Full article by Alexander Poulos on Seeking Alpha

Summary

- The proposed merger between Pfizer and Allergan is now cancelled.

- The new rules proposed by the Us Treasury department has effectively thwarted the tax inversion.

- The article below I'll update my thoughts on Pfizer going forward.

Investing carries many risks an investor must navigate when determining a suitable investment. When investing in a single entity, the company's future earnings potential is often the key to the share price future performance. If your determination of the company's fair value is correct, you can often enter into a position at an advantageous price. The article below will update my bullish stance on the prospects of Pfizer (NYSE:PFE) in light of the recent termination of the deal for Allergan (NYSE:AGN). The original article can be seen here.

Overview

PFE is in the midst of an audacious plan to reshape the company to be able to compete more efficiently. One of the main goals of the plan is to complete a tax inversion whereas PFE would change its tax domicile to a foreign address. The widely commented reason for the move is for PFE to save money on its yearly tax bill. The view is partially correct, yet the overriding concern for the current management team is to tap the enormous cash hoard held overseas due to the outdated US tax code. PFE holds over $50 billion in cash overseas, money that they are unable to use unless they issue debt.

With today's announcement that the deal to purchase AGN is canceled, PFE has hit the proverbial road block yet again. This is PFE second failed attempt the first came in 2014 when they sought to buy AstraZeneca (NYSE:AZN). PFE will pay AGN $150 million dollars to cover the costs incurred thus far while trying to complete the merger.

The Path Forward

The path forward for PFE remains a bit cloudy yet a few key events over the course of the next year should illuminate the next course of action. I will highlight as few events below.

- The US Presidential Election- A new administration will be chosen in November, which is a fabulous opportunity to finally pass new tax legislation. Both parties agree the current corporate tax system is not competitive with the rates offered in many other parts of the world. The uncompetitive rates provided in the US has led to numerous companies completing a tax inversion and re-domiciling in other countries depriving the US of tax revenue.

- Pfizer should now split into two entities- PFE due to the recent completion of the deal for Hospira has laid the groundwork out for an eventual split up of the company. The AGN deal would have pushed the timetable of such a split-up back until 2019. In my view, PFE would be better off announcing the intended split-up during one of their upcoming earnings calls. I suspect the move will be met with investor enthusiasm especially if conducted in a tax efficient manner. The AGN deal would have created a taxable event much to the detriment of long-term shareholders.

- Pfizer may set its sights on a smaller US-based biotech/pharma company. The possibility remains that PFE will attempt to take out a smaller player to augment its current pipeline. In my opinion, PFE would be better off waiting until after the election to gauge if a new tax regime is in place. To be able to gain access to the cash hoard held overseas in a tax efficient manner opens up many possibilities for PFE.

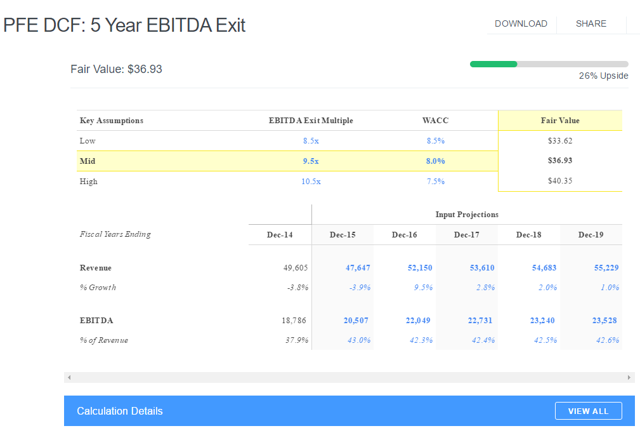

Finbox. io Fair Value Model

My fair value for PFE remains $36.93 as shown in the table above. In my original piece, I mentioned that PFE was the safer choice as shown below:

Getting paid to wait

In my view, the more interesting play here is PFE for two distinct reasons. The first revolves around risk. If the deal to acquire AGN is scuttled, the shares of AGN will plummet, handing short-term players an immediate capital loss. Shares of PFE may rise as buying pressure would emerge as arbs would cover the shares of PFE held short. The second reason for my optimism towards PFE is the generous dividend. PFE's current dividend yield is approximately 4%, far superior to most income plays readily available to investors. There is significant value embedded in the share price of PFE as a standalone company as displayed by the Finbox DCF table shown above.

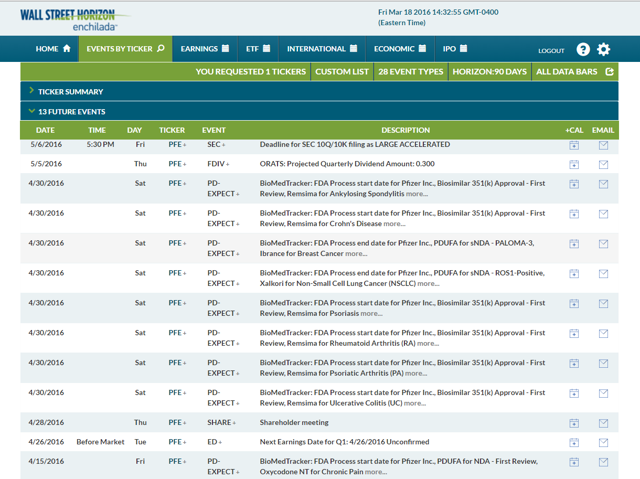

The chart is courtesy of Wall Street Horizon, a fantastic app for tracking future corporate events.

I am not surprised the US Treasury took action to torpedo the deal. Losing a high-profile company such as PFE would have been an embarrassment to any administration. The political risk involved in the deal was the main reason the merger spread remained as wide as it did. I expect PFE shares to continue to power higher over the course of the next couple of days as the shares held short are repurchased by those who tried to profit from the deal premium by holding shares of PFE short while going long AGN. I will continue to monitor PFE and will post a timely update after their earnings announcement. Thank you for reading, and I look forward to your comments.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)