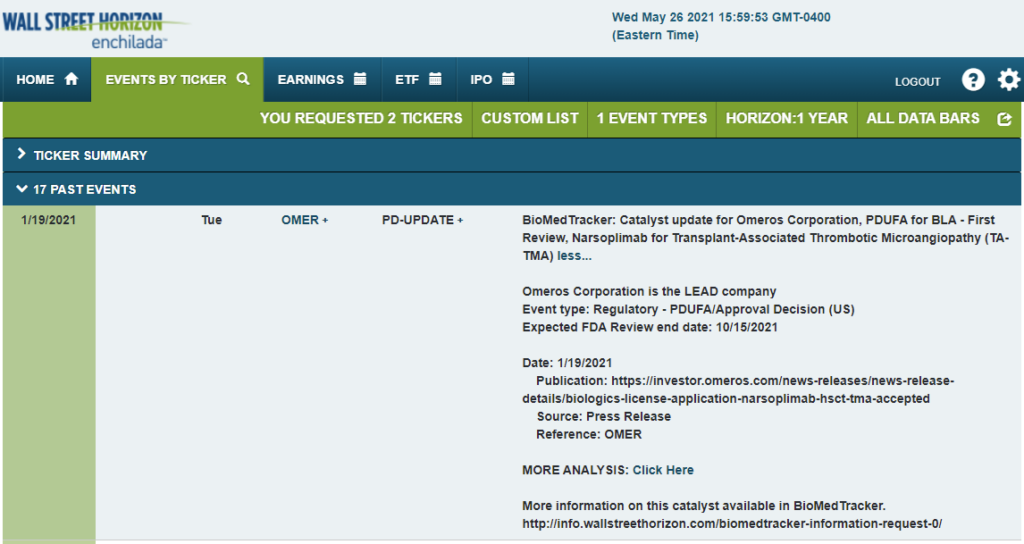

Within the small and mid-cap biotech space, Omeros Corporation (OMER) recently had its Transplant-Associated Thrombotic Microangiopathy (TA-TMA) drug Narsoplimab pushed back three months from mid-July to mid-October.

Omeros is a biotech firm with a market cap slightly under $1 billion. The Seattle-based company and Nasdaq-listed stock has been a strong performer since Q3 2021 as traders grow more optimistic regarding upcoming drugs. Management believes Narsoplimab plays a role in growing its diversified pipeline.V

On January 19, 2021, Wall Street Horizon reported OMER’s PDUFA target action date of July 18. On May 20, however, OMER announced that the FDA will require additional time to review the BLA for Narsoplimab.VI The new PDUFA target action date is October 17, 2021. As this date falls on a weekend, we expect the PDUFA decision on the preceding Friday (see Figure 1). Wall Street Horizon provided clients a link to the Omeros press release so they can investigate the news further.

Figure 1: OMER PDUFA Update

Source: Wall Street Horizon

Source: Wall Street Horizon

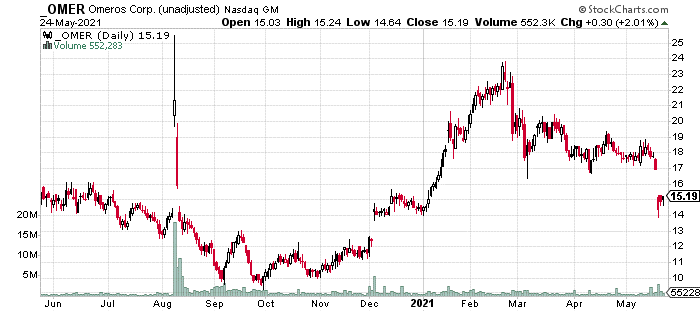

Shares of OMER fell sharply on the news as seen in Figure 2. There was a small uptick in volume on the May 20 decline as well.

