Kroger Company (The) (NYSE:KR) : Avoid Bear Market Risk: The Secret to Option Trading Before Earnings

Date Published: 2017-09-1

Capital Market Laboratories

Preface

With the market's direction becoming tenuous, we can explore option trading opportunities in Kroger Company (The) (NYSE:KR) that do not rely on stock direction. It turns out, over the long-run, for stocks with certain tendencies like Kroger Company (The), there is a clever way to trade market anxiety or market optimism before earnings announcements with options.

This is particularly interesting given the large stock drop KR has seen due to Amazon.com's entry into grocery with the acquisition of Whole Foods and the large gap down move off of the last earnings release. Here is the KR stock chart for the last year:

Kroger has earnings due out 9-8-2017 according to our data provider Wall Street Horizon, and earnings are before the market opens.

Discovery

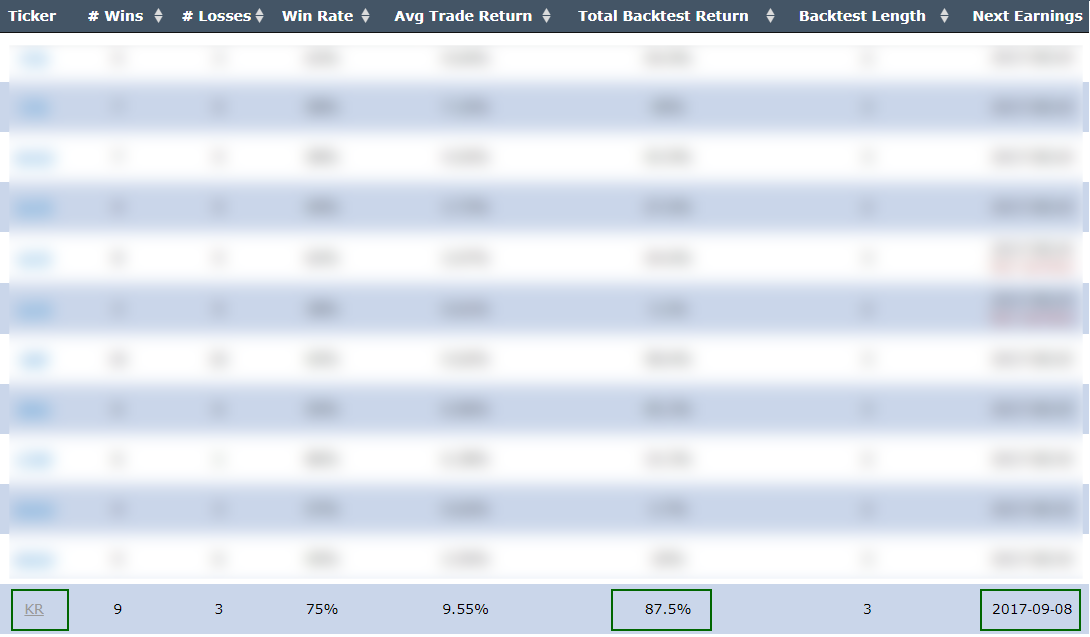

We found this trade looking at the 6-day pre-earnings straddle scan and sorting by earnings date and then choosing the best win rate:

The Trade Before Earnings

What a trader wants to do is to see the results of buying an at the money straddle a few days before earnings, and then sell that straddle just before earnings. The goal is to benefit from a unique and very short time frame when the stock might move 'a lot', either due to earnings anxiety (stock drops before earnings) or earnings optimism (stock rises before earnings), but taking no actual earnings risk.

Given the wild move in Kroger earnings last reporting period, we could see some anxiety set in.

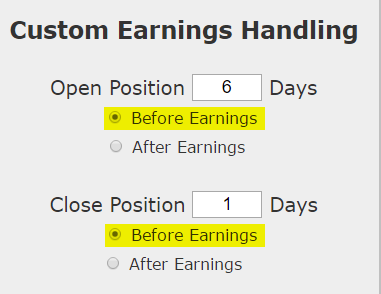

Here is the setup:

We are testing opening the position 6 calendar days before earnings and then closing the position 1 day before earnings. This is not making any earnings bet. This is not making any stock direction bet.

Once we apply that simple rule to our back-test, we run it on an at-the-money straddle:

Returns

If we did this long at-the-money (also called '50-delta') straddle in Kroger Company (The) (NYSE:KR) over the last three-years but only held it before earnings we get these results:

| KR Long At-the-Money Straddle |

|||

| % Wins: | 75.00% | ||

| Wins: 9 | Losses: 3 | ||

| % Return: | 87.5% | ||

| % Annualized: | 532.3% | ||

We see a 87.5% return, testing this over the last 12 earnings dates in Kroger Company (The). That's a total of just 60 days (5 days for each earnings date, over 12 earnings dates). That's a annualized rate of 532.3%.

We can also see that this strategy hasn't been a winner all the time, rather it has won 9 times and lost 3 times, for a 75% win-rate and again, that 87.5% return in less than two-full months of trading.

Setting Expectations

While this strategy has an overall return of 87.5%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 9.6%.

➡ The average percent return per winning trade was 13.9%.

➡ The average percent return per losing trade was -3.6%.

With that low of an average loss per losing trade, this could be quite a compelling trade to examine.

Option Trading in the Last Year

We can also look at the last year of earnings releases and examine the results:

| KR Long At-the-Money Straddle |

|||

| % Wins: | 75.00% | ||

| Wins: 3 | Losses: 1 | ||

| % Return: | 55.9% | ||

| % Annualized: | 1,020.2% | ||

In the latest year this pre-earnings option trade has 3 wins and lost 1 times and returned 55.9% which annualizes to 1,020.2% .

➡ Over just the last year, the average percent return per trade was 14.97%.

➡ The average percent return per winning trade was 20.3%.

➡ The percent return for the one losing trade was -0.9%.

Reality Check -- Even Better

Since we are now on an extended weekend for Labor Day, the earliest this trade could open would be Tuesday, and held for Wednesday and Thursday and must be closed on Thursday because earnings are due out Friday before the market opens.

When we adjust this trade to open 3-days before earnings and close one-day before earnings the results are actually better over the last year:

| KR Long At-the-Money Straddle |

|||

| % Wins: | 100% | ||

| Wins: 4 | Losses: 0 | ||

| % Return: | 54.3% | ||

To copy this implementation, the straddle would be opened on Tuesday near the end of the day and closed on Thursday near the end of the day.

WHAT HAPPENED

This is it -- this is how people profit from the option market -- finding trading opportunities that avoid earnings risk and work equally well during a bull or bear market.

To see how to do this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)

_thumb.png)