Figure 2: OMER Stock Price History (1-Year)VII

Source: Stockcharts.com

Source: Stockcharts.com

Incyte Corporation (INCY) is expected to receive an FDA decision on Ruxolitinib Cream to treat Atopic Dermatitis (Eczema). Incyte submitted an NDA for the drug and on February 19, 2021. The company announced that the FDA accepted the application for Priority Review. The resulting PDUFA target action date was set to June 21.

INCY is an $18 billion market cap biotech company listed on the Nasdaq. Based in Wilmington, Delaware, the global company focuses on the discovery and development of small-molecule drugs.

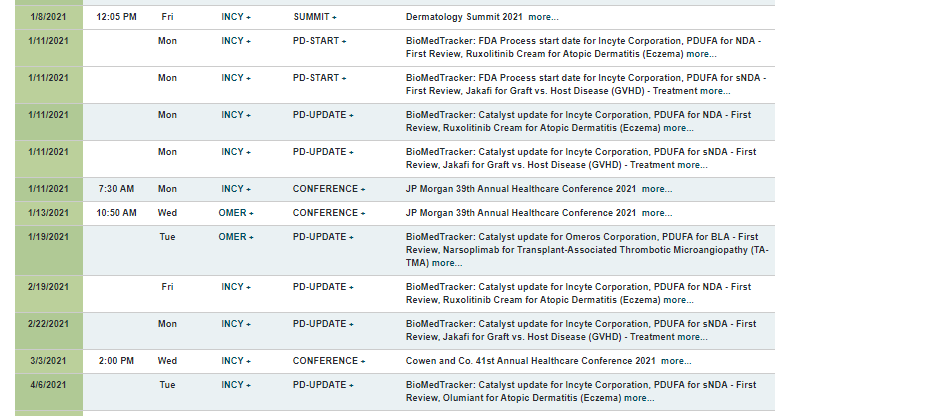

Event Clusters – Forming the INCY Mosaic

Institutional traders may gather additional insight by analyzing clusters of corporate events around these crucial PDUFA updates. For example, with INCY, Figure 3 shows that a lot was happening in the first quarter.

Figure 3: INCY Event Cluster

Source: Wall Street Horizon

Source: Wall Street Horizon

Amid several PDUFA updates, there were two Healthcare conferences and a Dermatology Summit. This event cluster helps traders grasp potential risks.

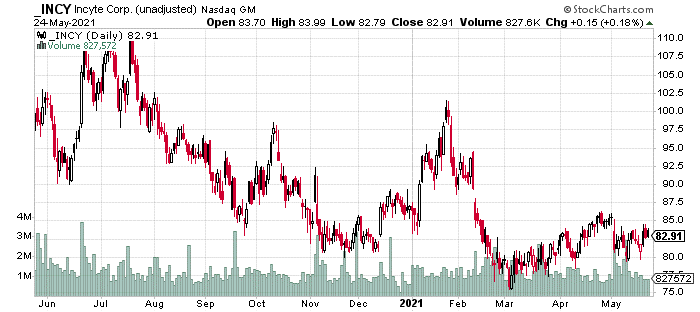

Look no further than Figure 4. Where do we see the most volatility? January through early March. In fact, the stock bottomed during the March 3 Cowen and Co. 41st Annual Healthcare Conference 2021 – which Wall Street Horizon clients were aware of ahead of time. Clients often glean additional intel on a stock by researching the speakers at a conference, the topics discussed, in addition to the timing and dates of these important corporate events.

Figure 4: INCY Stock Price History (1-Year)VIII

Source: stockcharts.com

Source: stockcharts.com

Trading Strategy and Managing Risk

There is a parallel between trading around PDUFA dates and owning stocks through earnings. Traders must know what the market expectation is. Are analysts optimistic or pessimistic? What do the options chains show in terms of important strike levels regarding open interest? What has company management been saying recently (i.e. has there been any pieces of guidance)? Has there been valuable information shared by an FDA Review Committee? These are all boxes to be checked by a seasoned trader.

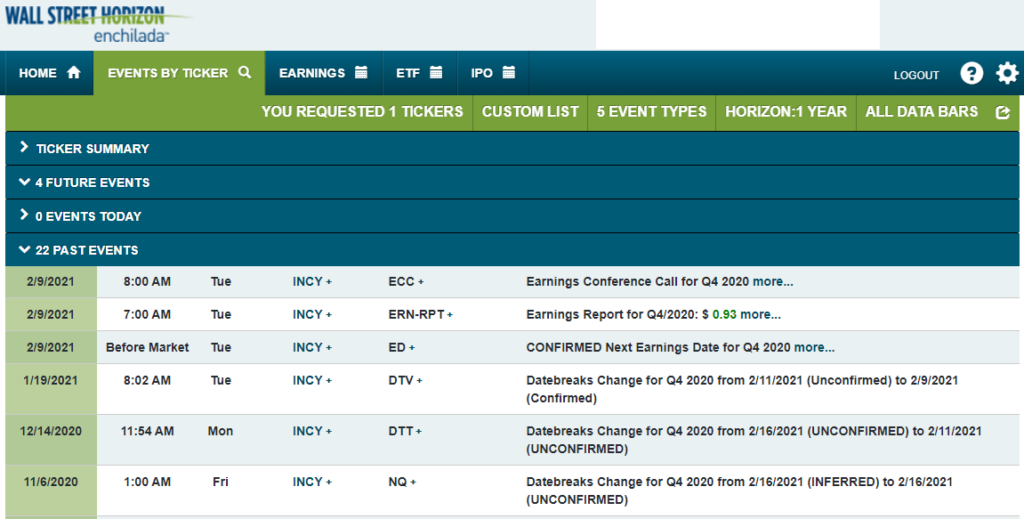

Relating this concept to INCY, WSH clients can also view all past and upcoming events. Earnings dates play a critical role in managing risk. It’s often the case, following a key PDUFA update, that the company will provide additional color during an earnings release or conference call.

Keeping abreast of earnings dates and changes helps manage risk. For example, during the volatile Q1 2021 period, traders were able to spot the February 9 earnings report date. We provided a URL to the Businesswire full earnings report briefing.

On January 19, 2021 at 8:02am, as shown in Figure 5, Wall Street Horizon recorded a key change in INCY’s Q4 2020 earnings date from February 11 Unconfirmed to February 9 Confirmed.

Figure 5

Source: Wall Street Horizon

Source: Wall Street Horizon

Conclusion

It’s been said many times, but the COVID-19 pandemic accelerated many existing trends. Drug manufacturers and biotech companies could provide more breakthroughs in the years ahead care of the experiences of the last 18 months. The FDA approval process might also become more streamlined. For investors, this combination could bring about a higher volume of critical company-specific announcements. Investors must step up their game to keep pace. Wall Street Horizon PDUFA content and corporate event coverage keep traders a step ahead.

I - https://www.nature.com/articles/d41586-020-01524-0

II - https://www.fda.gov/news-events/fda-voices/2020-strong-year-new-drug-therapy-approvals-despite-many-covid-19-challenges

III - https://www.statnews.com/2020/05/27/beating-covid-19-will-change-how-new-therapies-are-developed/

IV - https://avalere.com/insights/what-covid-19-may-mean-for-future-fda-regulatory-oversight

V - https://investor.omeros.com/static-files/717fb2dc-2d3f-4336-96bf-6c2e2b2ee0ea

VI - https://investor.omeros.com/news-releases/news-release-details/omeros-announces-extension-fda-review-period-narsoplimab-hsct

VII - https://stockcharts.com/h-sc/ui?s=_OMER&p=D&yr=1&mn=0&dy=0&id=p96414645580

VIII - https://stockcharts.com/h-sc/ui?s=_INCY&p=D&yr=1&mn=0&dy=0&id=p70882502520

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)